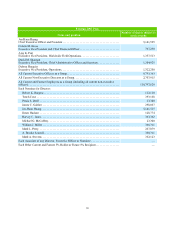

NVIDIA 2016 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

company). Except as otherwise stated in a stock award agreement, if the surviving or acquiring corporation (or its parent

company) does not assume, continue, or substitute such stock awards, then (i) any such stock awards that are held by

participants whose continuous service has not terminated prior to the effective time of the corporate transaction or change

in control will become fully vested and exercisable (contingent upon the effectiveness of the corporate transaction or change

in control), and such stock awards will be terminated if not exercised prior to the effective time of the corporate transaction

or change in control and any reacquisition or repurchase rights held by us with respect to such stock awards will lapse

(contingent upon the effectiveness of the corporate transaction or change in control ), and (ii) all other stock awards will

be terminated if not exercised prior to the effective time of the corporate transaction or change in control, provided that any

reacquisition or repurchase rights held by us with respect to such stock awards will not terminate and may continue to be

exercised.

For purposes of the 2007 Plan, a corporate transaction generally will be deemed to occur in the event of the consummation

of: (i) a sale or other disposition of all or substantially all of our consolidated assets; (ii) a sale or other disposition of at

least 50% of our outstanding securities, in the case of awards granted on or after the date of the 2012 Annual Meeting of

Stockholders, and at least 90% of our outstanding securities, in the case of awards granted prior to the date of the 2012

Annual Meeting of Stockholders; (iii) a merger, consolidation or similar transaction following which we are not the surviving

corporation; or (iv) a merger, consolidation or similar transaction following which we are the surviving corporation but the

shares of our common stock outstanding immediately prior to such transaction are converted or exchanged into other property

by virtue of the transaction.

For purposes of the 2007 Plan, a change in control generally will be deemed to occur in the event: (i) a person, entity

or group acquires, directly or indirectly, securities of NVIDIA representing more than 50% of the combined voting power

of our then outstanding securities, other than by virtue of a merger, consolidation, or similar transaction; (ii) there is

consummated a merger, consolidation, or similar transaction and, immediately after the consummation of such transaction,

our stockholders immediately prior thereto do not own, directly or indirectly, more than 50% of the combined outstanding

voting power of the surviving entity or the parent of the surviving entity in substantially the same proportions as their

ownership of our outstanding voting securities immediately prior to such transaction; (iii) there is consummated a sale or

other disposition of all or substantially all of our consolidated assets, other than a sale or other disposition to an entity in

which more than 50% of the entity’s combined voting power is owned by our stockholders in substantially the same

proportions as their ownership of our outstanding voting securities immediately prior to such sale or other disposition; or

(iv) a majority of our Board becomes comprised of individuals whose nomination, appointment, or election was not approved

by a majority of the Board members or their approved successors.

Plan Amendments and Termination. The Plan Administrator will have the authority to amend or terminate the 2007

Plan at any time. However, except as otherwise provided in the 2007 Plan, no amendment or termination of the 2007 Plan

may materially impair any rights under awards already granted to a participant unless agreed to by the affected participant.

We will obtain stockholder approval of any amendment to the 2007 Plan as required by applicable law and listing

requirements. Unless sooner terminated, the 2007 Plan will automatically terminate on March 21, 2022.

U.S. Federal Income Tax Consequences

The following is a summary of the principal United States federal income taxation consequences to participants and

us with respect to participation in the 2007 Plan. This summary is not intended to be exhaustive, and does not discuss the

income tax laws of any local, state or foreign jurisdiction in which a participant may reside. The information is based upon

current federal income tax rules and therefore is subject to change when those rules change. Because the tax consequences

to any participant may depend on his or her particular situation, each participant should consult the participant’s tax adviser

regarding the federal, state, local, and other tax consequences of the grant or exercise of an award or the disposition of stock

acquired the 2007 Plan. The 2007 Plan is not qualified under the provisions of Section 401(a) of the Internal Revenue Code

and is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974. Our ability to realize

the benefit of any tax deductions described below depends on our generation of taxable income as well as the requirement

of reasonableness, the provisions of Section 162(m) of the Internal Revenue Code and the satisfaction of our tax reporting

obligations.