ICICI Bank 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

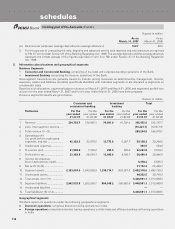

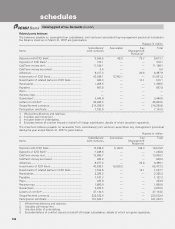

F28

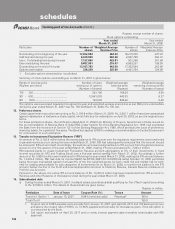

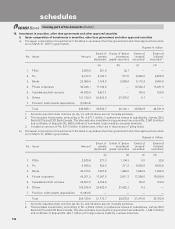

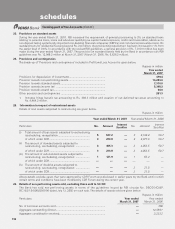

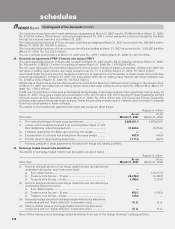

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 2 Option 1 July 17, 2006 9.50% Annual115 years210,000.0

Total (Upper Tier II) 10,000.0

1. Coupon rate of 9.50% for first 10 years. For next 5 years, 50 basis points over and above coupon rate of 9.50%

i.e. 10.00%, if the call option is not exercised by the Bank.

2. Call option after 10 years, i.e. on July 17, 2016 (exercisable with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 1 Option 1 July 11, 2006 9.00% Annual 10 years 20,000.0

Total (Tier II) 20,000.0

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 5 Option 1 June 22, 2006 8.95% Annual115 years22,552.0

Total (Upper Tier II) 2,552.0

1. Coupon rate of 8.95% for first 10 years. For next 5 years, 50 basis points over and above coupon rate of 8.95%

i.e. 9.45%, if the call option is not exercised by the Bank.

2. Call option after 10 years, i.e. on June 22, 2016 (exercisable with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 4 Option 1

Tranche 4 Option 2

Tranche 4 Option 3

May 19, 2006

May 19, 2006

May 19, 2006

8.50% Annual

8.60% Annual

8.40% Annual

10 years

12 years

5 years and 11 months

230.0

140.0

350.0

Total (Tier II) 720.0

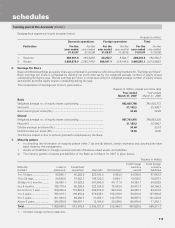

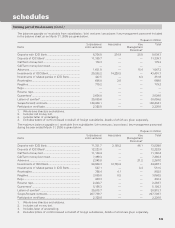

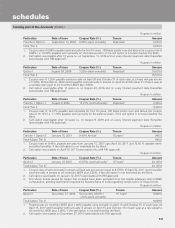

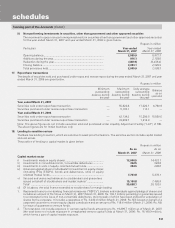

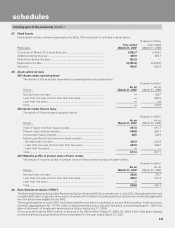

b) During the year ended March 31, 2006, the Bank raised subordinated debt amounting to Rs. 39,730.0 million through

private placements of bonds. The details of these bonds are given below.

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 3 Option I

Tranche 2 Option I

Tranche 1 Option I

March 31, 2006

March 25, 2006

March 14, 2006

8.83% Annual

8.80% Annual

8.55% Annual

10 years and 15 days

9 years 11 months and

19 days

10 years and 1 month

2,500.0

20,000.0

2,500.0

Total (Tier II) 25,000.0

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Option I

Option II February 14, 2006

February 14, 2006 8.15% Annual

8.25% Annual 10 years

15 years 1,190.0

370.0

Total (Tier II) 1,560.0

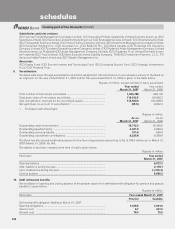

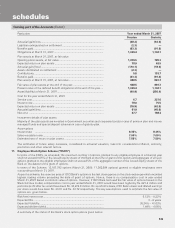

forming part of the Accounts (Contd.)

schedules