ICICI Bank 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

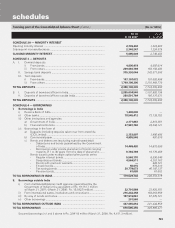

F40

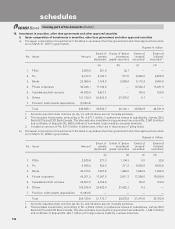

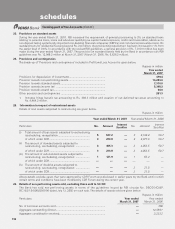

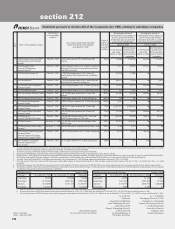

Statement pursuant to Section 212 of the Companies Act, 1956, relating to subsidiary companies

section 212

Sr.

No. Name of the subsidiary company

Financial year

of the subsidiary

ended on

No. of equity shares held by ICICI Bank

and/or its nominees in the subsidiary

as on March 31, 2007

Extent of

interest of

ICICI Bank

in capital of

subsidiary

Net aggregate amount of

profits/(losses) of the subsidiary so

far as it concerns the members

of ICICI Bank and is not dealt with

in the accounts of ICICI Bank1

Net aggregate amount of

profits/(losses) of the subsidiary so

far as it concerns the members

of ICICI Bank dealt with or provided

for in the accounts of ICICI Bank2

Rupees in '000s Rupees in '000s

for the financial

year ended

March 31, 2007

for the previous

financial years

of the subsidiary

since it became

a subsidiary

for the financial

year ended

March 31, 2007

for the previous

financial years

of the subsidiary

since it became

a subsidiary

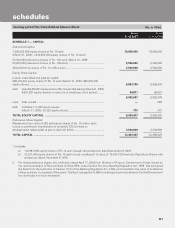

1 ICICI Securities Primary Dealership

Limited (formerly ICICI Securities

Limited)3

March 31, 2007 16,201 equity shares of Rs. 100,000 each fully

paid up 99.9% 722,966 3,186,782 601,699 4,145,011

2 ICICI Securities Limited

(formerly ICICI Brokerage

Services Limited)4, 5

March 31, 2007 8,250,700 equity shares of Rs. 10 each, fully paid up

held by ICICI Securities Primary Dealership Limited

and ICICI Equity Fund

— 74,011 468,068 551,279 166,370

3 ICICI Securities Holdings Inc.5 March 31, 2007 77,00,000 common stock of USD 1 each fully

paid up held by ICICI Securities Primary Dealership

Limited

— (21,923) (1,584) Nil Nil

4 ICICI Securities Inc.5 March 31, 2007 7,050,000 common stock of USD 1 each fully paid

up held by ICICI Securities Holdings Inc. — (66,507) 21,292 Nil 15,635

5 ICICI Venture Funds Management

Company Limited March 31, 2007 1,000,000 equity shares of Rs. 10 each fully paid up 100.0% 198,670 544,115 500,000 1,275,979

6 ICICI International Limited6March 31, 2007 90,000 ordinary shares of US$ 10 each fully paid up 100.0% 230 10,923 Nil 15,782

7 ICICI Home Finance Company Limited March 31, 2007 283,750,000 equity shares of Rs. 10 each fully

paid up 100.0% 214,263 475,382 255,390 360,375

8 ICICI Trusteeship Services Limited March 31, 2007 50,000 equity shares of Rs. 10 each fully paid up 100.0% 239 997 Nil Nil

9 ICICI Investment Management

Company Limited March 31, 2007 10,000,700 equity shares of Rs. 10 each fully paid up 100.0% 6,553 21,112 Nil Nil

10 ICICI Prudential Life Insurance

Company Limited March 31, 2007 969,328,571 equity shares of Rs. 10 each fully

paid up 73.9% (4,793,477) (6,460,974) Nil Nil

11 ICICI Lombard General Insurance

Company Limited March 31, 2007 247,900,000 equity shares of Rs.10 each fully

paid up 73.8% 181,090 449,034 323,689 465,179

12 ICICI Bank UK PLC.

(formerly ICICI Bank UK Limited)6March 31, 2007 135,000,000 ordinary shares of USD 1 each and

50,002 ordinary shares of 1 GBP each 100.0% 1,602,236 464,649 186,619 182,449

13 ICICI Bank Canada7, 8, 9 December 31, 2006 112,000,000 common shares of Canadian Dollar

(CAD) 1 each 100.0% (13,964) (528,591) Nil Nil

14 ICICI Bank Eurasia Limited Liability

Company7, 9 December 31, 2006 985,600,000 shares of Russian Rouble (RUB) 1 each 100.0% 2,780 12,457 Nil Nil

15 ICICI Prudential Asset Management

Company Limited

(formerly Prudential ICICI Asset

Management Company Limited)

March 31, 2007 9,002,573 equity shares of Rs. 10 each, fully paid up 51.0% 86,570 48,915 160,160 79,029

16 ICICI Prudential Trust Limited

(formerly Prudential ICICI

Trust Limited)

March 31, 2007 51,157 equity shares of Rs. 10 each, fully paid up 50.8% 145 161 256 Nil

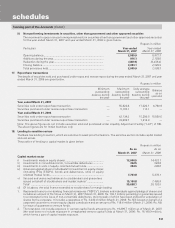

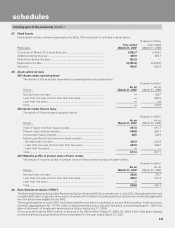

1. The above companies (other than ICICI Bank UK PLC., ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, ICICI Prudential Asset Management Company Limited and ICICI Prudential Trust Limited) which were subsidiaries of erstwhile

ICICI Limited have become subsidiaries of the Bank consequent to the merger of erstwhile ICICI Limited with ICICI Bank.

2. The amount received by erstwhile ICICI Limited upto March 29, 2002 as dividend has also been included in the reserves of ICICI Bank.

3. During the year ended March 31, 2007, ICICI Securities Primary Dealership Limited has consolidated the face value of each equity share from Rs. 10 to Rs. 100,000.

4. Effective October 1, 2006, ICICI Web Trade Limited has merged with ICICI Securities Limited, a subsidiary of the Bank. Accordingly, the profit of ICICI Securities Limited for the current year includes the profit of erstwhile ICICI Web Trade Limited.

5. ICICI Securities Limited and ICICI Securities Holdings Inc. are wholly-owned subsidiaries of ICICI Securities Primary Dealership Limited. ICICI Securities Inc. is a wholly-owned subsidiary of ICICI Securities Holdings Inc.

6. The profits/ (losses) of ICICI Bank UK PLC. and ICICI International Limited for the year ended March 31, 2007 have been translated into Indian Rupees at the rate of 1 USD = Rs. 45.2409.

7. The profits/ (losses) of ICICI Bank Canada and ICICI Bank Eurasia Limited Liability Company for the year ended December 31, 2006 have been translated into Indian Rupees at the rate of 1 CAD = Rs. 40.4742 and 1 RUB = Rs. 1.6984

respectively.

8. ICICI Wealth Management Inc. (“ICICI WM”) has been incorporated as a 100% subsidiary of ICICI Bank Canada on July 28, 2006. ICICI WM has not yet been capitalised and is yet to commence operations, both of which are expected shortly.

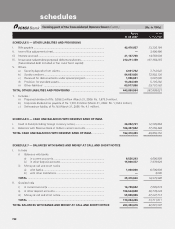

9. The information furnished for ICICI Bank Canada and ICICI Bank Eurasia Limited Liability Company is from the period January 1, 2006 to December 31, 2006, being their financial year. Please find below key financial parameters of these companies

as on March 31, 2007 and their movement from December 31, 2006 levels.

ICICI Bank Canada

Rupees in '000s ICICI Bank Eurasia Limited Liability Company

Rupees in '000s

Particulars As on March 31, 2007 As on December 31, 2006 Movement Particulars As on March 31, 2007 As on December 31, 2006 Movement

Fixed assets 105,636 109,642 (4,006) Fixed assets 44,864 43,183 1,681

Investments 21,797,396 24,841,984 (3,044,588) Investments 5,021,323 4,550,293 471,030

Advances 53,944,996 41,134,139 12,810,857 Advances 5,744,772 4,658,104 1,086,668

Borrowingsa 1,812,227 — 1,812,227 Borrowingsa 4,489 4,392 97

a. Since it is not possible to identify the amount borrowed to meet its current liabilities, the amount shown above represents the total borrowings.

b. The financials parameters of ICICI Bank Canada have been translated into Indian Rupees at 1 CAD = Rs. 37.6825 for the year ended March 31, 2007 and 1 CAD = Rs. 38.1375 for the year ended December 31, 2006.

c. The financials parameters of ICICI Bank Eurasia Limited Liability Company have been translated into Indian Rupees at 1 RUB =Rs. 1.6694 for the year ended March 31, 2007 and 1 RUB = Rs. 1.6763 for the year ended December 31, 2006.

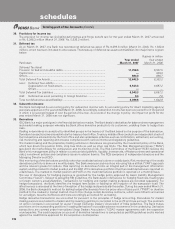

N. VAGHUL K. V. KAMATH

Chairman Managing Director & CEO

KALPANA MORPARIA CHANDA D. KOCHHAR

Joint Managing Director Deputy Managing Director

NACHIKET MOR V. VAIDYANATHAN

Deputy Managing Director Executive Director

VISHAKHA MULYE JYOTIN MEHTA RAKESH JHA

Place: Mumbai Group Chief Financial Officer General Manager & General Manager

Date: April 28, 2007 Company Secretary