ICICI Bank 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Overview

34

The Retail Banking Group is responsible for our products and services for retail customers and small

enterprises including various credit products, liability products, distribution of third party investment and

insurance products and transaction banking services.

The Wholesale Banking Group is responsible for our products and services for large and medium-sized

corporate clients, including credit and treasury products, investment banking, project finance, structured

finance and transaction banking services.

The Rural, Micro-Banking & Agri-Business Group is responsible for envisioning and implementing our

rural banking strategy, including agricultural banking and micro-finance.

The Government Banking Group is responsible for our government banking initiatives.

The International Banking Group is responsible for our international operations, including our operations

in various overseas markets as well as our products and services for non-resident Indians and our

international trade finance and correspondent banking relationships.

The Corporate Centre comprises the internal control environment functions (including operations, risk

management, compliance, audit and legal); finance (including financial reporting, planning and strategy,

asset liability management, investor relations and corporate communications); human resources

management; and facilities management & administration.

In addition to the above, the Global Principal Investments & Trading Group is responsible for taking

proprietary positions in the Indian and international markets. The Global Markets Group is responsible for

the global client-centric treasury operations. The Structural Rate Risk Management Group is responsible

for taking interest rate views and determining interest rate risk positions for the Bank as a whole, with

oversight over banking subsidiaries as applicable.

The Bank also has certain specialised groups namely, Technology Management Group (TMG) which is

responsible for enterprise-wide technology initiatives, Organisational Excellence Group (OEG) which is

responsible for quality initiatives and Social Initiatives Group (SIG) which is responsible for our social

and community development activities.

BUSINESS REVIEW

During fiscal 2007, the Bank continued to grow and diversify its asset base and revenue streams by

leveraging the growth platforms created over the past few years. We maintained our leadership position

in retail credit, achieved robust growth in our fee income from both corporate and retail customers, grew

our deposit base and significantly scaled up our international operations and rural reach.

Retail Banking

While we were among the first banks to identify the growth potential of retail credit in India, over the last

few years the banking system as a whole has seen significant expansion of retail credit, with retail loans

accounting for a major part of overall systemic credit growth. Despite the increase in interest rates during

fiscal 2007, we believe that the retail credit continues to have robust long term growth potential, driven by

sound fundamentals, namely, rising income levels, favourable demographic profile and wide availability

of credit. At the same time, the retail credit business requires a high level of credit and analytical skills

and strong operations processes backed by technology. Our retail strategy is centred around a wide

distribution network, leveraging our branches and offices, direct marketing agents and dealer and real

estate developer relationships; a comprehensive and competitive product suite; technology-enabled

back-office processes; and a robust credit and analytical framework.

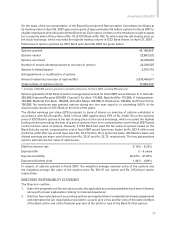

We are the largest provider of retail credit in India. Our total retail disbursements in fiscal 2007 were

approximately Rs. 777.00 billion, compared to approximately Rs. 627.00 billion in fiscal 2006. Our total

retail portfolio increased from Rs. 921.98 billion at March 31, 2006 to Rs. 1,277.03 billion at March 31,

2007, constituting 65% of our total loans at that date. We continued our focus on retail deposits to create

a stable funding base. At March 31, 2007 we had more than 25 million retail customer accounts.