ICICI Bank 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

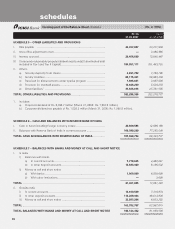

F9

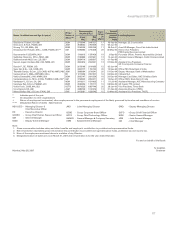

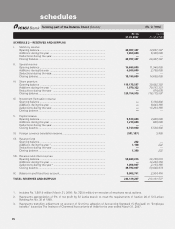

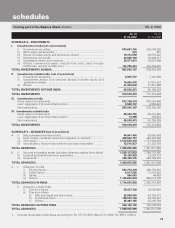

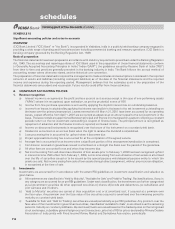

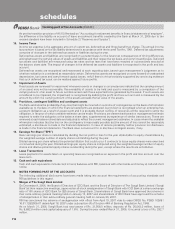

SCHEDULE 8 – INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ........................................................................ 673,681,742 510,744,392

ii) Other approved securities................................................................... 601 601

iii) Shares (includes equity and preference shares) ................................ 19,372,558 20,578,522

iv) Debentures and bonds ...................................................................... 24,628,194 18,040,317

v) Subsidiaries and/or joint ventures ....................................................... 26,071,831 16,691,698

vi) Others (commercial paper, mutual fund units, pass through

certificates, security receipts etc.) ..................................................... 123,785,241 104,308,855

TOTAL INVESTMENTS IN INDIA ...................................................................... 867,540,167 670,364,385

II. Investments outside India [net of provisions]

i) Government securities ........................................................................ 2,965,737 1,342,384

ii) Subsidiaries and/or joint ventures abroad (includes equity and

preference shares) ............................................................................ 14,650,476 11,915,291

iii) Others ............................................................................................. 27,422,038 31,851,884

TOTAL INVESTMENTS OUTSIDE INDIA .......................................................... 45,038,251 45,109,559

TOTAL INVESTMENTS ...................................................................................... 912,578,418 715,473,944

III. Investments in India

Gross value of investments ........................................................................ 873,108,274 675,324,809

Less: Aggregate of provision/depreciation ................................................ 5,568,107 4,960,424

Net investments .......................................................................................... 867,540,167 670,364,385

IV. Investments outside India

Gross value of investments ........................................................................ 45,052,750 45,215,492

Less: Aggregate of provision/depreciation ................................................ 14,499 105,933

Net investments .......................................................................................... 45,038,251 45,109,559

TOTAL INVESTMENTS ...................................................................................... 912,578,418 715,473,944

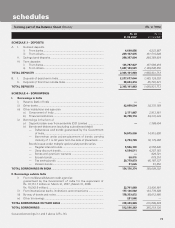

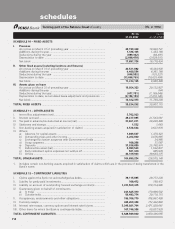

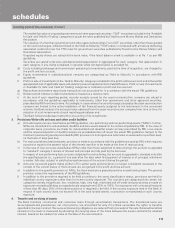

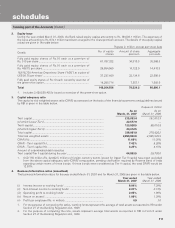

SCHEDULE 9 – ADVANCES [net of provisions]

A. i) Bills purchased and discounted .......................................................... 44,947,460 63,065,998

ii) Cash credits, overdrafts and loans repayable on demand ................. 328,642,181 249,328,298

iii) Term loans........................................................................................... 1,512,550,418 1,117,904,639

iv) Securitisation, finance lease and hire purchase receivables1 ............ 72,515,937 31,332,154

TOTAL ADVANCES ............................................................................................ 1,958,655,996 1,461,631,089

B. i) Secured by tangible assets [includes advances against book debts] 1,528,133,832 1,199,732,405

ii) Covered by Bank/Government guarantees ......................................... 34,195,829 13,508,731

iii) Unsecured ........................................................................................... 396,326,335 248,389,953

TOTAL ADVANCES ............................................................................................ 1,958,655,996 1,461,631,089

C. I. Advances in India

i) Priority Sector .............................................................................. 552,772,378 426,756,181

ii) Public Sector ............................................................................... 4,017,005 11,572,043

iii) Banks ........................................................................................... 906,063 48,863

iv) Others .......................................................................................... 1,156,860,404 898,014,748

TOTAL ADVANCES IN INDIA ............................................................................ 1,714,555,850 1,336,391,835

II. Advances outside India

i) Due from banks ........................................................................... 30,027,302 18,559,863

ii) Due from others

a) Bills purchased and discounted .......................................... 22,000,550 43,769,271

b) Syndicated loans ................................................................. 146,579,129 29,704,361

c) Others .................................................................................. 45,493,165 33,205,759

TOTAL ADVANCES OUTSIDE INDIA ................................................................ 244,100,146 125,239,254

TOTAL ADVANCES ............................................................................................ 1,958,655,996 1,461,631,089

1. Includes receivables under lease amounting to Rs. 577.9 million (March 31, 2006: Rs. 695.1 million).

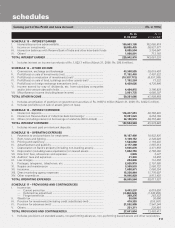

(Rs. in ‘000s)

forming part of the Balance Sheet (Contd.)

As on As on

31.03.2007 31.03.2006

schedules