ICICI Bank 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F65

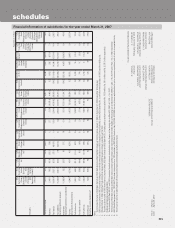

schedules

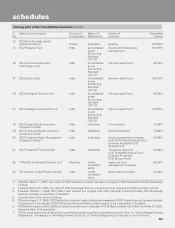

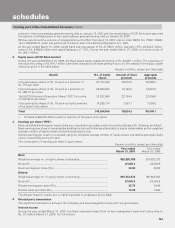

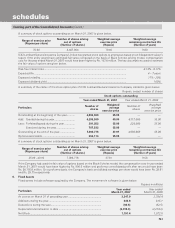

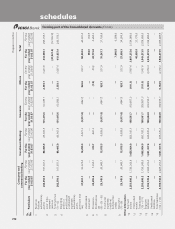

A summary of the status of the Bank’s stock option plan is given below. Rupees, except number of shares

Stock options outstanding

Year ended March 31, 2007 Year ended March 31, 2006

Particulars Number of

shares

Weighted

average

exercise price

Number of

shares

Weighted

average

exercise price

Outstanding at the beginning of the year ........... 17,362,584 262.60 18,215,335 207.33

Add: Granted during the year ............................. 6,439,900 582.26 4,981,780 362.12

Less: Forfeited/lapsed during the year ............... 1,127,650 422.81 931,280 261.89

Exercised during the year1 ........................ 9,487,051 210.47 4,903,251 158.50

Outstanding at the end of the year ..................... 13,187,783 442.50 17,362,584 262.60

Options exercisable ............................................ 326,259 225.80 4,451,704 194.00

1. Excludes options exercised but not allotted.

A summary of stock options outstanding as on March 31, 2007 is given below.

Range of exercise price

(Rupees per share)

Number of shares arising

out of options

(Number of shares)

Weighted average

exercise price

(Rupees)

Weighted average

remaining contractual life

(Number of years)

105 - 300 203,190 168.24 4.50

301 - 600 12,861,093 442.93 8.27

601 - 1000 123,500 849.22 9.69

The options were exercised regularly throughout the year and weighted average share price as per NSE price volume data

during the year ended March 31, 2007 was Rs. 750.58 (March 31, 2006: Rs. 531.34).

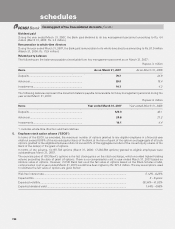

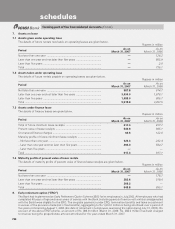

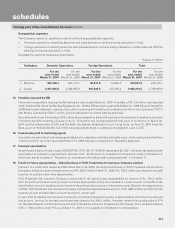

ICICI Prudential Life Insurance Company Limited has formulated three ESOS schemes, namely “Founder option”,

“FY 2004-05 scheme” and “FY 2005-06 scheme”.

During the year, ICICI Prudential Life Insurance Company Limited has recognised a compensation cost of Rs. 5.6 million.

If the entity had used the fair value of options based on the Black-Scholes model, compensation cost in year ended March

31, 2007 would have been higher by Rs. 61.0 million. The key assumptions used to estimate the fair value of options are

given below.

Risk-free interest rate ..................................................................................................................................... 6.87%

Expected life .................................................................................................................................................. 5 years

Expected volatility .......................................................................................................................................... 28.7%

Expected dividend yield ................................................................................................................................. 1.50%

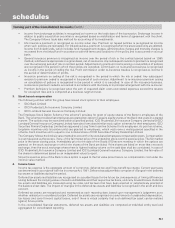

A summary of the status of the stock option plan – “Founder option” is given below.

Rupees, except number of shares

Stock options outstanding

Year ended March 31, 2007 Year ended March 31, 2006

Particulars Number of

shares

Weighted

average

exercise price

Number of

shares

Weighted

average

exercise price

Outstanding at the beginning of the year ........... 2,287,500 30.00 2,665,500 30.00

Add: Granted during the year ............................. ————

Less: Forfeited/lapsed during the year ............... 150,500 30.00 378,000 30.00

Exercised during the year ......................... 1,573,423 30.00 ——

Outstanding at the end of the year ..................... 563,577 30.00 2,287,500 30.00

Options exercisable ............................................ 60,202 30.00 1,143,750 30.00

forming part of the Consolidated Accounts (Contd.)