ICICI Bank 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Annual Report 2006-2007

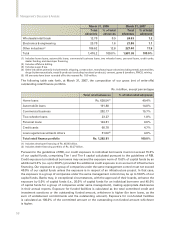

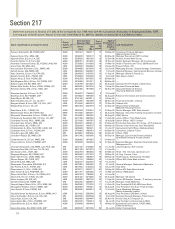

Contingent liabilities increased by 42.5% or Rs. 1,679.25 billion to Rs. 5,629.60 billion at year-end fiscal

2007 from Rs. 3,950.35 billion at year-end fiscal 2006 primarily due to a 35.4% increase in interest rate

swaps and currency options and a 45.0% increase in liability on account of outstanding forward exchange

contracts. The 47.3% increase in contingent liabilities to Rs. 3,950.35 billion at year-end fiscal 2006 from

Rs. 2,681.54 billion at year-end fiscal 2005 was primarily due to a 62.7% increase in interest rate swaps

and currency options.

Our contingent liabilities have been steadily increasing over the period from fiscal 2003. This increase is

primarily due to increase in foreign exchange and derivative transactions. The swap and forward exchange

contract market in India is a developing market. Market volumes have increased significantly in recent

years. As an active player and market maker in swap and forward exchange contract markets and due

to the fact that reduction in positions is generally achieved by entering into offsetting transactions rather

than termination/cancellation of existing transactions, we have seen substantial increase in notional

principal of our swap portfolio in recent years.

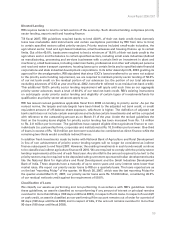

An interest rate swap does not entail exchange of notional principal and the cash flow arises on account

of the difference between interest rate pay and receive legs of the swaps which is generally much smaller

than the notional principal of the swap. A large proportion of interest rate swap, currency swap and

forward exchange contracts is on account of market making which involves providing regular two-way

prices to customers or inter-bank counter parties. The exposure due to these transactions is normally

reduced by entering into an off-setting transaction with another counter-party. This results in generation

of a higher number of outstanding transactions, and hence a large value of gross notional principal of the

portfolio. For example, if a transaction entered into with a customer is covered by an exactly opposite

transaction entered into with another counter-party, the net market risk of the two transactions will be

zero whereas, the notional principle of the portfolio will be sum of both the transactions.

Claims against the Bank not acknowledged as debts represents demands made by the Government of

India’s tax authorities in excess of the provisions made in our accounts, in respect of income tax, interest

tax, wealth tax and sales tax matters.

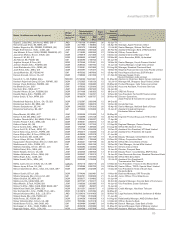

Guarantees

As a part of our project financing and commercial banking activities, we have issued guarantees to

enhance the credit standing of our customers. These generally represent irrevocable assurances that we

will make payments in the event that the customer fails to fulfill its financial or performance obligations.

Financial guarantees are obligations to pay a third party beneficiary where a customer fails to make

payment towards a specified financial obligation. Performance guarantees are obligations to pay a third

party beneficiary where a customer fails to perform a non-financial contractual obligation. The guarantees

are generally for a period not exceeding 10 years.

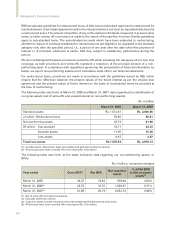

The credit risks associated with these products, as well as the operating risks, are similar to those relating

to other types of financial instruments.

We generally have collateral available to reimburse potential losses on the guarantees. Margins available

to reimburse losses realised under guarantees amounted to Rs. 11.93 billion at year end fiscal 2007 and

Rs. 10.29 billion at year-end fiscal 2006. Other property or security may also be available to us to cover

losses under guarantees.

Capital Commitments

We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature,

which have been committed. As of the balance sheet date, work had not been completed to this extent.

Estimated amounts of contracts remaining to be executed on capital account aggregated Rs. 3.43

billion at year-end fiscal 2007 compared to Rs. 1.13 billion at year-end fiscal 2006. Estimated amounts of

contracts remaining to be executed on capital account at year-end fiscal 2005 aggregated Rs. 0.70 billion

compared to Rs. 0.29 billion at year-end fiscal 2004 signifying the unpaid amount for acquisition of fixed

assets as per contracts entered into with suppliers.