ICICI Bank 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

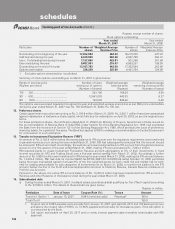

F16

As per the transition provision of AS 15 (Revised) on “Accounting for retirement benefits in financial statements of employer”,

the difference in the liability on account of leave encashment benefits created by the Bank at March 31, 2006 due to the

revised standard have been included in Schedule 2 (“Reserves and Surplus”).

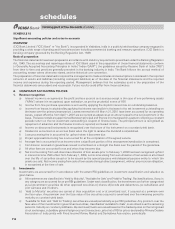

10. Income Taxes

Income tax expense is the aggregate amount of current tax, deferred tax and fringe benefit tax charge. The annual income

tax provision is based on the tax liability determined in accordance with the Income Tax Act, 1961. Deferred tax adjustments

comprise of changes in the deferred tax assets or liabilities during the year.

Deferred tax assets and liabilities are recognised on a prudent basis for the future tax consequences of timing differences

arising between the carrying values of assets and liabilities and their respective tax basis, and carry forward losses. Deferred

tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantively enacted at

the balance sheet date. The impact of changes in the deferred tax assets and liabilities is recognised in the profit and loss

account.

Deferred tax assets are recognised and reassessed at each reporting date, based upon management’s judgement as to

whether realisation is considered as reasonably certain. Deferred tax assets are recognised on carry forward of unabsorbed

depreciation, tax losses and carry forward capital losses, only if there is virtual certainty supported by convincing evidence

that such deferred tax asset can be realised against future profits.

11. Impairment of Assets

Fixed assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the

carrying amount of an asset to future net discounted cash flows expected to be generated by the asset. If such assets are

considered to be impaired, the impairment is recognised by debiting the profit and loss account and is measured by the

amount by which the carrying amount of the assets exceeds the fair value of the assets.

12. Provisions, contingent liabilities and contingent assets

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information

available up to the date on which the financial statements are prepared. A provision is recognised when an enterprise has

a present obligation as a result of a past event and it is probable that an outflow of resources will be required to settle the

obligation, in respect of which a reliable estimate can be made. Provisions are determined based on management estimate

required to settle the obligation at the balance sheet date, supplemented by experience of similar transactions. These are

reviewed at each balance sheet date and adjusted to reflect the current management estimates. In cases where the available

information indicates that the loss on the contingency is reasonably possible but the amount of loss cannot be reasonably

estimated, a disclosure is made in the financial statements. In case of remote possibility neither provision nor disclosure

is made in the financial statements. The Bank does not account for or disclose contingent assets, if any.

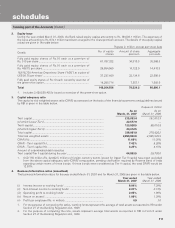

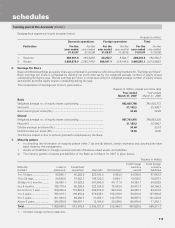

13. Earnings Per Share (“EPS”)

Basic earnings per share is calculated by dividing the net profit or loss for the year attributable to equity shareholders by

the weighted average number of equity shares outstanding during the year.

Diluted earning per share reflects the potential dilution that could occur if contracts to issue equity shares were exercised

or converted during the year. Diluted earnings per equity share is computed using the weighted average number of equity

shares and dilutive potential equity shares outstanding during the year, except where the results are anti-dilutive.

14. Lease Transactions

Lease payments for assets taken on operating lease are recognised as an expense in the profit and loss account over the

lease term.

15. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short

notice.

B. NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account the requirements of accounting standards and

RBI guidelines in this regard.

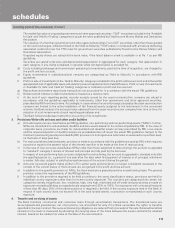

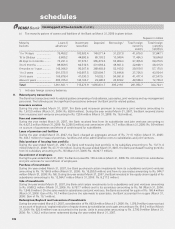

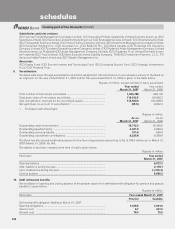

1. Merger of The Sangli Bank Limited

On December 9, 2006, the Board of Directors of ICICI Bank and the Board of Directors of The Sangli Bank Limited (‘Sangli

Bank’) at their respective meetings, approved an all-stock amalgamation of Sangli Bank with ICICI Bank at a share exchange

ratio of 100 shares of ICICI Bank for 925 shares of Sangli Bank. Shareholders of Sangli Bank have approved the scheme in

their extra-ordinary general meeting held on January 15, 2007 and shareholders of ICICI Bank have approved the scheme

of amalgamation in their extra-ordinary general meeting held on January 20, 2007.

RBI has sanctioned the scheme of amalgamation with effect from April 19, 2007 vide its order DBOD No. PSBD 10268 /

16.01.128/2006-07 dated April 18, 2007 under sub-section (4) of Section 44A of Banking Regulation Act, 1949.

As on March 31, 2006, Sangli Bank had total assets of Rs. 21,508.5 million, deposits of Rs. 20,043.3 million, loans of

Rs. 8,882.8 million and capital adequacy of 1.6%. During the year ended March 31, 2006, it incurred a loss of Rs. 292.7

million.

forming part of the Accounts (Contd.)

schedules