ICICI Bank 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

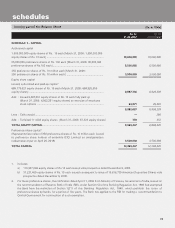

F15

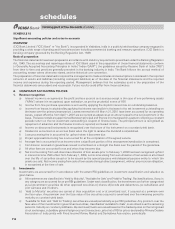

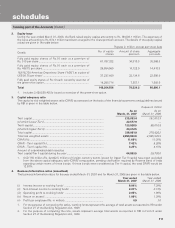

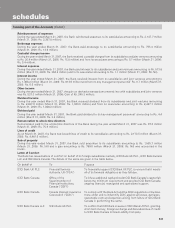

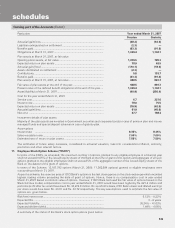

8. Employee Stock Option Scheme (“ESOS”)

The Employees Stock Option Scheme (“the scheme “) provides for the grant of equity shares of the Bank to its employees.

The Scheme provides that employees are granted an option to acquire equity shares of the Bank that vests in a graded

manner. The options may be exercised within a specified period. The Bank follows the intrinsic value method to account for

its stock-based employees compensation plans. Compensation cost is measured by the excess, if any, of the fair market

price of the underlying stock over the exercise price on the grant date. The fair market price is the latest closing price,

immediately prior to the date of the Board of Directors meeting in which the options are granted, on the stock exchange on

which the shares of the Bank are listed. If the shares are listed on more than one stock exchange, then the stock exchange

where there is highest trading volume on the said date is considered.

Since the exercise prices of the Bank’s stock options are equal to fair market price on the grant date, there is no compensation

cost under the intrinsic value method.

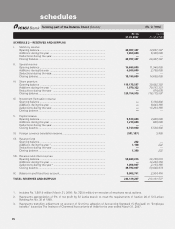

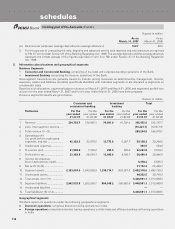

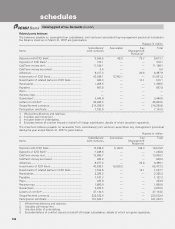

9. Staff Retirement Benefits

Gratuity

ICICI Bank pays gratuity to employees who retire or resign after a minimum period of five years of continuous service. ICICI

Bank makes contributions to three separate gratuity funds, for employees inducted from erstwhile ICICI Limited (erstwhile

ICICI), employees inducted from erstwhile Bank of Madura and employees of ICICI Bank other than employees inducted

from erstwhile ICICI and erstwhile Bank of Madura.

Separate gratuity funds for employees inducted from erstwhile ICICI and erstwhile Bank of Madura are managed by ICICI

Prudential Life Insurance Company Limited. Actuarial valuation of the gratuity liability is determined by an actuary appointed

by ICICI Prudential Life Insurance Company Limited. The investments of the funds are made according to rules prescribed

by the Government of India. The gratuity fund for employees of ICICI Bank, other than employees inducted from erstwhile

ICICI and erstwhile Bank of Madura, is administered by the Life Insurance Corporation of India and ICICI Prudential Life

Insurance Company Limited. In accordance with the gratuity fund’s rules, actuarial valuation of gratuity liability is calculated

based on certain assumptions regarding rate of interest, salary growth, mortality and staff attrition as per the projected unit

credit method.

As per the transition provision of AS 15 (Revised) on “Accounting for retirement benefits in financial statements of employer”,

the difference in the liability on account of gratuity benefits created by the Bank at March 31, 2006 due to the revised

standard have been included in Schedule 2 (“Reserves and Surplus”).

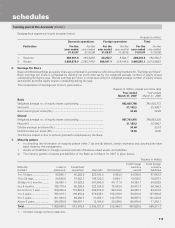

Superannuation Fund

ICICI Bank contributes 15.0% of the total annual salary of each employee to a superannuation fund for ICICI Bank employees.

ICICI Bank’s employees get an option on retirement or resignation to receive one-third of the total balance and a monthly

pension based on the remaining two-third balance. In the event of death of an employee, his or her beneficiary receives

the remaining accumulated two-third balance. ICICI Bank also gives cash option to its employees, allowing them to receive

the amount contributed by ICICI Bank in their monthly salary during their employment.

Upto March 31, 2005, the superannuation fund was administered solely by the Life Insurance Corporation of India. Subsequent

to March 31, 2005, the fund is being administered by both Life Insurance Corporation of India and ICICI Prudential Life

Insurance Company Limited. Employees had the option to retain the existing balance with Life Insurance Corporation of

India or seek a transfer to ICICI Prudential Life Insurance Company Limited.

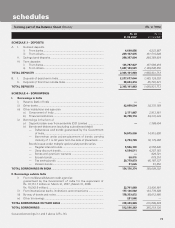

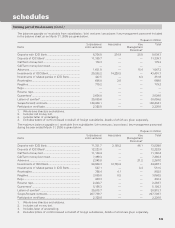

Pension

The Bank provides for pension, a deferred retirement plan covering certain employees. The plan provides for a pension

payment on a monthly basis to these employees on their retirement based on the respective employee’s salary and years

of employment with the Bank. Employees covered by the pension plan are not eligible for benefits under the provident

fund plan, a defined contribution plan.

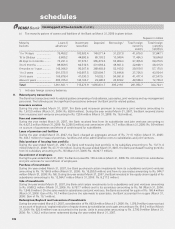

As per the transition provision of AS 15 (Revised) on “Accounting for retirement benefits in financial statements of employer”,

the difference in the liability on account of pension benefits created by the Bank at March 31, 2006 due to the revised

standard have been included in Schedule 2 (“Reserves and Surplus”).

Provident Fund

ICICI Bank is statutorily required to maintain a provident fund as a part of its retirement benefits to its employees. There

are separate provident funds for employees inducted from erstwhile Bank of Madura (other than those employees who

have opted for pensions), and for other employees of ICICI Bank. These funds are managed by in-house trustees. Each

employee contributes 12.0% of his or her basic salary (10.0% for clerks and sub-staff of erstwhile Bank of Madura) and

ICICI Bank contributes an equal amount to the funds. The investments of the funds are made according to rules prescribed

by the Government of India.

Leave encashment

The Bank provides for leave encashment benefit, which is a defined benefit scheme, based on actuarial valuation as at the

balance sheet date conducted by an independent actuary.

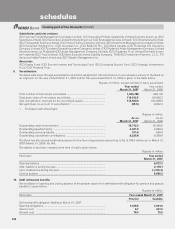

forming part of the Accounts (Contd.)

schedules