ICICI Bank 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

56

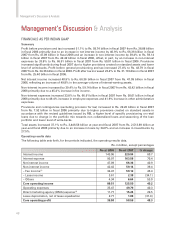

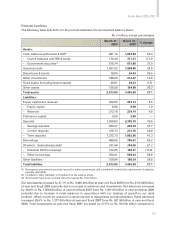

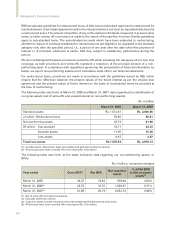

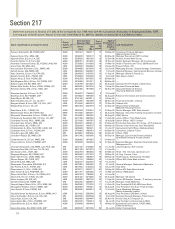

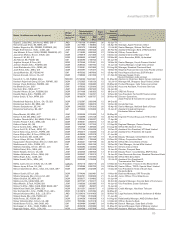

Capital Adequacy

Rs. in billion, except percentages

March 31, 2006 March 31, 2007

Tier I capital Rs. 191.82 Rs. 215.03

Tier II capital 86.61 123.93

Total capital 278.43 338.96

On- balance sheet risk weighted assets 1,557.24 2,132.64

Off-balance sheet risk weighted assets 528.70 767.29

Total risk weighted assets Rs. 2,085.94 Rs. 2,899.93

Tier I capital adequacy ratio 9.20% 7.42%

Tier II capital adequacy ratio 4.15% 4.27%

Total capital adequacy ratio 13.35% 11.69%1

(1) USD 750 million (Rs. 32.60 billion) of foreign currency bonds raised for Upper Tier II capital have been excluded from the

above capital adequacy ratio computation, pending clarification required by RBI regarding certain terms of these bonds.

If these bonds were considered as Tier II capital, the total capital adequacy ratio would be 12.81%.

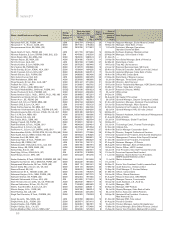

We are subject to the capital adequacy requirements of the RBI, which are primarily based on the

capital adequacy accord reached by the Basel Committee of Banking Supervision, Bank of International

Settlements in 1988. We are required to maintain a minimum ratio of total capital to risk adjusted assets

of 9.0%, at least half of which must be Tier I capital.

Our total capital adequacy ratio calculated in accordance with the RBI guidelines at year-end fiscal 2007

was 11.69%, including Tier I capital adequacy ratio of 7.42% and Tier II capital adequacy ratio of 4.27%.

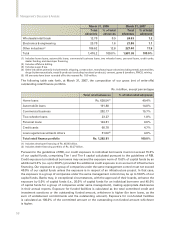

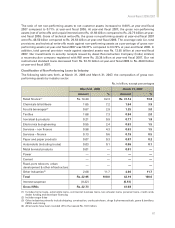

In accordance with the RBI guidelines, the risk-weighted assets at year-end fiscal include home loans

to individuals at a risk weightage of 75%, other consumer loans and capital market exposure at a risk

weightage of 125%. Commercial real estate exposure and investments in venture capital funds have

been considered at a risk weightage of 150%. The risk-weighted assets at year-end fiscal 2006 and year-

end fiscal 2007 also include the impact of capital requirement for market risk on the held for trading and

available for sale portfolio. Deferred tax asset amounting to Rs. 6.10 billion and unamortised amount of

expenses on Early Retirement Option Scheme amounting to Rs. 0.50 billion at year-end fiscal 2007, have

been reduced from Tier I capital while computing the capital adequacy ratio.

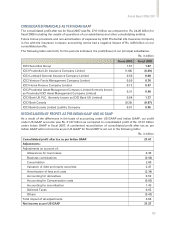

ICICI had outstanding preference share capital of Rs. 3.50 billion, representing 350, 0.001% preference

shares of Rs. 1,00,00,000 each issued under the scheme of amalgamation of erstwhile ITC Classic Finance

with ICICI. These preference shares are redeemable in the year 2018. The RBI vide letter dated April 21,

1999, permitted ICICI to include the “grant element” of such preference shares in Tier I capital subject

to the creation of a corpus to be invested in Government of India securities of equivalent maturity.

Subsequently, ICICI created a corpus of Rs. 0.47 billion on May 3, 1999 and invested the amount in

Government of India securities. Accordingly, the grant element of this preference share capital has been

included in our Tier I capital. For these preference shares, the notification dated April 17, 2002 from

Ministry of Finance, Government of India, issued on the recommendation of Reserve Bank of India (RBI),

under Section 53 of the Banking Regulation Act, 1949, had exempted the Bank from the restriction of

Section 12 (1) of the Banking Regulation Act, 1949, which prohibits the issue of preference shares by

banks, for a period of five years. The Bank has applied to RBI for making a recommendation to Central

Government for continuation of such exemption.

For all securitisation deals executed subsequent to February 1, 2006, capital requirement has been

considered in accordance with the RBI guidelines issued in this regard on February 1, 2006. In January

2006, the RBI issued guidelines permitting banks to issue perpetual debt with a call option after not less

than 10 years, to be exercised with its prior approval, for inclusion in Tier I capital up to a maximum