ICICI Bank 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F31

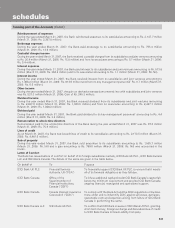

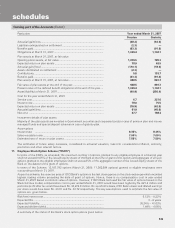

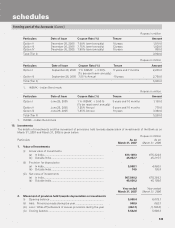

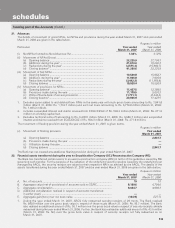

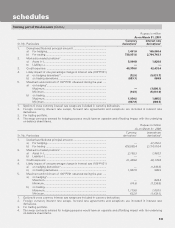

ii) Non-performing investments in securities, other than government and other approved securities

The movement in gross non-performing investments in securities other than government and other approved securities

for the year ended March 31, 2007 and year ended March 31, 2006 is given below.

Rupees in million

Particulars Year ended Year ended

March 31, 2007 March 31, 2006

Opening balance ................................................................................. 2,595.9 8,877.3

Additions during the year .................................................................... 916.1 2,158.0

Reduction during the year ................................................................... (428.9) (8,439.4)

Closing balance ................................................................................... 3,083.1 2,595.9

Total provisions held ........................................................................... 2,045.9 1,509.3

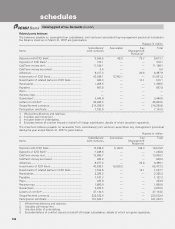

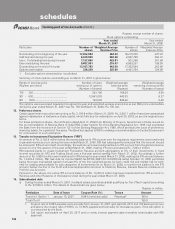

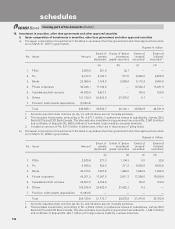

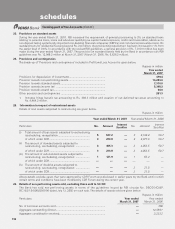

17. Repurchase transactions

The details of securities sold and purchased under repos and reverse repos during the year ended March 31, 2007 and year

ended March 31, 2006 are given below.

Rupees in million

Minimum

outstanding

balance during

the year

Maximum

outstanding

balance during

the year

Daily average

outstanding

balance during

the year

Balance

as on

year end

Year ended March 31, 2007

Securities sold under repurchase transaction — 55,823.8 17,020.1 4,760.6

Securities purchased under reverse repurchase transaction — 5,100.1 110.1 —

Year ended March 31, 2006

Securities sold under repurchase transaction — 43,134.3 15,296.0 10,000.0

Securities purchased under reverse repurchase transaction — 33,608.7 1,214.9 —

Note: The above figures do not include securities sold and purchased under Liquidity Adjustment Facility (‘’LAF”) of RBI.

The above figures are for Indian branches only.

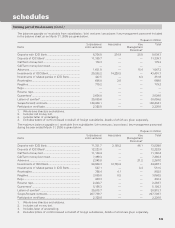

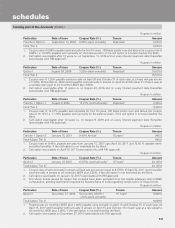

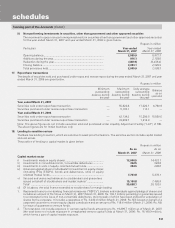

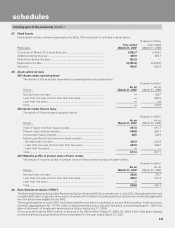

18. Lending to sensitive sectors

The Bank has lending to sectors, which are sensitive to asset price fluctuations. The sensitive sectors include capital market

and real estate.

The position of lending to capital market is given below.

Rupees in million

As on As on

March 31, 2007 March 31, 2006

Capital market sector

i) Investments made in equity shares .................................................... 12,046.5 14,453.1

ii) Investments in convertible bonds / convertible debentures .............. 332.5 583.8

iii) Investments in units of equity–oriented mutual funds ....................... 394.5 200.6

iv) Advances against share to individuals for investment in equity shares

(including IPOs /ESOPs), bonds and debentures, units of equity

oriented mutual funds ......................................................................... 7,763.8 5,470.1

v) Secured and unsecured advances to stockbrokers and guarantees

issued on behalf of stockbrokers and market makers1 ...................... 15,160.8 7,485.9

Total2 .................................................................................................. 35,698.1 28,193.5

vi) Of (v) above, the total finance extended to stockbrokers for margin trading — —

1. Represents loans to non-banking financial companies (“NBFCs”), brokers and individuals against pledge of shares and

includes an amount of Rs. Nil as on March 31, 2007 (March 31, 2006: Rs. 102.7 million) pertaining to guarantee issued

to a corporate for the issue of non-convertible debentures, the proceeds of which have been utilised for acquisition of

shares by the corporate. It includes a guarantee of Rs. 3,040.0 million (March 31, 2006: Rs. Nil) issued on behalf of a

corporate customer to ensure equity capital contribution and an amount of Rs. 118.4 million (March 31, 2006: Rs. Nil)

for issue of guarantee to venture funds.

2. The total does not include exposure in venture capital funds amounting to Rs. 19,499.7 million as of March 31, 2007

(the total does not include exposure in unregistered venture capital funds at March 31, 2006: Rs. 16,149.9 million),

which forms a part of capital market exposure.

forming part of the Accounts (Contd.)

schedules