ICICI Bank 2007 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F84

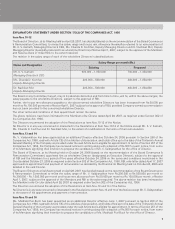

h) Accounting for Securitisation

Under US GAAP, the Company accounts for gain on sale of loans securitised (including float income) at the time of sale

in accordance with Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment

of Liabilities. As per Statement No. 140, any gain on loss on the sale of the financial asset is accounted for in the

income statement at the time of the sale. Under Indian GAAP, with effect from February 1, 2006, net income arising

from securitisation of loan assets is accounted for over the life of the securities issued or to be issued by the special

purpose vehicle/special purpose entity to which the assets are sold. The float income is accrued as it is earned under

Indian GAAP.

i) Deferred Taxes

The differences in the accounting for deferred taxes are primarily on account of:

i) Tax impact of all US GAAP adjustments.

ii) Deferred taxes created on undistributed earnings of subsidiaries and affiliates under US GAAP. Deferred taxes

are not required to be created on undistributed earnings of subsidiaries and affiliates under Indian GAAP.

iii) Under Indian GAAP deferred tax assets or liabilities are created based on substantively enacted tax rates whereas

under US GAAP these are created on enacted tax rates in force at the balance sheet date.

j) Others

Others include gains realised on redemption of certain venture capital units through equity shares under Indian GAAP.

The same was not accounted for as a gain under US GAAP as consideration other than beneficial interest was not

received.

k) Dividend

Under US GAAP, dividends on common stock and the related dividend tax are recognised in the year of approval by

the Board of Directors. Under Indian GAAP, dividends on common stock and the related dividend tax are recognised

in the year to which it relates to.

reconciliation to US GAAP and related notes

for the year ended March 31, 2007