ICICI Bank 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F36

30. Provisions for income tax

The provision for income tax (including deferred tax and fringe benefit tax) for the year ended March 31, 2007 amounted

to Rs. 5,348.2 million (March 31, 2006: Rs. 5,535.3 million).

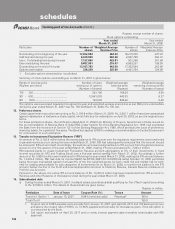

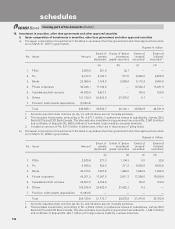

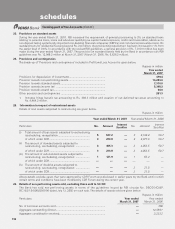

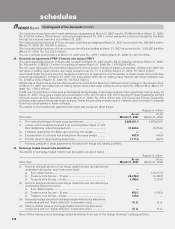

31. Deferred tax

As on March 31, 2007, the Bank has recorded net deferred tax asset of Rs. 6,099.6 million (March 31, 2006: Rs. 1,642.8

million), which has been included in other assets. The break-up of deferred tax assets and liabilities into major items is given

below.

Rupees in million

Year ended Year ended

Particulars March 31, 2007 March 31, 2006

Deferred Tax Asset

Provision for bad and doubtful debts ......................................................... 11,758.5 6,501.5

Capital loss .................................................................................................. — 950.0

Others.......................................................................................................... 884.0 880.7

Total Deferred Tax Assets ........................................................................... 12,642.5 8,332.2

Less: Deferred Tax Liability ......................................................................

Depreciation on fixed assets .......................................................... 6,543.3 6,697.2

Others ............................................................................................. — —

Total Deferred Tax Liabilities ...................................................................... 6,543.3 6,697.2

Add: Deferred tax asset pertaining to foreign branches ........................ 0.4 7.8

Total net deferred tax asset/(liability) .......................................................... 6,099.6 1,642.8

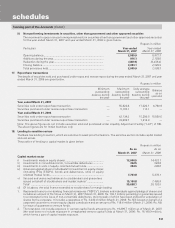

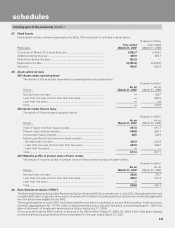

32. Subvention Income

The Bank had aligned its accounting policy for subvention income with its accounting policy for direct marketing agency/

associate expenses in the year ended March 31, 2006. Accordingly, subvention income has been accounted for in the period

in which it is received instead of over the period of the loan. As a result of the change in policy, the impact on profit for the

year ended March 31, 2006 was not significant.

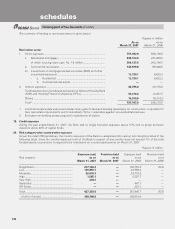

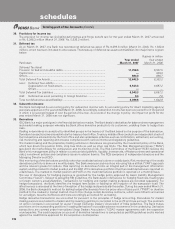

33. Derivatives

ICICI Bank is a major participant in the financial derivatives market. The Bank deals in derivatives for balance sheet management

and market making purposes whereby the Bank offers derivative products to its customers, enabling them to hedge their

risks.

Dealing in derivatives is carried out by identified groups in the treasury of the Bank based on the purpose of the transaction.

Derivative transactions are entered into by the treasury front office. Treasury middle office conducts an independent check of

the transactions entered into by the front office and also undertakes activities such as confirmation, settlement, accounting,

risk monitoring and reporting and ensures compliance with various internal and regulatory guidelines.

The market making and the proprietary trading activities in derivatives are governed by the investment policy of the Bank,

which lays down the position limits, stop loss limits as well as other risk limits. The Risk Management Group (“RMG”)

lays down the methodology for computation and monitoring of risk. The Risk Committee of the Board (“RCB”) reviews the

Bank’s risk management policy in relation to various risks (portfolio, liquidity, interest rate, off-balance sheet and operational

risks), investment policies and compliance issues in relation thereto. The RCB comprises of independent directors and the

Managing Director and CEO.

Risk monitoring of the derivatives portfolio other than credit derivatives is done on a daily basis. Risk monitoring of the credit

derivatives portfolio is done on a monthly basis. The Bank measures and monitors risk using Value at Risk (“VAR”) approach

and the relevant greeks for options. Risk reporting on derivatives forms an integral part of the management information

system and the marked to market position and the VAR of the derivatives portfolio other than credit derivatives is reported on

a daily basis. The marked to market position and VAR on the credit derivatives portfolio is reported on a monthly basis.

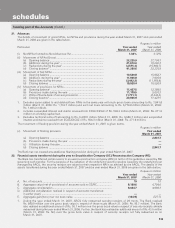

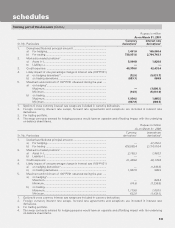

The use of derivatives for hedging purpose is governed by the hedge policy approved by Asset Liability Management

Committee (“ALCO”). Subject to prevailing RBI guidelines, the Bank deals in derivatives for hedging fixed rate, floating rate

or foreign currency assets/liabilities. Transactions for hedging and market making purposes are recorded separately. For

hedge transactions, the Bank identifies the hedged item (asset or liability) at the inception of the transaction itself. The

effectiveness is assessed at the time of inception of the hedge and periodically thereafter. During the year ended March 31,

2006, the Bank changed its method for testing hedge effectiveness from the price value of basis point (“PVBP”) or duration

method to the marked to market method. Due to this change certain derivative contracts, which were hitherto accounted

for as hedges, became ineffective and were accordingly accounted for as trading.

Hedge derivative transactions are accounted for pursuant to the principles of hedge accounting. Derivatives for market

making purpose are marked to market and the resulting gain/loss is recorded in the profit and loss account. The premium

on option contracts is accounted for as per Foreign Exchange Dealers’ Association of India guidelines. The Bank makes

provisions on the outstanding positions in trading derivatives for possible adverse movements in the underlying. Derivative

transactions are covered under International Swap Dealers Association (‘’ISDA”) master agreements with the respective

counterparties. The credit exposure on account of derivative transactions is computed as per RBI guidelines and is marked

against the credit limits approved for the respective counterparties.

forming part of the Accounts (Contd.)

schedules