ICICI Bank 2007 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

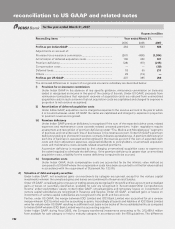

F80

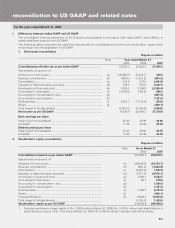

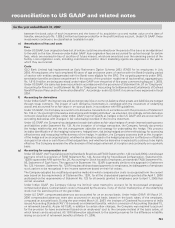

amalgamation, although ICICI Bank was the legal acquirer. On the acquisition date, ICICI held a 46% ownership

interest in ICICI Bank. Accordingly, the acquisition of the balance 54% ownership interest has been accounted for as

a step-acquisition. Under Indian GAAP, ICICI Bank Limited was recognised as the legal and the accounting acquirer

and the assets and liabilities of ICICI Limited were incorporated in the books of ICICI Bank Limited in accordance

with the purchase method of accounting. Further, under US GAAP, the amalgamation resulted in goodwill and

intangible assets while the amalgamation under Indian GAAP resulted in a capital reserve (negative goodwill),

which was accounted for as Revenue and Other Reserves according to the scheme of amalgamation.

Further, for certain acquisitions made by the Company, no goodwill has been accounted for under Indian GAAP

primarily due to accounting for the amalgamation by the pooling of interests method. However, under US GAAP,

goodwill has been accounted for in accordance with Statement No. 141 on “Business Combinations” and Statement

No. 142 on “Goodwill and Other Intangible Assets”.

Under US GAAP subsequent to the adoption of Statement No. 142, the Company does not amortise goodwill and

intangibles with infinite life but instead tests the same for impairment at least annually. The annual impairment

test under Statement No. 142 does not indicate an impairment loss for fiscal 2005, fiscal 2006 and fiscal 2007.

Under US GAAP intangible assets are amortised over their estimated useful lives in proportion to the economic

benefits consumed in each period.

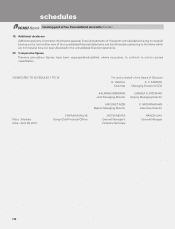

The estimated useful life of intangible assets is as follows.

No. of years

Customer-related intangibles .............................................................................. 10

Other intangibles ................................................................................................. 5

In fiscal 2006, the Company recorded goodwill under US GAAP of Rs. 1,196.8 million in relation to the acquisitions

of software, business process outsourcing and asset management companies in India and the United States for

an aggregate cash consideration of Rs 1,480.1 million. The revenue and total assets of the acquired companies

are immaterial to the consolidated results of operations and financial position of the Company. The Company has

also entered into a contract with some of the companies acquired, to pay additional amounts if certain criteria

are met.

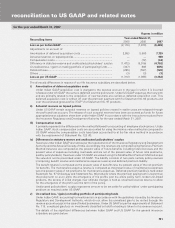

c) Consolidation

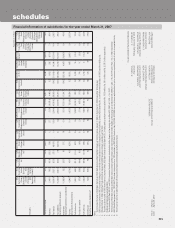

The differences on account of consolidation are primarily on account of:

i) Consolidation of insurance subsidiaries.

ii) Equity affiliates and majority owned subsidiaries.

iii) Variable interest entities.

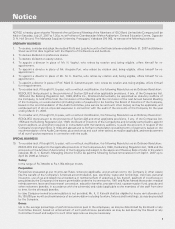

Under Indian GAAP, the Company has not consolidated certain entities in which control is intended to be

temporary. However under US GAAP, these entities have been consolidated in accordance with Statement No.

94 on “Consolidation of majority owned subsidiaries” which requires consolidation of such entities.

Under Indian GAAP, consolidation is required only if there is ownership of more than one-half of the voting

power of an enterprise or control of the composition of the board of directors in the case of a company or of the

composition of the governing body in case of any other enterprise.

However, under US GAAP, the Company is required to consolidate entities deemed to be Variable Interest Entities

(VIEs) where the Company is determined to be the primary beneficiary under FIN 46.

The Company’s venture capital subsidiary is involved with entities that may be deemed VIEs. The FASB permitted

non-registered investment companies to defer consolidation of VIEs with which they are involved until the

proposed Statement of Position on the clarification of the scope of the Investment Company Audit Guide is

finalised. Following issuance of the Statement of Position, the FASB will consider further modification to FIN

46R to provide an exception for companies that qualify to apply the revised Audit Guide. Following issuance of

the revised Audit Guide and further modification, if any, to FIN 46R, the Company will assess the effect of such

guidance on its venture capital business.

Under Indian GAAP, the insurance subsidiaries (ICICI Prudential Life Insurance Company Limited and ICICI Lombard

General Insurance Company Limited) are fully consolidated whereas under US GAAP, these subsidiaries are

accounted for by the equity method of accounting as the minority shareholders have substantive participating

rights as defined in Issue No. 96-16 issued by the Emerging Issues Task Force.

The significant differences between Indian GAAP and US GAAP in case of our life insurance subsidiary are given

below.

reconciliation to US GAAP and related notes

for the year ended March 31, 2007