ICICI Bank 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F69

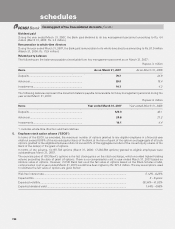

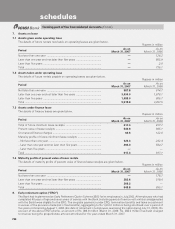

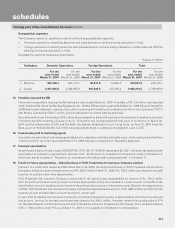

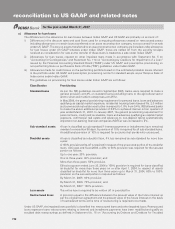

9. Preference shares

Certain government securities amounting to Rs. 2,104.8 million (March 31, 2006: Rs. 2,001.1 million) have been earmarked

against redemption of preference share capital, which falls due for redemption on April 20, 2018, as per the original issue

terms.

For these preference shares, the notification dated April 17, 2002 from Ministry of Finance, Government of India, issued on

the recommendation of Reserve Bank of India (RBI), under Section 53 of the Banking Regulation Act, 1949, had exempted

the Bank from the restriction of Section 12(1) of the Banking Regulation Act, 1949, which prohibits the issue of preference

shares by banks, for a period of five years. The Bank has applied to RBI for making a recommendation to Central Government

for continuation of such exemption.

10. Transfer to Investment Fluctuation Reserve (“IFR”)

An amount of Rs. 2,143.4 million being the excess balance in IFR account over the regulatory requirement was transferred

to General Reserve account during the year ended March 31, 2005. RBI had subsequently instructed that this amount

should be retained in IFR account itself. Accordingly, the said amount was transferred back to IFR account from the General

Reserve account in the first quarter of the year ended March 31, 2006, making IFR account balance Rs. 7,303.4 million.

RBI required banks to create IFR aggregating to 5% of their investments in fixed income securities (in ‘Available for

Sale” category and Trading Book) over a five-year period starting from March 31, 2002. Accordingly, a further amount of

Rs. 5,900.0 million was transferred to IFR account during the year ended March 31, 2006, making the IFR account balance

Rs. 13,203.4 million. RBI had vide its circular DBOD.No. BP.BC. 38/21.04.141/2005-06 dated October 10, 2005 permitted

banks that have maintained capital of at least 9% of the risk weighted assets for both credit risk and market risk for both

held for trading and available for sale categories of investments as on March 31, 2006, to transfer the balance in the IFR

account ‘below the line’ in the Profit and Loss Appropriation Account to Statutory Reserve, General Reserve or balance of

Profit and Loss Account.

Pursuant to the above, the entire IFR account balance of Rs.13,203.4 million has been transferred from IFR account to

Revenue and other Reserves in the balance sheet during the year ended March 31, 2006.

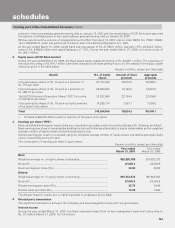

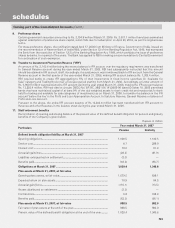

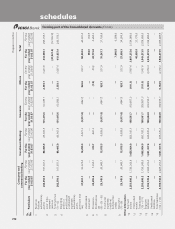

11. Staff retirement benefits

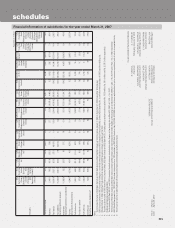

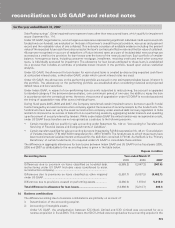

Reconciliation of opening and closing balance of the present value of the defined benefit obligation for pension and gratuity

benefits of the Company is given below.

Rupees in million

Particulars Year ended March 31, 2007

Pension Gratuity

Defined benefit obligation liability at March 31, 2007

Opening obligations ......................................................................................... 1,038.5 1,140.5

Service cost ...................................................................................................... 6.7 288.0

Interest cost ..................................................................................................... 78.0 81.9

Actuarial (gain)/loss .......................................................................................... (28.2) (61.9)

Liabilities extinguished on settlement ............................................................. (2.3) —

Benefits paid .................................................................................................... (63.3) (98.7)

Obligations at March 31, 2007 ....................................................................... 1,029.4 1,349.8

Plan assets at March 31, 2007, at fair value

Opening plans assets, at fair value .................................................................. 1,079.5 838.1

Expected return on plan assets ....................................................................... 78.9 84.5

Actuarial gain/(loss) .......................................................................................... (110.1) (13.5)

Assets distributed on settlement .................................................................... (2.3) —

Contributions .................................................................................................... 5.8 168.9

Benefits paid .................................................................................................... (63.3) (96.1)

Plan assets at March 31, 2007, at fair value 988.5 982.0

Fair value of plan assets at the end of the year ............................................... 988.5 982.0

Present value of the defined benefit obligations at the end of the year ......... 1,029.4 1,349.8

schedules

forming part of the Consolidated Accounts (Contd.)