ICICI Bank 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

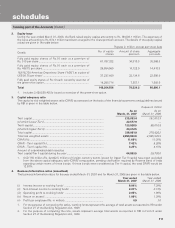

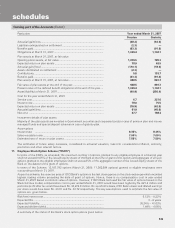

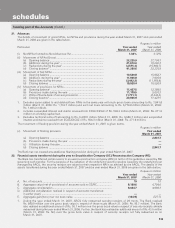

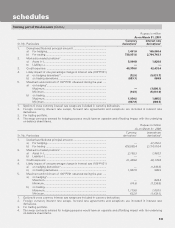

F27

Rupees in million

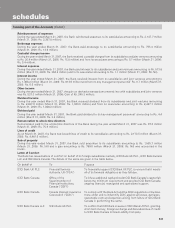

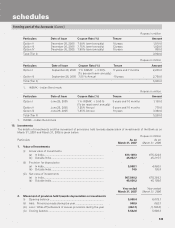

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 2 Option I September 13, 2006 9.98% (semi-annually)1Perpetual25,500.0

Total (Tier I) 5,500.0

1. Coupon rate of 9.98% payable semi-annually for first 10 years, 100 basis points over and above the coupon rate of

9.98% i.e. 10.98% payable semi-annually for the balance years, if the call option is not exercised by the Bank.

2. Call option exercisable after 10 years i.e. on September 13, 2016 and on every interest payment date thereafter

(exercisable with RBI approval).

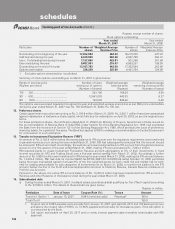

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Option I August 24, 2006 7.25% (semi-annually)1Perpetual215,510.0

Total (Tier I) 15,510.0

1. Coupon rate of 7.25% payable semi-annually on April 30 and October 31 of each year, at a fixed rate per annum

of 7.25% till October 31, 2016 and thereafter semi-annually in arrears on April 30 and October 31 of each year at

a variable rate equal to six monthly LIBOR plus 2.94%.

2. Call option exercisable after 10 years i.e. on August 23, 2016 and on every interest payment date thereafter

(exercisable with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 1 Option 1 August 9, 2006 10.10% (semi-annually)1Perpetual22,330.0

Total (Tier I) 2,330.0

1. Coupon rate of 10.10% payable semi-annually for first 10 years, 100 basis points over and above the coupon

rate of 10.10% i.e. 11.10% payable semi-annually for the balance years, if the call option is not exercised by the

Bank.

2. Call option exercisable after 10 years i.e. on August 9, 2016 and on every interest payment date thereafter

(exercisable with RBI approval).

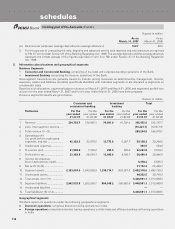

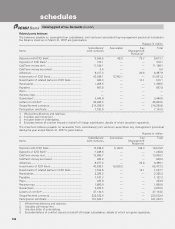

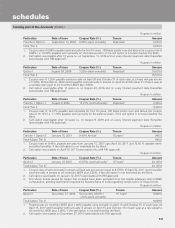

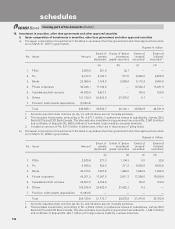

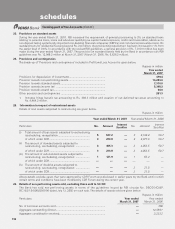

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 1 Option 2 January 15, 2007 9.40% Annual115 years2940.0

Total (Upper Tier II) 940.0

1. Coupon rate of 9.40% payable annually from January 15, 2007 upto April 30, 2017 and 10.40 % payable semi-

annually thereafter, if the call option is not exercised by the Bank.

2. Call option exercisable on April 30, 2017 (exercisable only with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Option I January 12, 2007 6.375% (semi-annually)115 Years233,135.0

Total (Upper Tier II)333,135.0

1. Coupon rate of semi-annually in arrears at fixed rate per annum equal to 6.375% till April 30, 2017 and thereafter

semi-annually in arrears at six monthly LIBOR plus 2.28%, if the call option is not exercised by the Bank.

2. Call option exercisable on January 12, 2017 (exercisable with RBI approval).

3. The above bonds issued for Upper Tier II capital have been excluded from the capital adequacy ratio (CRAR)

computation, pending clarification required by Reserve Bank of India regarding certain terms of these bonds.

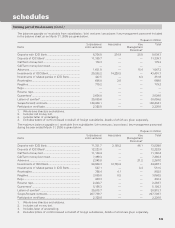

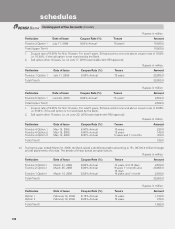

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Option I December 27, 2006 Six-monthly LIBOR +

1.40% (semi-annually)115 Years26,639.0

Total (Upper Tier II) 6,639.0

1. Floating rate six monthly LIBOR plus 1.40% payable semi-annually on April 15 and October 15 of each year, till

April 15, 2017 and thereafter semi-annually in arrears on April 15 and October 15 of each year at a rate equal to

six monthly LIBOR plus 2.40%, if the call option is not exercised by the Bank.

2. Call option exercisable on December 27, 2016 (exercisable with RBI approval).

forming part of the Accounts (Contd.)

schedules