ICICI Bank 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

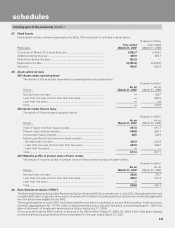

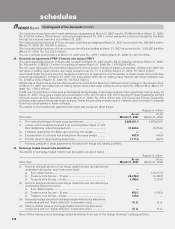

The notional principal amount of credit derivatives outstanding at March 31, 2007 was Rs. 59,096.9 million (March 31, 2006:

Rs. 23,514.4 million). Of the above, notional principal amount Rs. 434.7 million represents protection bought by the Bank

through its overseas branches as on March 31, 2007.

The notional principal amount of forex contracts classified as hedging at March 31, 2007 amounted to Rs. 288,639.6 million

(March 31, 2006: Rs. 165,041.4 million).

The notional principal amount of forex contracts classified as trading at March 31, 2007 amounted to Rs. 1,042,920.8 million

(March 31, 2006: Rs. 753,273.6 million).

The net overnight open position at March 31, 2007 was Rs. 1,279.7 million (March 31, 2006: Rs. 457.8 million).

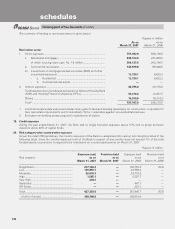

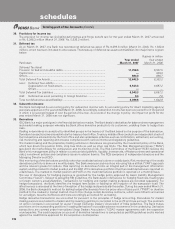

34. Forward rate agreement (“FRA”)/Interest rate swaps (“IRS”)

The notional principal amount of Rupee IRS contracts at March 31, 2007 was Rs. Nil for hedging contracts (March 31, 2006:

Rs. Nil) and Rs. 2,389,261.3 million for trading contracts (March 31, 2006: Rs. 1,870,025.6 million).

The fair value represents the estimated replacement cost of swap contracts at balance sheet date. At March 31, 2007 the

fair value of trading rupee interest rate swap contracts was Rs. 1,111.4 million (March 31, 2006: Rs. 922.4 million).

Associated credit risk is the loss that the Bank would incur in case all the counter-parties to these swaps fail to fulfil their

contractual obligations. At March 31, 2007, the associated credit risk on trading rupee interest rate swap contracts was

Rs. 37,605.4 million (March 31, 2006: Rs. 16,754.4 million).

Market risk is monitored as the loss that would be incurred by the Bank for a 100 basis points change in the interest rates.

At March 31, 2007 the market risk on trading rupee interest rate swap contracts amounted to Rs. 844.4 million (March 31,

2006: Rs. 1,192.3 million).

Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter-party. At

March 31, 2007, there was a credit risk concentration of Rs. 657.9 million with ICICI Securities Primary Dealership Limited

(formerly known as ICICI Securities Limited) (March 31, 2006: Rs. 476.4 million with ICICI Securities Primary Dealership

Limited) under rupee interest rate swap contracts. As per the prevailing market practice, the Bank does not insist on collateral

from the counter-parties in these contracts.

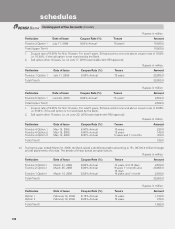

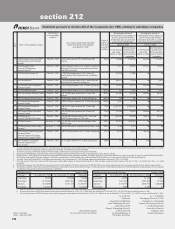

The details of the forward rate agreements/interest rate swaps are given below.

Rupees in million

As on As on

Particulars March 31, 2007 March 31, 2006

i) The notional principal of rupee swap agreements1 ............................ 2,389,261.3 1,870,025.6

ii) Losses which would be incurred if all counter-parties failed to fulfil

their obligations under the agreement ............................................... 37,605.4 16,754.4

iii) Collateral required by the Bank upon entering into swaps ................ — —

iv) Concentration on of credit risk arising from the rupee swaps ........... 657.9 476.4

v) The fair value of rupee trading swap book ......................................... 1,111.4 922.4

1. Notional principal of swap agreements includes both hedge and trading portfolio.

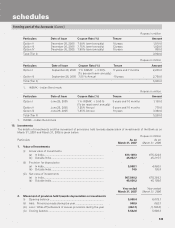

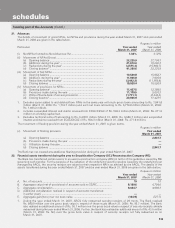

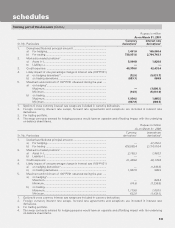

35. Exchange traded interest rate derivatives

The details of exchange traded interest rate derivatives are given below.

Rupees in million

As on As on

Particulars March 31, 2007 March 31, 2006

(i) Notional principal amount of exchange traded interest rate derivatives

undertaken during the year (instrument-wise)

a) Euro dollar futures ....................................................................... — 133,577.3

b) Treasury note futures – 10 year .................................................. 22,476.0 13,496.0

c) Treasury note futures – 5 year .................................................... 3,399.0 3,319.4

(ii) Notional principal amount of exchange traded interest rate derivatives

outstanding (instrument-wise)

a) Euro dollar futures ....................................................................... — —

b) Treasury note futures – 10 year .................................................. 652.1 1,516.9

c) Treasury note futures – 5 year .................................................... 130.4 —

(iii) Notional principal amount of exchange traded interest rate derivatives

outstanding and not “highly effective” (instrument-wise) .................. N. A. N. A.

(iv) Mark-to-market value of exchange traded interest rate derivatives

outstanding and not “highly effective” (instrument-wise) .................. N. A. N. A.

Note: All the transactions in exchange traded derivatives form part of the foreign branches’ trading portfolios.

forming part of the Accounts (Contd.)

schedules