ICICI Bank 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F32

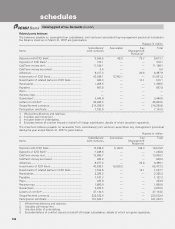

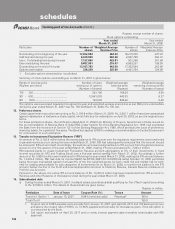

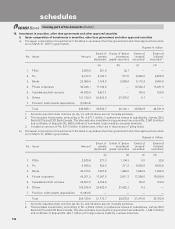

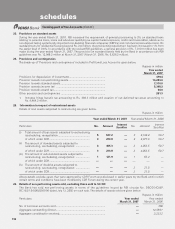

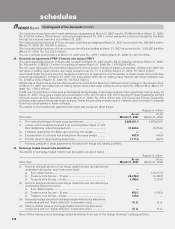

The summary of lending to real estate sector is given below.

Rupees in million

As on As on

March 31, 2007 March 31, 2006

Real estate sector

I. Direct exposure ................................................................................... 751,382.9 508,136.8

i) Residential mortgages, .............................................................. 595,153.0 431,668.5

of which housing loans upto Rs. 1.5 million .............................. 300,137.0 263,796.5

ii) Commercial real estate1 .............................................................. 142,509.8 69,846.0

iii) Investments in mortgage backed securities (MBS) and other

securitised exposures ................................................................. 13,720.1 6,622.2

– a. Residential .................................................................. 13,720.1 6,622.2

– b. Commercial real estate ............................................... — —

II. Indirect exposure ................................................................................ 45,785.0 30,135.8

Fund based and non-fund based exposures on National Housing Bank

(NHB) and Housing Finance Companies (HFCs) ................................. 30,214.4 13,821.5

Others ................................................................................................. 15,570.6 16,314.3

Total2 ................................................................................................... 797,167.9 538,272.5

1. Commercial real estate exposure includes loans given to land and building developers for construction, corporates for

their real estate requirements and to individuals / firms / corporates against non-residential premises.

2. Excludes non-banking assets acquired in satisfaction of claims.

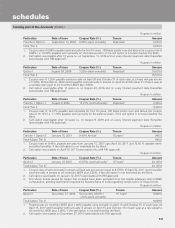

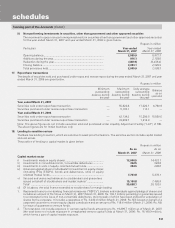

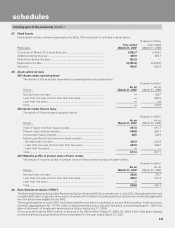

19. Credit exposure

During the year ended March 31, 2007, the Bank had no single borrower exposure above 15% and no group borrower

exposure above 40% of capital funds.

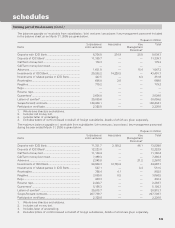

20. Risk category-wise country-wise exposure

As per the extant RBI guidelines, the country exposure of the Bank is categorised into various risk categories listed in the

following table. Since the country exposure (net) of the Bank in respect of any country does not exceed 1% of the total

funded assets, no provision is required to be maintained on country exposures as on March 31, 2007.

Rupees in million

Risk category

Exposure (net)

as on

March 31, 2007

Provision held

as at

March 31, 2007

Exposure (net)

as on

March 31, 2006

Provision held

as at

March 31, 2006

Insignificant ..................................................... 277,784.2 — 118,755.5 63.6

Low .................................................................. 126,883.7 — 44,689.4 —

Moderate ......................................................... 20,616.3 — 24,372.9 —

High ................................................................. 1,565.1 — 3,357.7 —

Very High ......................................................... 404.3 — ——

Restricted ........................................................ ——447.1 —

Off-Credit ......................................................... ——223.1 —

Total ................................................................. 427,253.6 — 191,845.7 63.6

– of which funded ........................................... 308,348.8 — 138,915.0

forming part of the Accounts (Contd.)

schedules