ICICI Bank 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

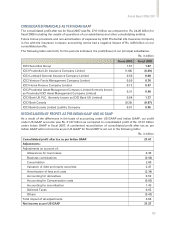

F5

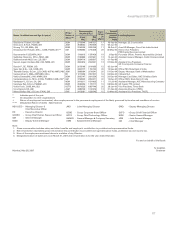

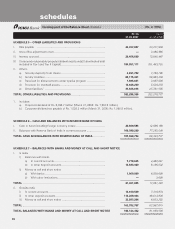

forming part of the Balance Sheet (Rs. in ‘000s)

As on As on

31.03.2007 31.03.2006

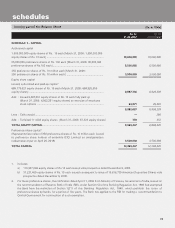

SCHEDULE 1 – CAPITAL

Authorised capital

1,000,000,000 equity shares of Rs. 10 each [March 31, 2006: 1,000,000,000

equity shares of Rs. 10 each] ............................................................................. 10,000,000 10,000,000

55,000,000 preference shares of Rs. 100 each [March 31, 2006: 55,000,000

preference shares of Rs.100 each] ..................................................................... 5,500,000 5,500,000

350 preference shares of Rs. 10 million each [March 31, 2006:

350 preference shares of Rs. 10 million each] .................................................. 3,500,000 3,500,000

Equity share capital

Issued, subscribed and paid-up capital 1

889,779,621 equity shares of Rs. 10 each (March 31, 2006: 884,920,650

equity shares) ..................................................................................................... 8,897,796 8,849,206

Add : Issued 9,487,051 equity shares of Rs. 10 each fully paid up

(March 31, 2006: 4,903,251 equity shares) on exercise of employee

stock options .......................................................................................... 94,871 49,033

8,992,667 8,898,239

Less : Calls unpaid ............................................................................................. — 266

Add : Forfeited 111,603 equity shares (March 31, 2006: 67,323 equity shares) 770 372

TOTAL EQUITY CAPITAL .................................................................................. 8,993,437 8,898,345

Preference share capital 2

(Represents face value of 350 preference shares of Rs. 10 million each issued

to preference share holders of erstwhile ICICI Limited on amalgamation

redeemable at par on April 20, 2018) 3,500,000 3,500,000

TOTAL CAPITAL 12,493,437 12,398,345

1. Includes:

a) 110,967,096 equity shares of Rs.10 each issued vide prospectus dated December 8, 2005.

b) 37,237,460 equity shares of Rs. 10 each issued consequent to issue of 18,618,730 American Depository Shares vide

prospectus dated December 6, 2005.

2. For these preference shares, the notification dated April 17, 2002 from Ministry of Finance, Government of India, issued on

the recommendation of Reserve Bank of India (RBI), under Section 53 of the Banking Regulation Act, 1949 had exempted

the Bank from the restriction of Section 12(1) of the Banking Regulation Act, 1949, which prohibits the issue of

preference shares by banks, for a period of five years. The Bank has applied to the RBI for making a recommendation to

Central Government for continuation of such exemption.

schedules