ICICI Bank 2007 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

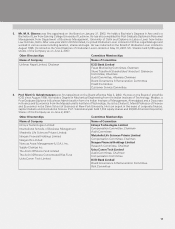

The Board of Directors, at its Meeting held on April 28, 2007 (based on the recommendation of the Board Governance &

Remuneration Committee), appointed her as wholetime Director (designated as Executive Director), subject to the approval of

RBI and the Members for a period of five years effective June 1, 2007 on the terms and conditions mentioned in the Circular

dated April 28, 2007 as required under Section 302 of the Companies Act, 1956.

The Directors recommend the adoption of the Resolutions at Item Nos.15 and 16 of the Notice.

No Director is in any way concerned or interested in the Resolutions at Item Nos.15 and 16 of the Notice except Ms. Madhabi

Puri-Buch to the extent of her appointment and payment of remuneration.

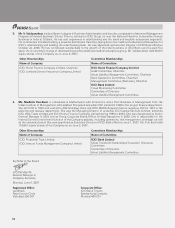

Item No.17

The Company will require additional capital due to the requirement of capital for operational risk under Basel II guidelines issued by

RBI. In January 2006, RBI issued guidelines on enhancement of banks’ capital raising options for capital adequacy purposes. The

guidelines provide that apart from innovative perpetual debt instruments qualifying as Tier 1 capital and debt capital instruments

qualifying as Upper Tier 2 capital, banks may augment their capital funds by issue of perpetual non-cumulative preference shares

eligible for inclusion as Tier 1 capital and redeemable cumulative preference shares eligible for inclusion as Tier 2 capital, subject

to laws in force from time to time. RBI has indicated that detailed guidelines regarding these two categories of instruments will

be issued separately in due course, as legislative changes are required to permit banks to issue preference shares.

At present, banking companies are not permitted to issue/have preference shares as per Section 12(1)(ii) of the Banking Regulation

Act, 1949. The Banking Regulation (Amendment) Bill, 2005 proposes to amend the Banking Regulation Act to permit banking

companies to issue preference shares in accordance with the guidelines framed by RBI. This aforesaid Bill is pending approval

of the Parliament.

Your Directors felt that it would be in the overall interest of the Company to explore the option of mobilisation of long-term

resources by issue of preference shares at an opportune time by way of private placement or public issue or rights issue to the

shareholders or to any domestic/foreign investors, or in such other manner, in such tranches, as the Board may, in its absolute

discretion deem fit, from time to time, subject to applicable provisions of the Companies Act, 1956, the Banking Regulation

Act, 1949 and the provisions of the Memorandum and Articles of Association of the Company. The Company would consider

issuance of preference shares denominated in Indian rupees or an appropriate foreign currency, subject to applicable statute/

regulation and receipt of necessary approvals. Further, while currently the Issue of Foreign Currency Convertible Bonds and

Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 of the Central Government envisage issue of overseas

depository receipts only against equity shares, subject to changes in this Scheme permitting the issue of overseas depository

receipts against preference shares, the Company would also consider undertaking the same. To give effect to the above, it

is proposed that the Board of Directors/any Committee thereof be authorised to do all such acts, matters, deeds and things

necessary or desirable in connection with or incidental thereto, including listing of the preference shares.

The Directors recommend the adoption of the Resolution at Item No.17 of the Notice.

No Director is in any way concerned or interested in the Resolution at Item No.17 of the Notice, except to the extent of his/her

participating in the proposed issue of preference shares as also to the extent of participation in the proposed issue of preference

shares by a financial institution/company/body corporate/firm/bank/undertaking in which the Director or his/her relative may be

directly or indirectly concerned/interested.

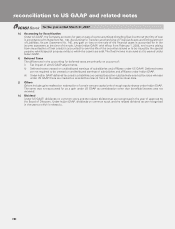

Item No. 18

In terms of Section 293(1)(d) of the Companies Act, 1956, read with Articles 83 to 88 of Articles of Association of the Company,

borrowings by the Company (apart from the deposits accepted in the ordinary course of business by the Company, temporary

loans repayable on demand or within six months from the date of the loan, and temporary loans, if any, obtained from the

Company’s Bankers, other than loans raised for the purpose of financing expenditure of a capital nature), in excess of the

paid-up capital of the Company and its free reserves, that is to say, reserves not set apart for any specific purpose, require the

approval of the Members.

The Members, at their Fourth Annual General Meeting (AGM) held on June 15, 1998, had approved the borrowing of sums

not exceeding Rs. 3,000 crore (Rupees three thousand crore) under Section 293(1)(d) of the Companies Act, 1956. Thereafter,

pursuant to the Scheme of Amalgamation (the Scheme) under Sections 391 to 394 of the Companies Act, 1956 of erstwhile

ICICI Limited, erstwhile ICICI Capital Services Limited and erstwhile ICICI Personal Financial Services Limited with the Company

effective May 3, 2002, the borrowing limit of the Company was enhanced to an amount aggregating to Rs.103,550 crore (Rupees

one lac three thousand five hundred fifty crore).

The balance sheet size of the Company has grown significantly since the revision of the borrowing limit as on May 3, 2002.

Correspondingly, the net worth of the Company has increased from Rs.6,245 crore as on March 31, 2002 to Rs.24,313 crore

as on March 31, 2007 which would further increase with the proposed equity issue. In view of the proposed equity issue the

borrowing limits linked to Tier-1 Capital will increase providing flexibility to the Company in its borrowing program. Further,

international business has been identified as one of the key growth drivers for the Company, with the expected growth in

the International Banking Group, entailing higher funding requirement. Considering the substantial growth in business and

operations of the Company, present and future requirements, your approval is being sought to increase the borrowing limits

from Rs.103,550 crore to Rs.200,000 crore.

The Directors recommend the adoption of the Resolution at Item No.18 of the Notice.

No Director is in any way concerned or interested in the Resolution at Item No.18 of the Notice.