ICICI Bank 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13th Annual Report and Accounts 2006-2007

Touching Lives

Table of contents

-

Page 1

Touching Lives 13th Annual Report and Accounts 2006-2007 -

Page 2

... of the future, the ICICI Group seeks to partner the country's growth by delivery of world-class financial services. As a multi-specialist financial services provider, our offerings span investment banking for large companies, technology-driven transaction banking for small enterprises, conveniently... -

Page 3

...Sustainable Development Organisational Excellence Management's Discussion and Analysis Particulars of Employees under Section 217 (2A) of the Companies Act, 1956 2 4 6 6 6 7 31 32 43 47 48 64 Financials : Auditors' Report Balance Sheet Profit and Loss Account Cash Flow Statement Schedules Statement... -

Page 4

...growth Fiscal 2007 was another eventful year for India and for Indian business. While the growth momentum in the economy remained strong, supply side constraints and inadequate investment in infrastructure, housing and manufacturing capacity in the past led to increase in inflation and rise in asset... -

Page 5

...address through innovative products and delivery mechanisms. We seek to support this strategy with financial and human capital, as we move to the next level in terms of scale of operations. Looking ahead, we see ourselves as the premier provider of financial services in India and to Indian customers... -

Page 6

... a market for a wide range of financial products and services for consumers - a mortgage to finance a house; a loan for a car; a credit card for ongoing purchases; a bank account; a long-term investment plan to finance a child's higher education; a pension plan for retirement; a life insurance Dear... -

Page 7

Annual Report 2006-2007 products. In the insurance sector, we continue to maintain our leadership position among both life and general insurers. We are among the two largest asset management companies in India in terms of assets under management. We have continued to deepen our relationships with ... -

Page 8

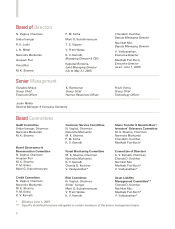

..., Executive Director (w.e.f. June 1, 2007) Senior Management Vishakha Mulye Group Chief Financial Officer K. Ramkumar Group Chief Human Resources Officer Pravir Vohra Group Chief Technology Officer Jyotin Mehta General Manager & Company Secretary Board Committees Audit Committee Sridar Iyengar... -

Page 9

...on account of first time adoption of Accounting Standard 15 (Revised) on "Employee benefits" issued by the Institute of Chartered Accountants of India for the year ended March 31, 2007. Proposed dividend for the year includes dividend paid on ESOPs exercised after balance sheet date of previous year... -

Page 10

Personal Banking Deposits Loans Investments Cards Insurance Demat Services Online Services Property Services Over 1 million homes financed through affordable and convenient products and services -

Page 11

... Dealership Limited2 ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Prudential Asset Management Company Limited4 ICICI Prudential Trust Limited6 ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Investment... -

Page 12

NRI Banking Bank Accounts Deposits Credit Cards Investments Remittance Solutions Property Solutions Insurance Loans Over USD 7.5 billion channelised through multi channel remittance services to India -

Page 13

...investments would be transferred to the proposed new company at book value in the books of ICICI Bank, on the date of transfer (Rs. 22.28 billion at March 31, 2007). DIRECTORS Lalita D. Gupte completed her term as Joint Managing Director of the Bank on October 31, 2006 and retired from the services... -

Page 14

Business Banking Roaming Current Accounts Trade and Forex Products Business Loans Equipment Loans Advisory Services Over 900,000 SMEs supported through financial and transaction banking services -

Page 15

..., 1956, read with Companies (Particulars of Employees) Rules, 1975, as amended, the names and other particulars of the employees are set out in the Annexure to the Directors' Report. APPOINTMENT OF NOMINEE DIRECTORS ON THE BOARD OF ASSISTED COMPANIES Erstwhile ICICI Limited (ICICI) had a policy of... -

Page 16

Building Sustainable Models Health Primary Education Microfinance and Livelihoods Finance and Development Research Environment Extended microfinance to over 3 million households as a part of our commitment to socio-economic development -

Page 17

... committees, namely, Audit Committee, Board Governance & Remuneration Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Risk Committee, Share Transfer & Shareholders'/ Investors' Grievance Committee, Committee of Directors and Asset Liability Management Committee... -

Page 18

... of their remuneration, approval of payment to statutory auditors for other services rendered by them, review of functioning of Whistle Blower Policy, review of the quarterly and annual financial statements before submission to Board, review of the adequacy of internal control systems and the... -

Page 19

... to the members of the staff, framing of guidelines for the Employees Stock Option Scheme and recommendation of grant of ICICI Bank stock options to the employees and wholetime Directors of ICICI Bank and its subsidiary companies. Composition The Board Governance & Remuneration Committee comprises... -

Page 20

...dated July 24, 2003. Approval of the Members for payment of sitting fees to the Directors had been obtained at the AGM held on August 20, 2005. Information on the total sitting fees paid to each of the independent Directors during fiscal 2007 for attending Meetings of the Board and Committees is set... -

Page 21

...Equity - - - Equity - - Equity - Equity American Depositary Share (ADS)1 - - No. of shares held 27,543 - - - 3,110,700 - - 5,050 - 1,613 29,500 - - IV. Credit Committee Terms of reference The functions of the Committee include review of developments in key industrial sectors and approval of credit... -

Page 22

... rate, off-balance sheet and operational risks), investment policies and strategy and regulatory and compliance issues in relation thereto. The Committee also reviews key risk indicators covering areas such as credit risk, interest rate risk, liquidity risk, foreign exchange risk and internal... -

Page 23

...options, review and redressal of shareholders' and investors' complaints, delegation of authority for opening and operation of bank accounts for payment of interest, dividend and redemption of securities and the listing of securities on stock exchanges. Composition The Share Transfer & Shareholders... -

Page 24

...Company for re-classification of the authorised share capital. • Approval for issue of preference shares subject to applicable laws and regulations. Twelfth Annual General Meeting July 22, 2006 Extraordinary General Meeting January 20, 2007 Nil • Merger of The Sangli Bank Limited with ICICI Bank... -

Page 25

...and presentations are also available on the website of ICICI Bank. The Management's Discussion & Analysis forms part of the Annual Report. General Shareholder Information Thirteenth Annual General Meeting Day, Date Saturday, July 21, 2007 Time 1.30 p.m. Venue Professor Chandravadan Mehta Auditorium... -

Page 26

Directors' Report ICICI Bank has paid annual listing fees for the relevant periods on its capital to BSE, NSE and NYSE where its equity shares and ADSs are listed. Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2007 ... -

Page 27

... in the physical form with the total issued/paid-up equity capital of ICICI Bank. Certificates issued in this regard are placed before the Share Transfer and Shareholders'/Investors' Grievance Committee and forwarded to BSE and NSE, where the equity shares of ICICI Bank are listed. Ap r-0 6 M ay... -

Page 28

... Bank Trust Company Americas (Depositary for ADS holders) Life Insurance Corporation of India Allamanda Investments Pte. Limited CLSA Merchant Bankers Limited A/c CLSA (Mauritius) Limited Bajaj Auto Limited Crown Capital Limited Government of Singapore The Growth Fund of America Inc. Calyon The New... -

Page 29

... Stanley and Company International Limited A/c Morgan Stanley Dean Witter Mauritius Company Limited BMF - Bank Bees Investment A/c Capital World Growth and Income Fund Inc. General Insurance Corporation of India Distribution of shareholding of ICICI Bank at March 31, 2007 Range - Shares Upto 1,000... -

Page 30

... to any employee/director in a year is limited to 0.05% of ICICI Bank's issued equity shares at the time of the grant, and the aggregate of all such options is limited to 5% of ICICI Bank's issued equity shares on the date of the grant (equivalent to 44,963,334 shares at April 28, 2007). Options... -

Page 31

... 28, 2007 approved a grant of approximately 4.8 million options for fiscal 2007 to eligible employees (including wholetime Directors). Each option confers on the employee a right to apply for one equity share of face value of Rs. 10 of ICICI Bank at Rs. 935.15, which was the last closing price on... -

Page 32

... to the Government of India, RBI, SEBI and overseas regulators for their continued co-operation, support and advice. ICICI Bank wishes to thank its investors, the domestic and international banking community, investment bankers, rating agencies and stock exchanges for their support. ICICI Bank would... -

Page 33

...on Corporate Governance To the Members of ICICI Bank Limited We have examined the compliance of conditions of corporate governance by ICICI Bank Limited ("the Bank") for the year ended on 31 March 2007, as stipulated in Clause 49 of the Listing Agreement of the said Company with stock exchanges. The... -

Page 34

... 12, 2007. The investment pipeline and demand for credit continue to be robust, and inflation conditions, global developments and external inflows will be key factors impacting liquidity and interest rates during the current year. India's exports was US$ 124.6 billion during fiscal 2007, a growth of... -

Page 35

...the non-life insurance sector (excluding Export Credit Guarantee Corporation of India Limited) grew by 22.4% to Rs. 250.02 billion in fiscal 2007 with the private sector's market share increasing from 26.6% in fiscal 2006 to 34.9% in fiscal 2007. Total assets under management of mutual funds grew by... -

Page 36

...the above, the Global Principal Investments & Trading Group is responsible for taking proprietary positions in the Indian and international markets. The Global Markets Group is responsible for the global client-centric treasury operations. The Structural Rate Risk Management Group is responsible for... -

Page 37

... party products like mutual funds, Government of India relief bonds and insurance products as well as initial public offerings of equity. Cross-selling new products and also the products of our life and general insurance subsidiaries to our existing customers is a key focus area for the Bank. Cross... -

Page 38

... balance sheets, and credit and structured financing expertise. Project Finance In order to sustain India's growth momentum, infrastructure development is a key requirement. The investment requirement in the infrastructure sector is expected to increase significantly over the next five years... -

Page 39

... retail side, the Bank offers crop loans, farm equipment financing, commodity-based loans, working capital loans for agri-enterprises, microfinance loans, jewel loans as well as savings, investment and insurance products. In addition we are introducing products like rural housing finance to cater to... -

Page 40

...policies and internal approvals. These groups form part of the Corporate Centre, are completely independent of all business operations and are accountable to the Risk and Audit Committees of the Board of Directors. GRMG is further organised into the Global Credit Risk Management Group and the Global... -

Page 41

... also draw upon reports from the Credit Information Bureau (India) Limited (CIBIL). Market Risk Market risk is the risk of loss resulting from changes in interest rates, foreign currency exchange rates, equity prices and commodity prices. Our exposure to market risk is a function of our trading and... -

Page 42

... equity markets, realising gains on its equity portfolio. In line with the international expansion of the bank, treasury functions have been set up in Hong Kong, Sri Lanka, Bahrain, Singapore and the Offshore Banking Unit in Mumbai to support the operations of these branches. HUMAN RESOURCES ICICI... -

Page 43

... among private sector life insurance companies with a retail market share of about 28% in the private sector in fiscal 2007 (on weighted received premium basis). Life insurance companies worldwide tend to make losses in the initial years, in view of business set-up and customer acquisition costs... -

Page 44

... Limited (CARE) Investment Information and Credit Rating Agency (ICRA) CRISIL Limited 1. Senior foreign currency debt ratings. Rating Baa21 BBB-1 CARE AAA AAA AAA PUBLIC RECOGNITION Bank of the Year 2006 India" by The Banker "Best Transaction Bank in India" by Asset Triple AAA "Best Trade Finance... -

Page 45

... CSO Platform The core strategy has been to identify partners and work with them to build competencies and effectiveness on the field. 1. Social Initiatives Group The foundations of ICICI Bank's most recent approach towards human and social development were laid with the setting up of the Social... -

Page 46

... Product development to ensure a comprehensive suite of financial services. Technology Finance Group (TFG) TFG has been instrumental in ushering in new technology, innovative projects, processes and products. Projects supported under this scheme include collaborative R&D, post-harvest agri-business... -

Page 47

... clients). In order to facilitate the creation of such a network, through our uniquely designed "partnership model" we provide partner microfinance institutions financial resources for on-lending, access to mezzanine finance for growth, financial engineering (securitization) and product development... -

Page 48

...and teaching and offers research support to new initiatives launched by ICICI Bank and its divisions. It has set up the following specialized centres: • Centre for Micro Finance (CMF) that strives to maximise access to financial service through research, training and strategy building for MFIs. To... -

Page 49

... take up new initiatives to improve efficiency and enhance their "quality quotient". At ICICI Bank, the quality journey started in 2002, by setting up an Organisational Excellence Group (OEG), headed by a Senior General Manager, reporting to the Managing Director & CEO. OEG is engaged in building... -

Page 50

... level of write-backs. Total assets increased 37.1% to Rs. 3,446.58 billion at year-end fiscal 2007 from Rs. 2,513.89 billion at year-end fiscal 2006 primarily due to an increase in loans by 34.0% and an increase in investments by 27.5%. Operating results data The following table sets forth, for... -

Page 51

... income Operating profit Provisions, net of write-backs(3) Profit before tax Tax, net of deferred tax Profit after tax (1) Includes merchant foreign exchange income and margin on customer derivative transactions. (2) For the fiscal 2007, the Bank has reported all direct marketing agency expenses... -

Page 52

... an increase in lending rates in line with the general increase in interest rates and increase in the volumes of certain high yielding loans. Our prime lending rate (ICICI Bank's benchmark prime lending rate) has increased by 300 basis points from March 31, 2006 to April 1, 2007. Our home loan rates... -

Page 53

Annual Report 2006-2007 by our foreign branches, which is offset by the higher fee income that we are able to earn by leveraging our international presence and our ability to meet the foreign currency borrowing requirements of Indian companies. Fee income Fee income increased by 45.4% to Rs. 50.12 ... -

Page 54

...banking, and includes maintenance of ATMs, credit card expenses, including promotional expenses on cash back scheme, insurance premium, collection expenses and other expenses. The number of branches (excluding foreign branches and OBUs) and extension counters increased to 755 at year-end fiscal 2007... -

Page 55

... & banks - Government securities Advances (net) Debentures & bonds Other investments Fixed assets (including leased assets) Other assets Total assets Liabilities: Equity capital and reserves - Equity capital - Reserves Preference capital Deposits - Savings deposits - Current deposits - Term deposits... -

Page 56

... and credit linked notes. Total assets (gross) of overseas branches (including overseas banking unit in Mumbai) increased by 90.2% to Rs. 524.71 billion at year-end fiscal 2007 from Rs. 275.86 billion at year-end fiscal 2006. Our equity share capital and reserves at year-end fiscal 2007 increased to... -

Page 57

...year-end fiscal 2006. Other property or security may also be available to us to cover losses under guarantees. Capital Commitments We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature, which have been committed. As of the balance sheet date, work... -

Page 58

..., Bank of International Settlements in 1988. We are required to maintain a minimum ratio of total capital to risk adjusted assets of 9.0%, at least half of which must be Tier I capital. Our total capital adequacy ratio calculated in accordance with the RBI guidelines at year-end fiscal 2007 was... -

Page 59

... our portfolio diversification strategy. Our loans and advances to retail finance constituted 65.2% of our total loans and advances at year-end fiscal 2007 compared to 62.9% at year-end fiscal 2006 and 60.9% at year-end fiscal 2005. Our Credit Risk Management Group monitors all major sectors of the... -

Page 60

....0% of capital funds for a group of companies under same management), making appropriate disclosures in their annual reports. Exposure for funded facilities is calculated as the total committed credit and investment sanctions or the outstanding funded amount, whichever is higher (for term loans, as... -

Page 61

... government sponsored Indian development banks like the National Bank for Agriculture and Rural Development and the Small Industries Development Bank of India. These deposits have a maturity of up to seven years and carry interest rates lower than market rates. We report our priority sector loans... -

Page 62

... the original loan agreement and the present values of future interest on the basis of rescheduled terms be provided at the time of restructuring. The following table sets forth, at March 31, 2006 and March 31, 2007, data regarding the classification of our gross assets (net of write-offs and unpaid... -

Page 63

... to 63.72% at year-end fiscal 2006. In addition, total general provision made against standard assets was Rs. 12.95 billion at year-end fiscal 2007. Our investments in security receipts issued by Asset Reconstruction Company (India) Limited, a reconstruction company registered with RBI were Rs... -

Page 64

...-term and long-term project and infrastructure financing, securitisation, factoring, lease financing, working capital finance and foreign exchange services to clients. Further, it provides deposit and loan products to retail customers. The investment banking segment includes treasury operations... -

Page 65

... Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Prudential Asset Management Company Limited (formerly known as Prudential ICICI Asset Management Company Limited) ICICI Bank UK... -

Page 66

Section 217 Statement pursuant to Section 217 (2A) of the Companies Act, 1956 read with the Companies (Particulars of Employees) Rules, 1975 (forming part of the Directors' Report for the year ended March 31, 2007) in respect of employees of ICICI Bank Limited Desig./ Nature of duties*** DGM DGM AGM... -

Page 67

... Capital - Deputy Manager, United Bank of India Officer, Corporation Bank Officer MII, Union Bank of India Chief Manager, Arvind Mills Limited Simens India Limited Director, Prospect Base Deputy Head - Corp Banking, BNP Paribas Head Accounts Services, Standard Chartered Bank Officer MIII, Dena Bank... -

Page 68

... Manager, Eicher Motors Limited Manager, State Bank of India Assistant Manager Operations, Standard Chartered Bank Software Engineer, Mastek Limited Manager, Union Bank of India - Area Sales Manager, Bank of America State Bank of India Tata AIG Life Insurance Regional Business Head, SBI Cards... -

Page 69

...other employees are in the permanent employment of the Bank, governed by its rules and conditions of service Designation/Nature of duties - Abbreviations JMD GCBO GCTO GM&CS AGM - Joint Managing Director Group Corporate Brand Officer Group Chief Technology Officer General Manager & Company Secretary... -

Page 70

financials -

Page 71

... generally accepted in India: (i) in the case of the Balance Sheet, of the state of affairs of the Bank as at March 31, 2007; (ii) in the case of the Profit and Loss Account, of the profit of the Bank for the year ended on that date; and (iii) in the case of the Cash Flow Statement, of the cash... -

Page 72

..., 2007 Schedule CAPITAL AND LIABILITIES Capital ...Reserves and Surplus ...Deposits ...Borrowings ...Other liabilities and provisions ...TOTAL CAPITAL AND LIABILITIES ASSETS Cash and balance with Reserve Bank of India...Balances with banks and money at call and short notice ...Investments...Advances... -

Page 73

......TOTAL ...Significant accounting policies and notes to accounts ...Earning per share (Refer Note 18.B.6 ) Basic (Rs.)...Diluted (Rs.) ...Face value per share (Rs.) ...The Schedules referred to above form an integral part of the Balance Sheet. As per our Report of even date. For BSR & Co. Chartered... -

Page 74

...Deputy Managing Director Place : Mumbai Date : April 28, 2007 F4 VISHAKHA MULYE Group Chief Financial Officer JYOTIN MEHTA General Manager & Company Secretary K. V. KAMATH Managing Director & CEO CHANDA D. KOCHHAR Deputy Managing Director V. VAIDYANATHAN Executive Director RAKESH JHA General Manager -

Page 75

... ...Add : Forfeited 111,603 equity shares (March 31, 2006: 67,323 equity shares) TOTAL EQUITY CAPITAL ...Preference share capital 2 (Represents face value of 350 preference shares of Rs. 10 million each issued to preference share holders of erstwhile ICICI Limited on amalgamation redeemable at par... -

Page 76

...the year...Closing balance ...Share premium Opening balance ...Additions during the year 1...Deductions during the year ...Closing balance ...Investment fluctuation reserve Opening balance ...Additions during the year ...Deductions during the year...Closing balance ...Capital reserve Opening balance... -

Page 77

... TOTAL DEPOSITS ...SCHEDULE 4 - BORROWINGS I. Borrowings in India i) Reserve Bank of India ...ii) Other banks ...iii) Other institutions and agencies a) Government of India ...b) Financial institutions ...iv) Borrowings in the form of a) Deposits taken over from erstwhile ICICI Limited ...b) Bonds... -

Page 78

...,548 89,343,737 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ... SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India i) Balances with banks a) In current accounts ...b) In other deposit accounts ...ii) Money at call and short notice a) With banks ...b) With other... -

Page 79

schedules forming part of the Balance Sheet (Contd.) As on 31.03.2007 SCHEDULE 8 - INVESTMENTS I. Investments in India [net of provisions] i) Government securities ...ii) Other approved securities...iii) Shares (includes equity and preference shares) ...iv) Debentures and bonds ...v) Subsidiaries ... -

Page 80

...process of being transferred in the Bank's name. SCHEDULE 12 - CONTINGENT LIABILITIES Claims against the Bank not acknowledged as debts...Liability for partly paid investments ...Liability on account of outstanding forward exchange contracts ...Guarantees given on behalf of constituents a) In India... -

Page 81

... Bank of India/inter-bank borrowings1 ...III. Others (including interest on borrowings of erstwhile ICICI Limited) ...TOTAL INTEREST EXPENDED ...1. Includes interest paid on inter-bank deposits. SCHEDULE 16 - OPERATING EXPENSES I. Payments to and provisions for employees ...II. Rent, taxes and... -

Page 82

... forming part of the Accounts (Contd.) SCHEDULE 18 Significant accounting policies and notes to accounts OVERVIEW ICICI Bank Limited ("ICICI Bank" or "the Bank"), incorporated in Vadodara, India is a publicly held banking company engaged in providing a wide range of banking and financial services... -

Page 83

...scheme, the Bank reckons the net asset value obtained from the asset reconstruction company from time to time, for valuation of such investments at each reporting period/year end. j) The Bank follows trade date method for accounting of its investments. Provisions/Write-offs on loans and other credit... -

Page 84

...at quarterly average closing rates. Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India at the balance sheet date and the resulting profits/losses are included... -

Page 85

... to ICICI Prudential Life Insurance Company Limited. Pension The Bank provides for pension, a deferred retirement plan covering certain employees. The plan provides for a pension payment on a monthly basis to these employees on their retirement based on the respective employee's salary and years of... -

Page 86

... statements. The Bank does not account for or disclose contingent assets, if any. 13. Earnings Per Share ("EPS") Basic earnings per share is calculated by dividing the net profit or loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding... -

Page 87

schedules forming part of the Accounts (Contd.) 2. Equity issue During the year ended March 31, 2006, the Bank raised equity capital amounting to Rs. 80,006.1 million. The expenses of the issue amounting to Rs. 874.1 million have been charged to the share premium account. The details of the equity ... -

Page 88

schedules forming part of the Accounts (Contd.) Rupees in million As on March, 31, 2007 (vi) Business per employee (average deposits plus average advances)3 3. 102.7 As on March 31, 2006 90.5 For the purpose of computing the ratio, deposits and advances are the total deposits and total advances as ... -

Page 89

...currency exclude off-balance sheet assets and liabilities. a) The maturity pattern of assets and liabilities of the Bank as on March 31, 2007 is given below. Rupees in million Maturity buckets 1 to 14 days ...15 to 28 days ...29 days to 3 months ...3 to 6 months ...6 months to 1 year ...1 to 3 years... -

Page 90

... subsidiaries, associates, joint ventures and key management personnel. The following are the significant transactions between the Bank and its related parties. Insurance services During the year ended March 31, 2007, the Bank paid insurance premium to insurance joint ventures amounting to Rs. 1,613... -

Page 91

... all losses, damages, reasonable costs and expenses arising from failure of ICICI Bank Canada in performing the same. To confirm that ICICI Bank is aware of ICICI Bank UK PLC. granting short-term money, foreign exchange and derivative lines of credit to ICICI Bank Eurasia Limited Liability Company... -

Page 92

... receivable from subsidiaries/ joint ventures/ associates/ key management personnel during the year ended March 31, 2007 is given below. Rupees in million Items Deposits with ICICI Bank ...Deposits of ICICI Bank2 ...Call/Term money lent ...Call/Term money borrowed ...Advances ...Investments of ICICI... -

Page 93

... / receivable from subsidiaries / joint ventures / associates / key management personnel during the year ended March 31, 2006 is given below. Rupees in million Items Deposits with ICICI Bank ...Deposits of ICICI Bank2 ...Call/Term money lent ...Call/Term money borrowed ...Advances ...Investments of... -

Page 94

... Services Limited, ICICI Home Finance Company Limited, ICICI Investment Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK Plc., ICICI Bank Canada, ICICI Prudential Life Insurance Company Limited, ICICI Lombard General Insurance Company Limited, ICICI... -

Page 95

....4 Investment details of plan assets Majority of the plan assets are invested in Government securities and corporate bonds in case of pension plan and insurer managed funds and special deposit schemes in case of gratuity plan. Assumptions Interest rate ...Salary escalation rate ...Estimated rate of... -

Page 96

... assets for both credit risk and market risk for both held for trading and available for sale categories of investments as on March 31, 2006, to transfer the balance in the IFR account 'below the line' in the Profit and Loss Appropriation Account to Statutory Reserve, General Reserve or balance... -

Page 97

... semi-annually for the balance years, if the call option is not exercised by the Bank. Call option exercisable after 10 years i.e. on August 9, 2016 and on every interest payment date thereafter (exercisable with RBI approval). Rupees in million Date of Issue January 15, 2007 Coupon Rate (%) 9.40... -

Page 98

...2006 March 14, 2006 Coupon Rate (%) 8.83% Annual 8.80% Annual 8.55% Annual Tenure 10 years and 15 days 9 years 11 months and 19 days 10 years and 1 month Amount 2,500.0 20,000.0 2,500.0 25,000.0 Rupees in million Particulars Option I Option II Total (Tier II) Date of Issue February 14, 2006 February... -

Page 99

schedules forming part of the Accounts (Contd.) Rupees in million Particulars Option II Option III Option IV Total (Tier II) Date of Issue December 30, 2005 December 30, 2005 December 30, 2005 Coupon Rate (%) 7.60% (semi-annually) 7.75% (semi-annually) 7.80% (semi-annually) Tenure 10 years 12 years ... -

Page 100

... UK Plc and ICICI Bank Canada. This also excludes investments in government securities (Rs. 2,967.8 million) and certificate of deposits (Rs. 869.4 million) of non-Indian origin made by overseas branches. Includes an amount of Rs. 931.5 million in debentures, which are in the process of being listed... -

Page 101

... are sensitive to asset price fluctuations. The sensitive sectors include capital market and real estate. The position of lending to capital market is given below. Rupees in million As on As on March 31, 2007 March 31, 2006 Capital market sector i) Investments made in equity shares ...12,046.5 14... -

Page 102

schedules forming part of the Accounts (Contd.) The summary of lending to real estate sector is given below. As on March 31, 2007 Real estate sector I. Direct exposure ...i) ii) iii) Residential mortgages, ...of which housing loans upto Rs. 1.5 million ...Commercial real estate ...1 Rupees in ... -

Page 103

...during the year ended March 31, 2007. 22. Financial assets transferred during the year to Securitisation Company (SC)/Reconstruction Company (RC) The Bank has transferred certain assets to an asset reconstruction company (ARC) in terms of the guidelines issued by RBI governing such transfer. For the... -

Page 104

schedules forming part of the Accounts (Contd.) 23. Provisions on standard assets During the year ended March 31, 2007, RBI increased the requirement of general provisioning to 2% on standard loans relating to personal loans, loans and advances qualifying as capital market exposure, credit card ... -

Page 105

schedules forming part of the Accounts (Contd.) 27. Fixed Assets Fixed assets include software acquired by the Bank. The movement in software is given below. Year ended March 31, 2007 2,852.7 455.9 (92.2) (2,385.9) 830.5 Rupees in million Year ended March 31, 2006 2,422.6 430.1 - (2,026.3) 826.4 ... -

Page 106

...The Risk Committee of the Board ("RCB") reviews the Bank's risk management policy in relation to various risks (portfolio, liquidity, interest rate, off-balance sheet and operational risks), investment policies and compliance issues in relation thereto. The RCB comprises of independent directors and... -

Page 107

... currency derivatives. Foreign currency interest rate swaps, forward rate agreements and swaptions are included in interest rate derivatives. 3. For trading portfolio. 4. The swap contracts entered for hedging purpose would have an opposite and offsetting impact with the underlying on-balance sheet... -

Page 108

...estimated replacement cost of swap contracts at balance sheet date. At March 31, 2007 the fair value of trading rupee interest rate swap contracts was Rs. 1,111.4 million (March 31, 2006: Rs. 922.4 million). Associated credit risk is the loss that the Bank would incur in case all the counter-parties... -

Page 109

... to "Operating Expenses". 38. Premium amortisation As per Reserve Bank of India circular DBOD.BP.BC.87/21.04.141/ 2006-07 dated April 20, 2007, the Bank has deducted the amortisation of premium on government securities from "Profit/(Loss) on revaluation of investments (net)" in Schedule 14... -

Page 110

... Funds Management Company Limited 6 ICICI International Limited6 7 ICICI Home Finance Company Limited 8 ICICI Trusteeship Services Limited 9 ICICI Investment Management Company Limited 10 ICICI Prudential Life Insurance Company Limited 11 ICICI Lombard General Insurance Company Limited 12 ICICI Bank... -

Page 111

Consolidated financial statements of ICICI Bank Limited and its subsidiaries -

Page 112

... consolidated Balance Sheet of ICICI Bank Limited ('the Bank') and its subsidiaries and joint ventures (collectively known as 'the Group') as at March 31, 2007 and also the consolidated Profit and Loss Account and the consolidated Cash Flow Statement of the Group for the year ended on that date... -

Page 113

...in India: (a) (b) (c) in the case of the consolidated Balance Sheet, of the state of affairs of the Group as at March 31, 2007; in the case of the consolidated Profit and Loss Account, of the profit of the Group for the year ended on that date; and in the case of the consolidated Cash Flow Statement... -

Page 114

... Deputy Managing Director VISHAKHA MULYE Group Chief Financial Officer JYOTIN MEHTA General Manager & Company Secretary K. V. KAMATH Managing Director & CEO CHANDA D. KOCHHAR Deputy Managing Director V. VAIDYANATHAN Executive Director RAKESH JHA General Manager Place : Mumbai Date : April 28, 2007... -

Page 115

... dividend tax ...Balance carried over to Balance Sheet ...TOTAL ...Significant accounting policies and notes to accounts ...Earning per share (Refer Note 18.B.3) Basic (Rs.)...Diluted (Rs.) ...Face value per share (Rs.) ...18 30.92 30.75 10.00 30.96 30.64 10.00 15 16 17 Year ended 31.03.2007... -

Page 116

... Deputy Managing Director VISHAKHA MULYE Group Chief Financial Officer JYOTIN MEHTA General Manager & Company Secretary K. V. KAMATH Managing Director & CEO CHANDA D. KOCHHAR Deputy Managing Director V. VAIDYANATHAN Executive Director RAKESH JHA General Manager Place : Mumbai Date : April 28, 2007... -

Page 117

... forming part of the Consolidated Balance Sheet As on 31.03.2007 SCHEDULE 1 - CAPITAL Authorised Capital 1,000,000,000 equity shares of Rs. 10 each (March 31, 2006: 1,000,000,000 equity shares of Rs. 10 each) 55,000,000 preference shares of Rs. 100 each (March 31, 2006: 55,000,000 preference shares... -

Page 118

... of Chartered Accountants of India for the year ended March 31, 2007. Includes transition adjustment on account of first time adoption of FRS 26 by ICICI Bank UK PLC. Includes restricted reserve of Rs. 2,547.1 million (March 31, 2006: Rs. 1,738.5 million) relating to life insurance subsidiary. Debit... -

Page 119

...Consolidated Balance Sheet (Contd.) As on 31.03.2007 SCHEDULE 2A - MINORITY INTEREST Opening minority interest ...Subsequent increase/decrease...CLOSING MINORITY INTEREST ...SCHEDULE 3 - DEPOSITS A. I. Demand deposits i) From banks...ii) From others ...II. Savings bank deposits ...III. Term deposits... -

Page 120

... 77,259,488 89,859,352 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ... SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India i) Balances with banks a) b) ii) a) b) in current accounts ...in other deposit accounts ...with banks ...with other institutions ...8,526,243... -

Page 121

... forming part of the Consolidated Balance Sheet (Contd.) As on 31.03.2007 SCHEDULE 8 - INVESTMENTS I. Investments in India (net of provisions) i) Government securities ...ii) Other approved securities...iii) Shares (includes equity and preference shares)...iv) Debentures and bonds ...v) Assets... -

Page 122

schedules forming part of the Consolidated Balance Sheet (Contd.) As on 31.03.2007 SCHEDULE 10 - FIXED ASSETS I. Premises At cost as on March 31 of preceding year ...Opening adjustment ...Additions during the year ...Deductions during the year...Depreciation to date ...Net block ...II. Other fixed ... -

Page 123

.... Profit/(loss) on sale of investments (net) ...III. Profit/(loss) on revaluation of investments (net)1 ...IV. Profit/(loss) on sale of land, buildings and other assets (net)2 ...V. Profit/(loss) on foreign exchange transactions (net) ...VI. Premium and other operating income from insurance business... -

Page 124

... Funds Management Company Limited ICICI Home Finance Company Limited5 ICICI Trusteeship Services Limited ICICI Investment Management Company Limited ICICI International Limited ICICI Bank UK PLC. (formerly ICICI Bank UK Limited) ICICI Bank Canada10 Country of Nature of incorporation Relationship... -

Page 125

....00% 16 ICICI Emerging Sectors Fund India Venture capital fund 99.29% 17 ICICI Strategic Investment Fund India Venture capital fund 100.00% 18 19 20 ICICI Prudential Life Insurance Company Limited7 ICICI Lombard General Insurance Company Limited7 ICICI Prudential Asset Management Company... -

Page 126

...integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India ("FEDAI") at the balance sheet date and the resulting profits/losses are included in the profit and loss account. Both monetary and non-monetary foreign currency assets and... -

Page 127

... group have issued stock options to their employees. • ICICI Bank Limited • ICICI Prudential Life Insurance Company Limited • ICICI Lombard General Insurance Company Limited The Employee Stock Option Scheme ("the scheme") provides for grant of equity shares of the Bank to employees of the Bank... -

Page 128

... year renewable group term insurance. The unit liability in respect of linked business has been taken as the value of the units standing to the credit of policyholders, using the net asset value (NAV) prevailing at the valuation date. The adequacy of charges under unit-linked policies to meet future... -

Page 129

... to ICICI Prudential Life Insurance Company Limited. Pension The Bank provides for pension, a deferred retirement plan covering certain employees. The plan provides for a pension payment on a monthly basis to these employees on their retirement based on the respective employee's salary and years of... -

Page 130

... Bonus shares and right entitlements are recorded when such benefits are known. Quoted investments are valued on the valuation date at the closing market price. Quoted investments that are not traded on the valuation date but are traded during the two months prior to the valuation date are valued at... -

Page 131

..., taking into account management's perception of the higher risk associated with the business of the company. Certain NPAs are considered as loss assets and full provision has been made against such assets. In case of the Bank's housing finance subsidiary, loans and other credit facilities are... -

Page 132

...line method over a period of three years from the date they are put to use, being management's estimate of the useful life of such intangibles. Depreciation on furniture and fixtures is charged @ 25% per annum. In case of the Bank's general insurance and housing finance subsidiary, computer software... -

Page 133

... loss of Rs. 292.7 million. 2. Equity issue of ICICI Bank Limited During the year ended March 31, 2006, the Bank raised equity capital amounting to Rs. 80,006.1 million. The expenses of the issue amounting to Rs. 874.1 million have been charged to the share premium account. The details of the equity... -

Page 134

... represent the maximum balance payable to/receivable from key management personnel during the year ended March 31, 2007: Rupees in million Items Deposits ...Advances ...Investments...1. Includes whole-time directors and their relatives. 5. Employee stock option scheme ("ESOS") In terms of the ESOS... -

Page 135

... year and weighted average share price as per NSE price volume data during the year ended March 31, 2007 was Rs. 750.58 (March 31, 2006: Rs. 531.34). ICICI Prudential Life Insurance Company Limited has formulated three ESOS schemes, namely "Founder option", "FY 2004-05 scheme" and "FY 2005-06 scheme... -

Page 136

schedules forming part of the Consolidated Accounts (Contd.) A summary of stock options outstanding as on March 31, 2007 is given below. Range of exercise price (Rupees per share) 30.00 Number of shares arising out of options (Number of shares) 563,577 Weighted average exercise price (Rupees) 30.00 ... -

Page 137

...out of options (Number of shares) 4,447,000 Weighted average exercise price (Rupees) 70.00 Weighted average remaining contractual life (Number of years) 9.80 ICICI Lombard General Insurance Company Limited has granted stock options to employees based on an independent valuer's report. If the entity... -

Page 138

... five years ...Total ...8. As on March 31, 2007 - 282.6 266.2 548.8 Rupees in million As on March 31, 2006 176.7 518.4 - 695.1 Early retirement option ("ERO") The Bank had implemented an Early Retirement Option Scheme 2003 for its employees in July 2003. All employees who had completed 40 years of... -

Page 139

... assets for both credit risk and market risk for both held for trading and available for sale categories of investments as on March 31, 2006, to transfer the balance in the IFR account 'below the line' in the Profit and Loss Appropriation Account to Statutory Reserve, General Reserve or balance... -

Page 140

... (gain)/loss ...Net cost ...Investment details of plan assets Majority of the plan assets are invested in Government securities and corporate bonds in case of pension plan and insurer managed funds and special deposit schemes in case of gratuity plan...Assumptions Interest rate ...Salary escalation... -

Page 141

..., ICICI Investment Management Company Limited, ICICI Trusteeship Services Limited, TCW/ICICI Investment Partners LLC and TSI Ventures (India) Private Limited. Inter-segment transactions are generally based on transfer pricing measures as determined by the management. Income, expenses, assets and... -

Page 142

....5 schedules 4 Revenue (before extraordinary profit) Less: Intersegment revenue Total revenue (1) - (2) Operating profit (i.e. profit before unallocated expenses extraordinary profit, provision and tax) 47,501.1 5 Unallocated expenses - 6 22,355.6 forming part of the Consolidated Accounts... -

Page 143

... actuarial reserves on policies which have lapsed earlier. ICICI Prudential Life Insurance Company Limited had in the previous year appropriated an amount of Rs. 792.2 million from the profit and loss account as Funds for Future Appropriation (FFA). This resulted in a lower amount of transfer to the... -

Page 144

...Deputy Managing Director K. V. KAMATH Managing Director & CEO CHANDA D. KOCHHAR Deputy Managing Director V. VAIDYANATHAN Executive Director RAKESH JHA General Manager Place : Mumbai Date : April 28, 2007 VISHAKHA MULYE Group Chief Financial Officer JYOTIN MEHTA General Manager & Company Secretary... -

Page 145

... ICICI ICICI ICICI Home ICICI Funds Prudential Lombard International UK PLC.6 Securities Securities Securities Securities Finance Trusteeship Investment Limited6 Life General Limited Services Management Management Inc.2 Holdings Company Primary Company Insurance Insurance Company Limited Dealership... -

Page 146

Reconciliation to US GAAP and related notes for the year ended March 31, 2007 -

Page 147

... income and stockholders' equity which would result from the application of US GAAP: 1. Net income reconciliation Rupees in million Note Consolidated profit after tax as per Indian GAAP ...Adjustments on account of : Allowance for loan losses ...Business combinations ...Consolidation ...Valuation of... -

Page 148

... year ended March 31, 2007. In January 2007, the general provisioning requirement for personal loans, credit card receivables, loans and advances qualifying as capital market exposure, commercial real estate and advances to non-deposit taking systematically important non-banking financial companies... -

Page 149

... terms. However, the process of upgradation under US GAAP is not rule-based and the timing of upgradation may differ across individual loans. During fiscal years 2005, 2006 and 2007, the Company transferred certain impaired loans to borrower specific funds/ trusts managed by an asset reconstruction... -

Page 150

... to the acquisitions of software, business process outsourcing and asset management companies in India and the United States for an aggregate cash consideration of Rs 1,480.1 million. The revenue and total assets of the acquired companies are immaterial to the consolidated results of operations and... -

Page 151

... the profit over the term of the policy. Unallocated policyholders' surplus represents amount to be set aside for policyholders' under participating products as required under US GAAP. Un-realised loss / (gain) on trading portfolio of participating funds Under Indian GAAP, accounting for investments... -

Page 152

... assets and liabilities of ICICI Bank Limited were fair valued under US GAAP resulting in a different cost basis in the books of the consolidated entity as compared to Indian GAAP wherein ICICI Bank Limited was the accounting acquirer. Under Indian GAAP, during fiscal 2005, the Company transferred... -

Page 153

... paid to direct marketing agents are expensed in the year in which they are incurred. Costs ICICI Bank Limited had implemented an Early Retirement Option Scheme 2003 ('ERO') for its employees in July 2003. All employees who had completed 40 years of age and seven years of service with the Bank... -

Page 154

...receive, consider and adopt the audited Profit and Loss Account for the financial year ended March 31, 2007 and Balance Sheet as at that date together with the Reports of the Directors and Auditors. To declare dividend on preference shares. To declare dividend on equity shares. To appoint a director... -

Page 155

...Reserve Bank of India to the extent required, Ms. Chanda D. Kochhar, Deputy Managing Director, be paid the following revised remuneration from April 1, 2007 up to March 31, 2011: Salary: In the range of Rs.400,000 to Rs.1,050,000 per month. Perquisites: Perquisites (evaluated as per Income-tax Rules... -

Page 156

...the terms mentioned above, subject to the approval of Reserve Bank of India, from time to time. RESOLVED FURTHER that in the event of absence or inadequacy of net profit in any financial year, the remuneration payable to Mr. V. Vaidyanathan shall be governed by Section II of Part II of Schedule XIII... -

Page 157

... the terms mentioned above, subject to the approval of Reserve Bank of India, from time to time. RESOLVED FURTHER that in the event of absence or inadequacy of net profit in any financial year, the remuneration payable to Ms. Madhabi Puri-Buch shall be governed by Section II of Part II of Schedule... -

Page 158

... Register of Members and the Share Transfer Book of the Company will remain closed from Saturday, June 16, 2007 to Saturday, July 14, 2007 (both days inclusive). Dividend for the year ended March 31, 2007, at Rs.10 per fully paid-up equity share, if declared at the Meeting, will be paid on and from... -

Page 159

... furnished by National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) at the close of business hours on Friday, June 15, 2007. In terms of the directives of Securities and Exchange Board of India, shares issued by companies should rank pari passu in... -

Page 160

... 2007, subject to the approval of the Members and Reserve Bank of India (RBI), to the extent required. The revision in the salary range of each of the wholetime Directors is detailed below : Name and Designation Mr. K. V. Kamath Managing Director & CEO Ms. Chanda D. Kochhar Deputy Managing Director... -

Page 161

... of the Board Governance & Remuneration Committee), appointed her as wholetime Director (designated as Executive Director), subject to the approval of RBI and the Members for a period of five years effective June 1, 2007 on the terms and conditions mentioned in the Circular dated April 28, 2007 as... -

Page 162

... Notice. No Director is in any way concerned or interested in the Resolution at Item No.19 of the Notice. By Order of the Board JYOTIN MEHTA General Manager & Company Secretary Mumbai, June 5, 2007 Registered Office: Landmark Race Course Circle Vadodara 390 007 Corporate Office: ICICI Bank Towers... -

Page 163

... issues and also served several governments and multilateral institutions on public policy. He spearheaded the development of McKinsey's India practice, oversaw the Asian and Latin American offices and was an elected member on its Board. Mr. Anupam Puri did not hold any equity shares of the Company... -

Page 164

..., Chairman Committee Memberships Name of Committee ICICI Bank Limited Fraud Monitoring Committee, Chairman Share Transfer & Shareholders'/Investors' Grievance Committee, Chairman Audit Committee, Alternate Chairman Board Governance & Remuneration Committee Credit Committee Customer Service Committee... -

Page 165

... Name of Committee ICICI Bank Limited Share Transfer & Shareholders'/Investors' Grievance Committee Committee of Directors Asset Liability Management Committee By Order of the Board JYOTIN MEHTA General Manager & Company Secretary Mumbai, June 5, 2007 Registered Office: Landmark Race Course... -

Page 166

...receive, consider and adopt the audited Profit and Loss Account for the financial year ended March 31, 2007 and Balance Sheet as at that date together with the Reports of the Directors and Auditors. To declare dividend on preference shares. To declare dividend on equity shares. To appoint a director... -

Page 167

...Reserve Bank of India to the extent required, Ms. Chanda D. Kochhar, Deputy Managing Director, be paid the following revised remuneration from April 1, 2007 up to March 31, 2011: Salary: In the range of Rs.400,000 to Rs.1,050,000 per month. Perquisites: Perquisites (evaluated as per Income-tax Rules... -

Page 168

...the terms mentioned above, subject to the approval of Reserve Bank of India, from time to time. RESOLVED FURTHER that in the event of absence or inadequacy of net profit in any financial year, the remuneration payable to Mr. V. Vaidyanathan shall be governed by Section II of Part II of Schedule XIII... -

Page 169

... the terms mentioned above, subject to the approval of Reserve Bank of India, from time to time. RESOLVED FURTHER that in the event of absence or inadequacy of net profit in any financial year, the remuneration payable to Ms. Madhabi Puri-Buch shall be governed by Section II of Part II of Schedule... -

Page 170

... Register of Members and the Share Transfer Book of the Company will remain closed from Saturday, June 16, 2007 to Saturday, July 14, 2007 (both days inclusive). Dividend for the year ended March 31, 2007, at Rs.10 per fully paid-up equity share, if declared at the Meeting, will be paid on and from... -

Page 171

... furnished by National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) at the close of business hours on Friday, June 15, 2007. In terms of the directives of Securities and Exchange Board of India, shares issued by companies should rank pari passu in... -

Page 172

... 2007, subject to the approval of the Members and Reserve Bank of India (RBI), to the extent required. The revision in the salary range of each of the wholetime Directors is detailed below : Name and Designation Mr. K. V. Kamath Managing Director & CEO Ms. Chanda D. Kochhar Deputy Managing Director... -

Page 173

... of the Board Governance & Remuneration Committee), appointed her as wholetime Director (designated as Executive Director), subject to the approval of RBI and the Members for a period of five years effective June 1, 2007 on the terms and conditions mentioned in the Circular dated April 28, 2007 as... -

Page 174

... Notice. No Director is in any way concerned or interested in the Resolution at Item No.19 of the Notice. By Order of the Board JYOTIN MEHTA General Manager & Company Secretary Mumbai, June 5, 2007 Registered Office: Landmark Race Course Circle Vadodara 390 007 Corporate Office: ICICI Bank Towers... -

Page 175

... issues and also served several governments and multilateral institutions on public policy. He spearheaded the development of McKinsey's India practice, oversaw the Asian and Latin American offices and was an elected member on its Board. Mr. Anupam Puri did not hold any equity shares of the Company... -

Page 176

..., Chairman Committee Memberships Name of Committee ICICI Bank Limited Fraud Monitoring Committee, Chairman Share Transfer & Shareholders'/Investors' Grievance Committee, Chairman Audit Committee, Alternate Chairman Board Governance & Remuneration Committee Credit Committee Customer Service Committee... -

Page 177

... Name of Committee ICICI Bank Limited Share Transfer & Shareholders'/Investors' Grievance Committee Committee of Directors Asset Liability Management Committee By Order of the Board JYOTIN MEHTA General Manager & Company Secretary Mumbai, June 5, 2007 Registered Office: Landmark Race Course... -

Page 178

... the year ended March 31, 2007 h) Accounting for Securitisation Under US GAAP, the Company accounts for gain on sale of loans securitised (including float income) at the time of sale in accordance with Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment...