Foot Locker 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

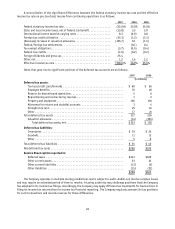

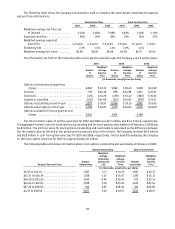

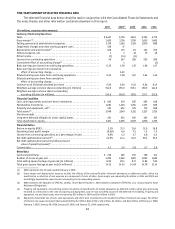

The following table shows the Company’s assumptions used to compute the stock-based compensation expense

and pro forma information:

Stock Option Plans Stock Purchase Plan

2007 2006 2005 2007 2006 2005

Weighted-average risk free rate

of interest ................... 4.43% 4.68% 3.99% 5.00% 4.39% 4.19%

Expected volatility ............... 28% 30% 28% 22% 22% 25%

Weighted-average expected

award life . . . . . . . . . . . . . . . . . . . 4.2 years 4.0 years 3.8 years 1.0 year 1.0 years .7 years

Dividend yield . . . . . . . . . . . . . . . . . . 2.3% 1.5% 1.1% 2.0% 1.4% —

Weighted-average fair value . . . . . . . . $5.28 $6.36 $6.69 $4.96 $4.71 $5.54

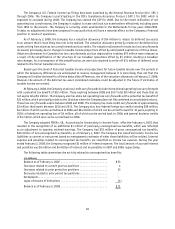

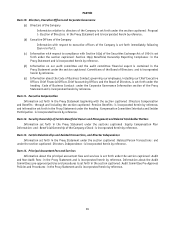

The information set forth in the following table covers options granted under the Company’s stock option plans:

2007 2006 2005

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

Options outstanding at beginning

of year ............................. 6,048 $ 19.15 5,962 $18.45 5,909 $16.69

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 778 $22.38 858 $23.98 1,014 $ 27.42

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (474) $15.29 (459) $ 15.12 (682) $ 15.03

Expired or cancelled . . . . . . . . . . . . . . . . . . . . . (375) $23.99 (313) $24.83 (279) $ 22.11

Options outstanding at end of year .......... 5,977 $19.57 6,048 $ 19.15 5,962 $18.45

Options exercisable at end of year ........... 4,530 $18.27 4,455 $16.94 4,042 $16.00

Options available for future grant at end

of year ............................. 5,804 4,931 5,768

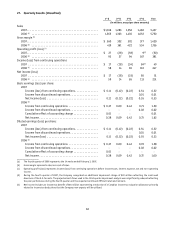

The total intrinsic value of options exercised for 2007 and 2006 was $2.7 million and $4.0 million, respectively.

The aggregate intrinsic value for stock options outstanding and for stock options exercisable as of February 2, 2008 was

$4.8 million. The intrinsic value for stock options outstanding and exercisable is calculated as the difference between

the fair market value as the end of the period and the exercise price of the shares. The Company received $6.9 million

and $6.8 million in cash from option exercises for 2007 and 2006, respectively. The tax benefit realized by the Company

on the stock option exercises for 2007 was approximately $1 million.

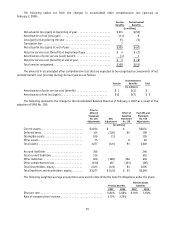

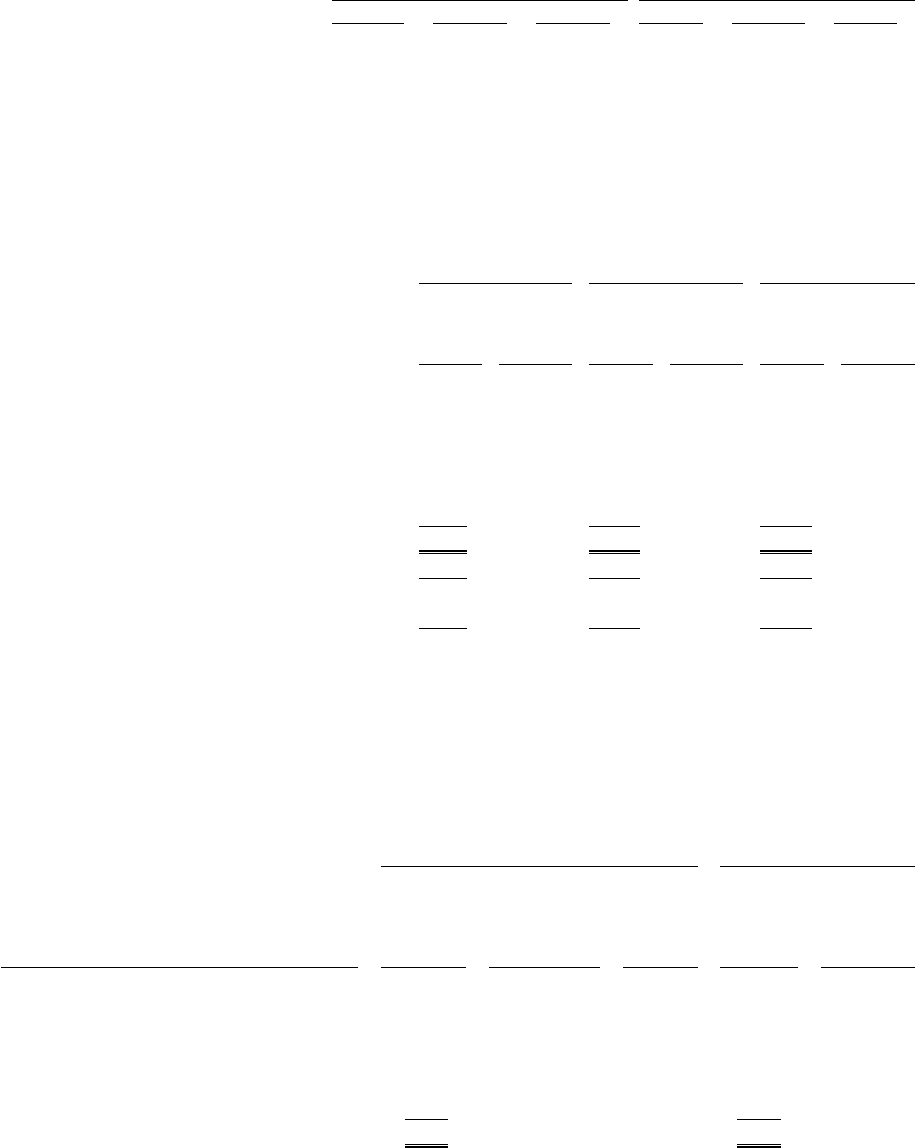

The following table summarizes information about stock options outstanding and exercisable at February 2, 2008:

Options Outstanding Options Exercisable

Range of Exercise Prices Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price Number

Exercisable

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

$4.53 to $11.91 ...................... 1,397 3.71 $10.72 1,397 $10.72

$12.31 to $16.19 ..................... 1,258 4.27 $ 15.07 1,193 $15.12

$16.20 to $23.92 ..................... 1,453 8.48 $ 23.34 325 $23.13

$24.04 to $27.01 ..................... 1,309 5.16 $25.53 1,224 $25.54

$27.10 to $28.50 ..................... 560 6.97 $28.09 391 $28.06

$4.53 to $28.50 . . . . . . . . . . . . . . . . . . . . . 5,977 5.61 $19.57 4,530 $18.27