Foot Locker 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

Robert W. McHugh, age 49, has served as Senior Vice President and Chief Financial Officer since November 2005.

He served as Vice President and Chief Accounting Officer from January 2000 to November 2005.

Lauren B. Peters, age 46, has served as Senior Vice President — Strategic Planning since April 2002. Ms. Peters

served as Vice President — Planning from January 2000 to April 2002.

Laurie J. Petrucci, age 49, has served as Senior Vice President — Human Resources since May 2001. Ms. Petrucci

served as Senior Vice President — Human Resources of the Foot Locker Worldwide division from March 2000 to

May 2001.

Giovanna Cipriano, age 38, has served as Vice President and Chief Accounting Officer since November 2005.

She served as Divisional Vice President, Financial Controller from June 2002 to November 2005 and as Financial

Controller from April 1999 to June 2002.

John Maurer, age 48, has served as Vice President and Treasurer since September 2006. Mr. Maurer served as

Assistant Treasurer from April 2002 to September 2006.

There are no family relationships among the executive officers or directors of the Company.

PART II

Item 5. Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

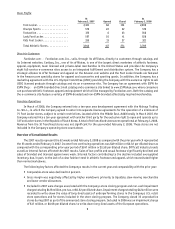

Information regarding the Company’s market for stock exchange listings, common equity, quarterly high and

low prices, and dividend policy are contained in the “Shareholder Information and Market Prices” footnote under

“Item 8. Consolidated Financial Statements and Supplementary Data.”

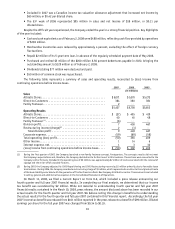

On March 7, 2007, the Company announced that its Board of Directors authorized a new $300 million, three-year

share repurchase program replacing the earlier $150 million program. Under the share repurchase program, subject to

legal and contractual restrictions, the Company may make purchases of its common stock from time to time, depending

on market conditions, availability of other investment opportunities and other factors. In October 2007, the Company

amended its revolving credit agreement. With regard to stock repurchases, the amendment provides that not more than

$50 million in the aggregate may be expended after October 26, 2007 unless the fixed charge coverage ratio is at least

2.0:1 for the quarter immediately preceding any such repurchase and the Company has delivered its annual audited

financial statements with respect to 2007. During 2007, the Company repurchased 2,283,254 shares of common stock at

a cost of approximately $50 million. There were no purchases of common stock during the fourth quarter of 2007.