Foot Locker 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Credit Rating

As of March 31, 2008, the Company’s corporate credit ratings from Standard & Poor’s and Moody’s Investors Service

are BB and Ba3, respectively. Additionally, as of March 31, 2008, Moody’s Investor Services has rated the Company’s

senior unsecured notes B1.

Debt Capitalization and Equity

For purposes of calculating debt to total capitalization, the Company includes the present value of operating

lease commitments in total net debt. Total net debt including the present value of operating leases is considered a non-

GAAP financial measure. The present value of operating leases is discounted using various interest rates ranging from

4 percent to 13 percent, which represent the Company’s incremental borrowing rate at inception of the lease. Operating

leases are the primary financing vehicle used to fund store expansion and, therefore, we believe that the inclusion of

the present value of operating lease in total debt is useful to our investors, credit constituencies, and rating agencies.

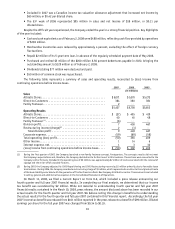

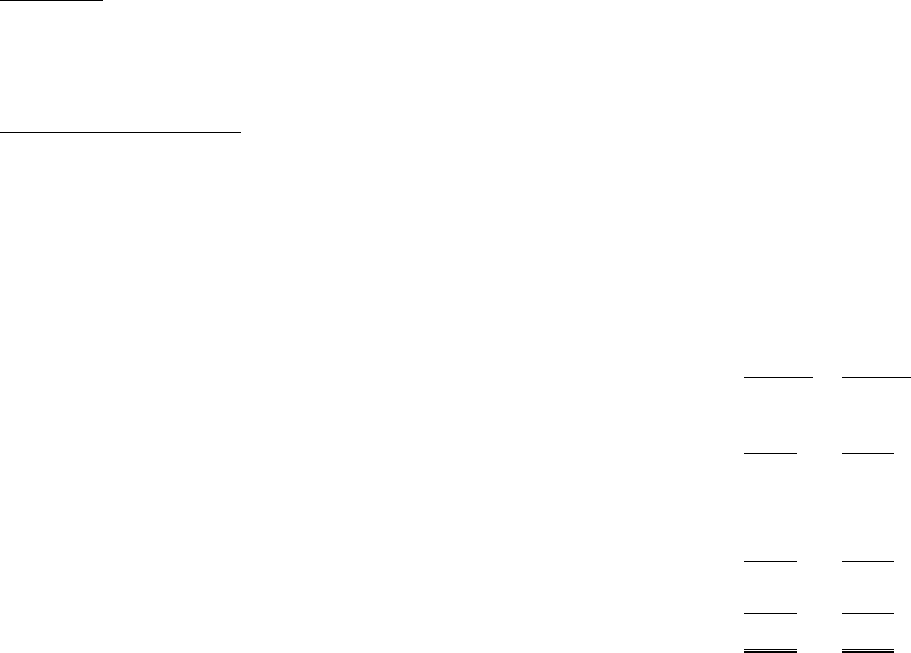

The following table sets forth the components of the Company’s capitalization, both with and without the present

value of operating leases:

2007 2006

(in millions)

Long-term debt and obligations under capital lease. . . . . . . . . . . . . . . . . . . . . . . . $ 221 $234

Present value of operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,126 2,069

Total debt including the present value of operating leases. . . . . . . . . . . . . . . . . 2,347 2,303

Less:

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 488 221

Short-term investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 249

Total net debt including the present value of operating leases. . . . . . . . . . . . . . 1,854 1,833

Shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,2712,295

Total capitalization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,125 $4,128

Total net debt capitalization percent including the present value of

operating leases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44.9% 44.4%

Net debt capitalization percent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —% —%

The Company reduced debt and capital lease obligations by $13 million, and increased cash, cash equivalents, and

short-term investments by $23 million during 2007. Additionally, the present value of the operating leases increased

by $57 million representing the net change of lease renewals and the effect of foreign currency fluctuations primarily

related to the euro. Including the present value of operating leases, the Company’s net debt capitalization percent

increased 50 basis points in 2007. The decrease in shareholders’ equity of $24 million in 2007 relates to the following:

net income of $51 million in 2007, $77 million in dividends paid, $21 million related to stock plans, and an increase

of $60 million in the foreign exchange currency translation adjustment, primarily related to the value of the euro in

relation to the U.S. dollar. Additionally, the Company repurchased 2,283,254 shares of common stock for approximately

$50 million during the year. As required by SFAS No. 158, during 2007 the Company recognized, within accumulated

other comprehensive loss, amortization of prior service costs and net actuarial gains and losses, as well as an additional

charge representing the change in the funded status of the pension plans which totaled $29 million, after-tax.