Foot Locker 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

Accounting for Leases

The Company recognizes rent expense for operating leases as of the possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions and

tenant allowances are recognized over the lease term on a straight-line basis. Contingent payments based upon sales

and future increases determined by inflation related indices cannot be estimated at the inception of the lease and

accordingly, are charged to operations as incurred.

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The translation

of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using current exchange

rates in effect at the balance sheet date and for revenue and expense accounts using the weighted-average rates of

exchange prevailing during the year. The unearned gains and losses resulting from such translation are included as a

separate component of accumulated other comprehensive loss within shareholders’ equity.

Recent Accounting Pronouncements Not Previously Discussed Herein

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”) which is effective

for fiscal years beginning after November 15, 2007 and for interim periods within those years. This statement defines

fair value, establishes a framework for measuring fair value and expands the related disclosure requirements. However,

the FASB issued FASB Staff Positions (“FSP”) 157-1 and 157-2. FSP 157-1 amends SFAS No. 157 to exclude FASB No. 13,

“Accounting for Leases,” and its related interpretive accounting pronouncements that address leasing transactions,

while FSP-2 delays the effective date of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities, except

those that are recognized or disclosed at fair value in the financial statements on a recurring basis, until fiscal years

beginning after November 15, 2008. The Company does not believe that this standard will significantly affect the

Company’s financial position or results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities—Including an Amendment of FASB Statement No. 115.” This statement permits, but does not require,

entities to measure many financial instruments at fair value. The objective is to provide entities with an opportunity to

mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to

apply complex hedge accounting provisions. The Company does not believe that this standard will significantly affect

the Company’s financial position or results of operations.

In December 2007, the FASB issued SFAS No. 141 (Revised 2007), “Business Combinations,” (“SFAS No. 141(R)”).

This standard will significantly change the accounting for business combinations. Under SFAS No. 141(R), an acquiring

entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-

date fair value with limited exceptions. SFAS No. 141(R) also includes a substantial number of new disclosure

requirements. SFAS No. 141(R) applies prospectively to business combinations for which the acquisition date is on or

after the beginning of the first annual reporting period beginning on or after December 15, 2008.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements

- An Amendment of ARB No. 51” (“SFAS No. 160”), which establishes new accounting and reporting standards for the

noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. Specifically, this statement requires

the recognition of a noncontrolling interest (minority interest) as equity in the consolidated financial statements and

separate from the parent’s equity. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal

years, beginning on or after December 15, 2008. This standard does not currently affect the Company.

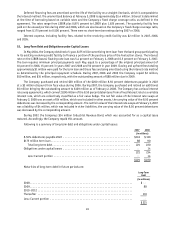

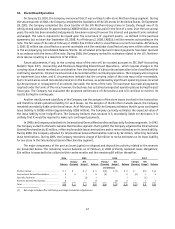

2. Impairment of Long-Lived Assets and Store Closing Program

During 2007, the Company concluded that triggering events had occurred at its U.S. retail store divisions, comprising

Foot Locker, Lady Foot Locker, Kids Foot Locker, Footaction, and Champs Sports. Accordingly, the Company evaluated

the long-lived assets of those operations for impairment and recorded non-cash impairment charges of $117 million

primarily to write-down long-lived assets such as store fixtures and leasehold improvements for 1,395 stores at the

Company’s U.S. store operations pursuant to SFAS No. 144.