Foot Locker 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

• Included in 2007 was a Canadian income tax valuation allowance adjustment that increased net income by

$65 million, or $0.42 per diluted share.

• The 53rd week of 2006 represented $95 million in sales and net income of $18 million, or $0.11 per

diluted share.

Despite the difficult year experienced, the Company ended the year in a strong financial position. Key highlights

of the year included:

• Cash and cash equivalents as of February 2, 2008 were $488 million, reflecting cash flow provided by operations

of $283 million.

• Merchandise inventories were reduced by approximately 4 percent, excluding the effect of foreign currency

fluctuations.

• Repaid $2 million of its 5-year term loan, in advance of the regularly scheduled payment date of May 2008.

• Purchased and retired $5 million of the $200 million 8.50 percent debentures payable in 2022, bringing the

outstanding amount to $129 million as of February 2, 2008.

• Dividends totaling $77 million were declared and paid.

• $50 million of common stock was repurchased.

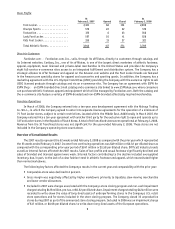

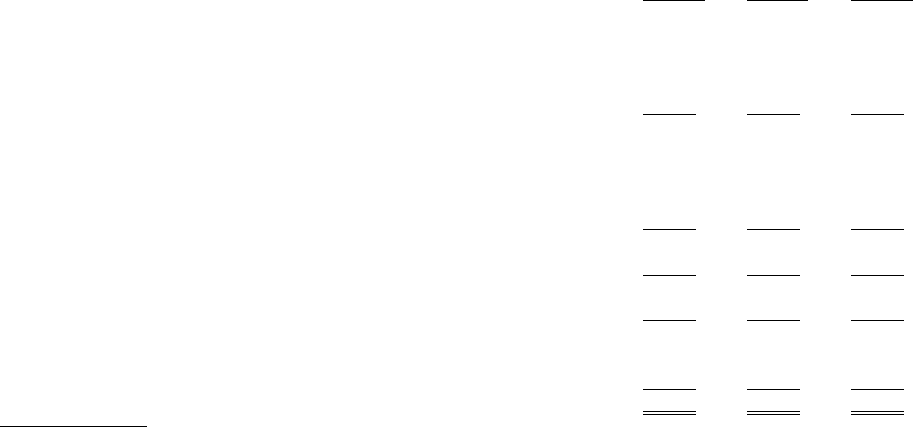

The following table represents a summary of sales and operating results, reconciled to (loss) income from

continuing operations before income taxes.

2007 2006 2005

(in millions)

Sales

Athletic Stores. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,071 $5,370 $5,272

Direct-to-Customers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 364 380 381

Family Footwear. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 — —

$5,437 $5,750 $5,653

Operating Results

Athletic Stores. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (27) $ 405 $ 419

Direct-to-Customers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 45 48

Family Footwear (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) — —

Division profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 450 467

Restructuring income (charge)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 (1) —

Total division profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 449 467

Corporate expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (59) (68) (58)

Total operating (loss) profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (50) 381 409

Other income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 14 6

Interest expense, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3 10

(Loss) income from continuing operations before income taxes . . . . $ (50) $ 392 $ 405

(1) During the first quarter of 2007, the Company launched a new family footwear concept, Footquarters. The concept’s results did not meet

the Company’s expectations and, therefore, the Company decided not to further invest in this business. These stores were converted to the

Company’s other formats. Included in the operating loss of $6 million, was approximately $2 million of costs associated with the removal of

signage and the write-off of unusable fixtures.

(2) During 2007, the Company adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease

terminations. During 2006, the Company recorded a restructuring charge of $1 million, which represented a revision to the original estimate

of the lease liability associated with the guarantee of The San Francisco Music Box Company distribution center. These amounts are included

in selling, general and administrative expenses in the Consolidated Statements of Operations.

On March 11, 2008, we filed a Current Report on Form 8-K, which included a press release announcing our

fourth quarter and full year 2007 financial results. In completing our final analysis, we determined that our income

tax benefit was overstated by $2 million. While not material to understanding fourth quarter and full year 2007

financial results contained in the March 10, 2008, press release, the amount disclosed above has been recorded in our

actual results for the fourth quarter and full year 2007. We believe noting this change is beneficial to understanding

the actual results for the fourth quarter and full year 2007 contained in this financial report. Accordingly, the full year

2007 income tax benefit was reduced from $101 million reported in the press release to a benefit of $99 million. Diluted

earnings per share for the full year 2007 was changed from $0.34 to $0.33.