Foot Locker 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

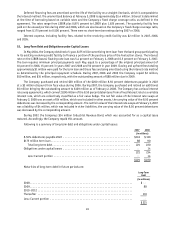

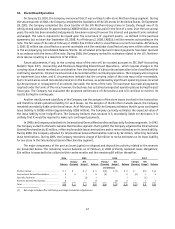

6. Short-Term Investments

The Company’s auction rate security investments are accounted for as available-for-sale securities. The following

represents the composition of the Company’s auction rate securities by underlying investment.

2007 2006

(in millions)

Tax exempt municipal bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 44

Equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 205

$ 5 $ 249

With the liquidity issues experienced in the global credit and capital markets, the Company’s preferred stock

auction rate security, having a face value of $7 million, has experienced failed auctions. The Company determined

that a temporary impairment has occurred and therefore has recorded a charge of $2 million, with no tax benefit,

to accumulated other comprehensive loss as of February 2, 2008. This security will continue to accrue interest at the

contractual rate and will be auctioned every 90 days until the auction succeeds. Based on the relatively small size of

this investment and the Company’s ability to access cash and other short-term investments, and expected operating

cash flows, we do not anticipate the lack of liquidity on this investment will affect our ability to operate our business

as usual.

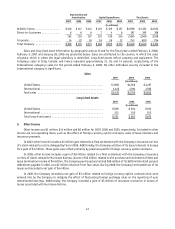

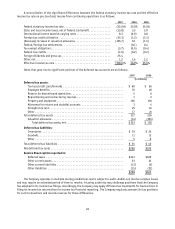

7. Merchandise Inventories

2007 2006

(in millions)

LIFO inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 907 $967

FIFO inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 374 336

Total merchandise inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,281 $1,303

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated

on a FIFO basis.

8. Other Current Assets

2007 2006

(in millions)

Net receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 50 $59

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 36

Prepaid rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 62

Prepaid income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70 67

Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 21

Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 14

Northern Group note receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 1

Current tax asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 —

Fair value of derivative contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

$290 $ 261