Foot Locker 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

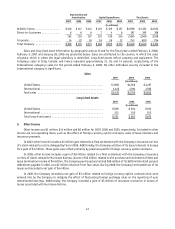

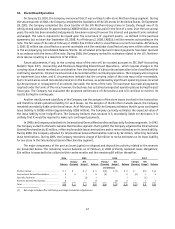

4. Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of February 2, 2008, the Company has two reportable segments, Athletic Stores and Direct-to-Customers.

The Company also operated the Family Footwear segment which included the retail format under the Footquarters brand

name through the second quarter of 2007. During the third quarter, the Company converted the Footquarters stores,

which were the only stores reported under the Family Footwear segment, to Foot Locker and Champs Sports outlet

stores. The Company has concluded that the Footquarters store closings are not discontinued operations pursuant to

SFAS No. 144.

The accounting policies of both segments are the same as those described in the “Summary of Significant

Accounting Policies.” The Company evaluates performance based on several factors, of which the primary financial

measure is division results. Division profit reflects (loss) income from continuing operations before income taxes,

corporate expense, non-operating income, and net interest expense.

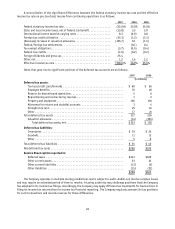

Sales

2007 2006 2005

(in millions)

Athletic Stores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,071 $5,370 $5,272

Direct-to-Customers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 364 380 381

Family Footwear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 — —

Total sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,437 $5,750 $5,653

Operating Results

2007 2006 2005

(in millions)

Athletic Stores(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(27) $405 $ 419

Direct-to-Customers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 45 48

Family Footwear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) — —

7450 467

Restructuring income (charge)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . 2 (1) —

Division profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 449 467

Corporate expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (59) (68) (58)

Operating (loss) profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (50) 381 409

Other income(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 14 6

Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3 10

(Loss) income from continuing operations before income taxes . . $(50) $392 $405

(1) The fiscal year ended February 2, 2008 includes a $128 million charge representing impairment and store closing costs related to the

Company’s U.S. operations. The fiscal year ended February 3, 2007, included a $17 million non-cash impairment charge related to the

Company’s European operations.

(2) During 2007, the Company adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease

terminations. During 2006, the Company recorded a restructuring charge of $1 million, which represented a revision to the original estimate

of the lease liability associated with the guarantee of The San Francisco Music Box Company distribution center. These amounts are included

in selling, general and administrative expenses in the Condensed Consolidated Statements of Operations.

(3) 2007 includes $1 million gain related to a final settlement with the Company’s insurance carriers of a claim related to a store damaged by

fire in 2006 and $1 million gain on the sale of two of its lease interests in Europe. These gains were offset primarily by premiums paid for

foreign currency option contracts.

2006 includes $4 million gain on lease terminations; $8 million of insurance proceeds related to the 2005 hurricane; and $2 million gain on

debt repurchase.

2005 includes a $3 million gain from insurance recoveries associated with Hurricane Katrina. Additionally, $3 million represented a net gain

on foreign currency option contracts that were entered into by the Company to mitigate the effect of fluctuating foreign exchange rates

on the reporting of euro dominated earnings.