Foot Locker 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Fair Value

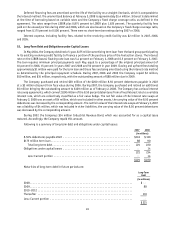

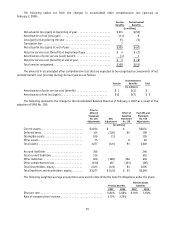

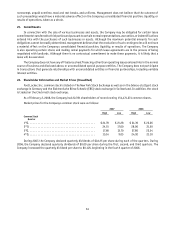

The following represents the fair value of the Company’s derivative holdings:

2007 2006

(in millions)

Current assets ...................................................... $ 3 $ 1

Non-current assets .................................................. 4 —

Current liabilities ................................................... — 2

Non-current liabilities ............................................... 32 12

Interest Rates

The Company’s major exposure to market risk is to changes in interest rates, primarily in the United States.

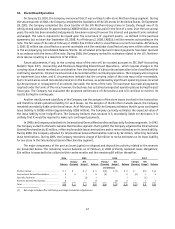

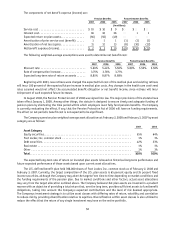

The table below presents the fair value of principal cash flows and related weighted-average interest rates by

maturity dates, including the effect of the interest rate swaps outstanding at February 2, 2008, of the Company’s long-

term debt obligations.

2008 2009 2010 2011 2012 Thereafter

Feb. 2,

2008

Total

Feb. 3

2007

Total

($ in millions)

Long-term debt ............................. $ — 88 — — — 128 $216 $222

Weighted-average interest rate ................. 6.8% 6.8% 7.0%7.0%7.0%7.0%

Fair Value of Financial Instruments

The carrying value and estimated fair value of long-term debt was $221 million and $216 million, respectively, at

February 2, 2008 and $220 million and $222 million, respectively, at February 3, 2007. The carrying value and estimated

fair value of long-term investments and notes receivable was $14 million, respectively, at February 2, 2008 and

$18 million and $19 million, respectively, at February 3, 2007. The carrying value and estimated fair value of the short-

term investment was $14 million and $15 million, respectively, at February 3, 2007. The carrying values of cash and cash

equivalents, other short-term investments and other current receivables and payables approximate their fair value.

Business Risk

The retailing business is highly competitive. Price, quality, selection of merchandise, reputation, store location,

advertising and customer service are important competitive factors in the Company’s business. The Company operates

in 21 countries and purchased approximately 77 percent of its merchandise in 2007 from its top 5 vendors. In 2007, the

Company purchased approximately 56 percent of its athletic merchandise from one major vendor and approximately

12 percent from another major vendor. Each of our operating divisions is highly dependent on Nike; they individually

purchase 43 to 74 percent of their merchandise from Nike. The Company generally considers all vendor relations to be

satisfactory.

Included in the Company’s Consolidated Balance Sheet as of February 2, 2008, are the net assets of the Company’s

European operations totaling $573 million, which are located in 17 countries, 11 of which have adopted the euro as

their functional currency.

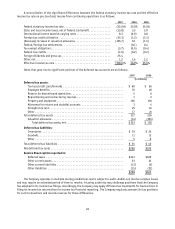

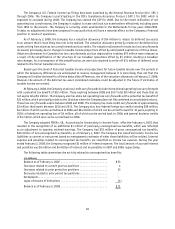

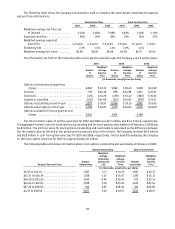

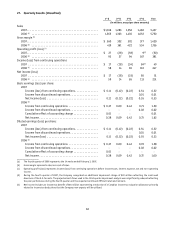

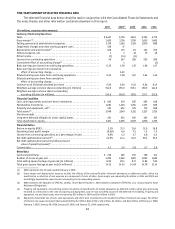

22. Retirement Plans and Other Benefits

Pension and Other Postretirement Plans

The Company has defined benefit pension plans covering most of its North American employees, which are funded

in accordance with the provisions of the laws where the plans are in effect. In addition to providing pension benefits,

the Company sponsors postretirement medical and life insurance plans, which are available to most of its retired U.S.

employees. These plans are contributory and are not funded. The measurement date of the assets and liabilities is the

last day of the fiscal year.