Foot Locker 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

by $20 million and $5 million, net of tax at February 2, 2008 and February 3, 2007. At January 28, 2006, the amount

recorded to foreign currency translation was not significant. The effect on the Consolidated Statements of Operations

related to the net investments hedges was income of $1 million for 2007 and $3 million for 2006.

Foreign Exchange Risk Management — Derivative Holdings Designated as Non-Hedges

The Company mitigates the effect of fluctuating foreign exchange rates on the reporting of foreign currency

denominated earnings by entering into a variety of derivative instruments including option currency contracts. Changes

in the fair value of these foreign currency option contracts, which are designated as non-hedges, are recorded in

earnings immediately. The premiums paid and changes in the fair market value recorded in the Consolidated Statement

of Operations were not significant for the years ended February 2, 2008 and February 3, 2007, respectively.

The Company also enters into forward foreign exchange contracts to hedge foreign-currency denominated

merchandise purchases and intercompany transactions. Net changes in the fair value of foreign exchange derivative

financial instruments designated as non-hedges were substantially offset by the changes in value of the underlying

transactions, which were recorded in selling, general and administrative expenses. The amount recorded during 2006

was not significant.

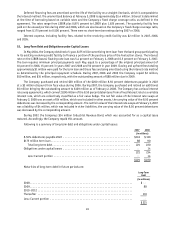

Foreign Currency Exchange Rates

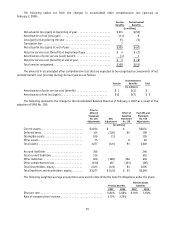

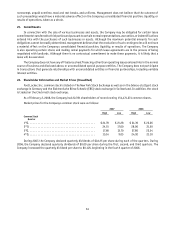

The table below presents the fair value, notional amounts, and weighted-average exchange rates of foreign

exchange forward and option contracts outstanding at February 2, 2008.

Fair Value

(US in millions) Contract Value

(US in millions) Weighted-Average

Exchange Rate

Inventory

Buy €/Sell British £ ......................... $2$48 .7239

Earnings

Buy CAD$/Sell $US . . . . . . . . . . . . . . . . . . . . . . . . . $— $ 71.0000

Buy €/Sell $US . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 34 1.4200

Intercompany

Buy US/Sell € . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $— $ —.6808

Buy €/ Sell British £ . . . . . . . . . . . . . . . . . . . . . . . . 1 16 .6918

Buy €/Sell SEK . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1 9.4712

Buy AUD/Sell NZD . . . . . . . . . . . . . . . . . . . . . . . . . . — 2 .8883

Buy US/Sell CAD$ . . . . . . . . . . . . . . . . . . . . . . . . . . — 6 .9861

Buy CAD$/Sell US . . . . . . . . . . . . . . . . . . . . . . . . . . — 6 .9971

Interest Rate Risk Management

The Company has employed various interest rate swaps to minimize its exposure to interest rate fluctuations. These

swaps, which mature in 2022, have been designated as a fair value hedge of the changes in fair value of $100 million

of the Company’s 8.50 percent debentures payable in 2022 attributable to changes in interest rates and effectively

convert the interest rate on the debentures from 8.50 percent to a 1-month variable rate of LIBOR plus 3.45 percent.

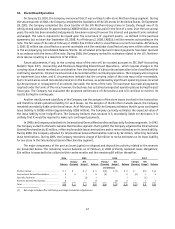

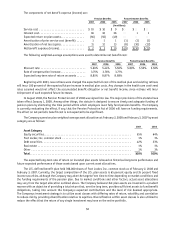

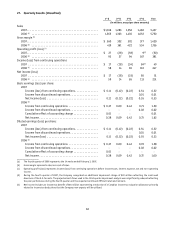

The following table presents the Company’s outstanding interest rate derivatives:

2007 2006 2005

(in millions)

Interest Rate Swaps:

Fixed to Variable ($US) — notional amount .................. $100 $100 $100

Average pay rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.22%8.53%8.00%

Average receive rate ................................. 8.50%8.50%8.50%

Variable to variable ($US) — notional amount ................ $100 $100 $100

Average pay rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.39%5.57% 4.82%

Average receive rate ................................. 3.02%5.32% 4.79%