Foot Locker 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

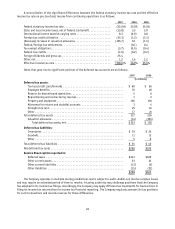

45

Deferred financing fees are amortized over the life of the facility on a straight-line basis, which is comparable to

the interest method. The unamortized balance at February 2, 2008 is approximately $1.4 million. Interest is determined

at the time of borrowing based on variable rates and the Company’s fixed charge coverage ratio, as defined in the

agreement. The rates range from LIBOR plus 0.875 percent to LIBOR plus 1.625 percent. The quarterly facility fees

paid on the unused portion during 2007 and 2006, which are also based on the Company’s fixed charge coverage ratio,

ranged from 0.175 percent to 0.500 percent. There were no short-term borrowings during 2007 or 2006.

Interest expense, including facility fees, related to the revolving credit facility was $2 million in 2007, 2006,

and 2005.

15. Long-Term Debt and Obligations under Capital Leases

In May 2004, the Company obtained a 5-year, $175 million amortizing term loan from the bank group participating

in its existing revolving credit facility to finance a portion of the purchase price of the Footaction stores. The interest

rate on the LIBOR-based, floating-rate loan was 5.4 percent on February 2, 2008 and 6.5 percent on February 3, 2007.

The loan requires minimum principal payments each May, equal to a percentage of the original principal amount of

10 percent in 2006, 15 percent in years 2007 and 2008 and 50 percent in year 2009. Closing and upfront fees totaling

approximately $1 million were paid for the term loan and these fees are being amortized using the interest rate method

as determined by the principal repayment schedule. During 2007, 2006 and 2005 the Company repaid $2 million,

$50 million, and $35 million, respectively, with the outstanding amount of $88 million due in 2009.

The Company purchased and retired $38 million of the $200 million 8.50 percent debentures payable in 2022

at a $2 million discount from face value during 2006. During 2007, the Company purchased and retired an additional

$5 million bringing the outstanding amount to $129 million as of February 2, 2008. The Company has various interest

rate swap agreements, which convert $100 million of the 8.50 percent debentures from a fixed interest rate to a variable

interest rate, which are collectively classified as a fair value hedge. The net fair value of the interest rate swaps at

February 2, 2008 was an asset of $4 million, which was included in other assets, the carrying value of the 8.50 percent

debentures was increased by the corresponding amount. The net fair value of the interest rate swaps at February 3, 2007

was a liability of $4 million, which was included in other liabilities, the carrying value of the 8.50 percent debentures

was decreased by the corresponding amount.

During 2007, the Company’s $14 million Industrial Revenue Bond, which was accounted for as a capital lease

matured. Accordingly, the Company repaid this amount.

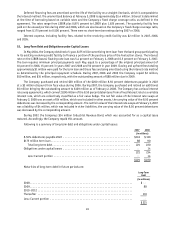

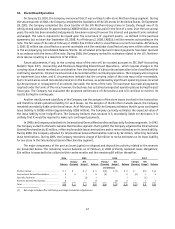

Following is a summary of long-term debt and obligations under capital leases:

2007 2006

(in millions)

8.50% debentures payable 2022 ........................................... $133 $130

$175 million term loan................................................... 88 90

Total long-term debt.................................................. 221 220

Obligations under capital leases ........................................... —14

221 234

Less: Current portion ................................................. —14

$221 $220

Maturities of long-term debt in future periods are:

Long-Term

Debt

(in millions)

2008 .................................................................. $ —

2009 .................................................................. 88

2010 -2012 ............................................................. —

Thereafter ............................................................. 133

Less: Current portion ..................................................... —

$221