Foot Locker 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

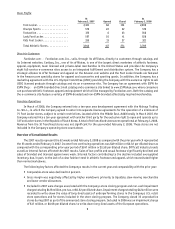

Net cash provided by investing activities of the Company’s continuing operations was $117 million in 2007 as

compared with $108 million used in investing activities in 2006. During 2007, the Company liquidated most of its short-

term investments, which represented auction rate securities, due to issues in the global credit and capital markets.

Capital expenditures of $148 million in 2007 and $165 million in 2006 primarily related to store remodeling and new

stores. During 2007, the Company received $21 million representing the maturity of an investment of $14 million and

the repayment of a note of $7 million.

Net cash used in investing activities of the Company’s continuing operations was $108 million in 2006 as

compared with $182 million in 2005. The Company’s purchase of short-term investments, net of sales, decreased by

$49 million in 2006 as compared with an increase of $31 million in 2005. Capital expenditures of $165 million in 2006

and $155 million in 2005 primarily related to store remodeling and new stores. During 2006, the Company received net

proceeds of $4 million as a result a lease termination. The Company also received $4 million of insurance proceeds from

its insurance carriers related to the final settlement of the property and equipment claims for the 2005 hurricanes.

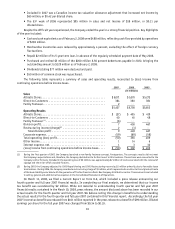

Net cash used in financing activities of continuing operations was $138 million in 2007 as compared with

$142 million in 2006. During 2007, the Company repaid $2 million of its term loan, purchased and retired $5 million of

its 8.50 percent debentures payable in 2022, and repaid and retired its $14 million Industrial Revenue Bond which was

accounted for as capital lease. As required by SFAS No. 123(R), the Company recorded an excess tax benefit related to

stock-based compensation of $1 million as a financing activity. The Company declared and paid dividends totaling

$77 million in 2007 and $61 million in 2006. During 2007 and 2006, the Company received proceeds from the issuance

of common stock and treasury stock in connection with the employee stock programs of $9 million and $12 million,

respectively. During 2007, the Company purchased 2,283,254 shares of its common stock for approximately $50 million.

On February 20, 2008, the Board of Directors declared a quarterly cash dividend of $0.15 per share, which will be payable

on May 2, 2008 to shareholders of record on April 18, 2008. This dividend represents a 20 percent increase over the

previous quarterly per share amount and is equivalent to an annualized rate of $0.60 per share.

Net cash used in financing activities of continuing operations was $142 million in 2006 as compared with

$105 million in 2005. During 2006, the Company repaid $50 million of its term loan and purchased and retired $38 million

of its 8.50 percent debentures payable in 2022 at a $2 million discount from face value. The Company recorded an

excess tax benefit related to stock-based compensation of $2 million as a financing activity. The Company declared

and paid dividends totaling $61 million in 2006 and $49 million in 2005. During 2006 and 2005, the Company received

proceeds from the issuance of common stock and treasury stock in connection with the employee stock programs of

$12 million and $14 million, respectively. During 2006, the Company purchased 334,200 shares of its common stock for

approximately $8 million.

Capital Structure

During 2004, the Company obtained a 5-year, $175 million term loan to finance a portion of the purchase price

of the Footaction stores. The Company has repaid $87 million of the term loan, in advance of the scheduled repayment

dates, thereby reducing the term loan to $88 million as of February 2, 2008.

In October 2007, the Company amended its revolving credit agreement to provide for a one-year extension of the

revolving credit facility to May 19, 2010 and a reduction in the fixed charge coverage ratio to no less than 1.25:1 for the

fourth quarter of 2007 and the first quarter of 2008, increasing to 2.0:1 by the first quarter of 2010. The amendment

also permits the payment of dividends by the Company of up to $90 million in 2008 and up to $100 million for each

year thereafter. On February 19, 2008, the Company further amended its revolving credit facility to increase the

amount permitted to be paid as dividends in 2008 to $95 million. With regard to stock repurchases, the amendment

provides that not more than $50 million in the aggregate may be expended after October 26, 2007 unless the fixed

charge coverage ratio is at least 2.0:1 for the quarter immediately preceding any such repurchase and the Company

has delivered its annual audited financial statements with respect to 2007. The agreement includes various restrictive

financial covenants with which the Company was in compliance on February 2, 2008.

During 2006, the Company purchased and retired $38 million of the $200 million 8.50 percent debentures payable

in 2022 at a $2 million discount from face value. During 2007, the Company purchased and retired $5 million of the

$200 million 8.50 percent debentures payable in 2022 bringing the outstanding amount (excluding the fair value of the

interest rate swap) to $129 million as of February 2, 2008.