Foot Locker 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

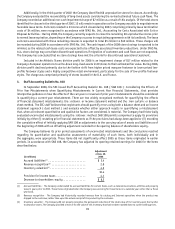

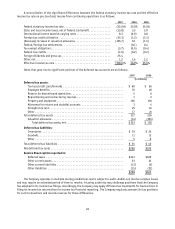

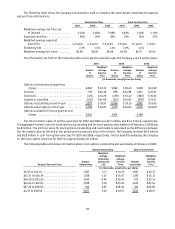

A reconciliation of the significant differences between the federal statutory income tax rate and the effective

income tax rate on pre-tax (loss) income from continuing operations is as follows:

2007 2006 2005

Federal statutory income tax rate .............................. (35.0)% 35.0%35.0%

State and local income taxes, net of federal tax benefit . . . . . . . . . . . . . (13.8) 3.3 2.8

International income taxed at varying rates ...................... 8.3 (0.9) 0.8

Foreign tax credit utilization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (53.1) (1.2) (3.1)

(Decrease) increase in valuation allowance ....................... (125.7) 0.1 (1.5)

Federal/foreign tax settlements ............................... — (0.1) 0.4

Tax exempt obligations ...................................... (3.7) (0.5) (0.4)

Federal tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.6) (0.2) (0.2)

Foreign dividends and gross-up ................................ 25.4 — —

Other, net ................................................ 1.2 1.4 1.2

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (198.0)% 36.9%35.0%

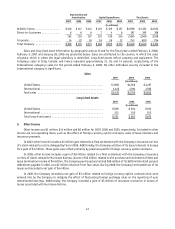

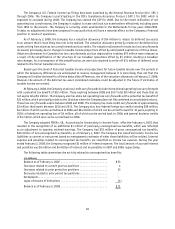

Items that gave rise to significant portions of the deferred tax accounts are as follows:

2007 2006

(in millions)

Deferred tax assets:

Tax loss/credit carryforwards ....................................... $ 68 $ 56

Employee benefits ............................................... 33 26

Reserve for discontinued operations .................................. 5 6

Repositioning and restructuring reserves .............................. 1 2

Property and equipment ........................................... 165 116

Allowance for returns and doubtful accounts ........................... 3 4

Straight-line rent ................................................ 25 24

Other ......................................................... 17 21

Total deferred tax assets ............................................. 317 255

Valuation allowance .............................................. (14) (105)

Total deferred tax assets, net ..................................... $303 $150

Deferred tax liabilities:

Inventories .................................................... $19 $24

Goodwill....................................................... 11 13

Other ......................................................... 5 8

Total deferred tax liabilities .......................................... $35 $45

Net deferred tax asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $268 $105

Balance Sheet caption reported in:

Deferred taxes .................................................. $243 $109

Other current assets .............................................. 53 21

Other current liabilities ........................................... (13) (4)

Other liabilities ................................................. (15) (21)

$268 $105

The Company operates in multiple taxing jurisdictions and is subject to audit. Audits can involve complex issues

and may require an extended period of time to resolve. A taxing authority may challenge positions that the Company

has adopted in its income tax filings. Accordingly, the Company may apply different tax treatments for transactions in

filing its income tax returns than for income tax financial reporting. The Company regularly assesses its tax positions

for such transactions and records reserves for those differences.