Foot Locker 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

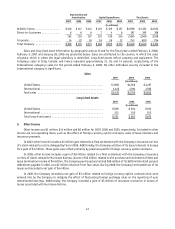

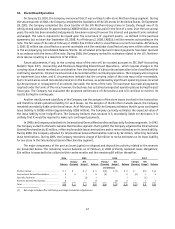

41

Depreciation and

Amortization Capital Expenditures Total Assets

2007 2006 2005 2007 2006 2005 2007 2006 2005

(in millions)

Athletic Stores . . . . . . . . . . . . . . . . $146 $ 147 $141 $125 $135 $137 $2,298 $ 2,374 $2,322

Direct-to-Customers . . . . . . . . . . . . 6 6 6 7 4 6 197 195 196

152 153 147 132 139 143 2,495 2,569 2,518

Corporate . . . . . . . . . . . . . . . . . . . . 14 22 24 16 26 12 753 680 794

Total Company . . . . . . . . . . . . . . . . $166 $ 175 $171 $148 $165 $155 $3,248 $3,249 $3,312

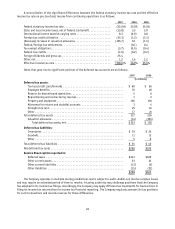

Sales and long-lived asset information by geographic area as of and for the fiscal years ended February 2, 2008,

February 3, 2007 and January 28, 2006 are presented below. Sales are attributed to the country in which the sales

originate, which is where the legal subsidiary is domiciled. Long-lived assets reflect property and equipment. The

Company’s sales in Italy, Canada, and France represent approximately 21, 18, and 14 percent, respectively, of the

International category’s sales for the period ended February 2, 2008. No other individual country included in the

International category is significant.

Sales

2007 2006 2005

(in millions)

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,991 $4,356 $4,257

International . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,446 1,394 1,396

Total sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,437 $5,750 $5,653

Long-Lived Assets

2007 2006 2005

(in millions)

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $368 $ 504 $523

International . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153 150 152

Total long-lived assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 521 $654 $675

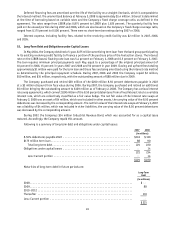

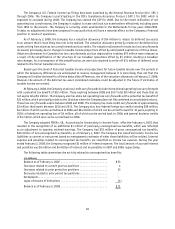

5. Other Income

Other income was $1 million, $14 million and $6 million for 2007, 2006 and 2005, respectively. Included in other

income are non-operating items, such as the effect of foreign currency option contracts, sales of lease interests and

insurance proceeds.

In 2007, other income includes a $1 million gain related to a final settlement with the Company’s insurance carriers

of a claim related to a store damaged by fire in 2006. Additionally, the Company sold two of its lease interests in Europe

for a gain of $1 million. These gains were offset primarily by premiums paid for foreign currency option contracts.

In 2006, other income includes a gain of $8 million related to a final settlement with the Company’s insurance

carriers of claims related to Hurricane Katrina, income of $2 million related to the purchase and retirement of debt and

lease termination income of $4 million. The Company purchased and retired $38 million of its $200 million 8.50 percent

debentures payable in 2022, at a $2 million discount from face value. During 2006, the Company terminated two of its

leases and recorded a net gain of $4 million.

In 2005, the Company recorded a net gain of $3 million related to foreign currency option contracts that were

entered into by the Company to mitigate the effect of fluctuating foreign exchange rates on the reporting of euro

denominated earnings. Additionally, the Company recorded a gain of $3 million of insurance recoveries in excess of

losses associated with Hurricane Katrina.