Foot Locker 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

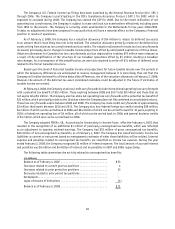

Amortization expense for the intangibles subject to amortization was approximately $19 million for both 2007

and 2006, and $18 for 2005. Annual estimated amortization expense for finite life intangible assets is expected

to approximate $18 million for 2008, $17 million for 2009, $15 million for 2010, $12 million for 2011 and $9 million

for 2012.

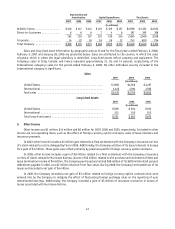

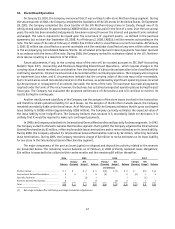

12. Other Assets

2007 2006

(in millions)

Deferred tax costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9 $ 21

Prepaid income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 —

Income tax asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 —

Investments and note receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 7

Northern Group note receivable, net of current portion . . . . . . . . . . . . . . . . . . . . . . — 10

Fair value of derivative contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 —

Pension benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 8

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 37

$58 $83

13. Accrued and Other Liabilities

2007 2006

(in millions)

Pension and postretirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4 $ 4

Incentive bonuses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12

Other payroll and payroll related costs, excluding taxes . . . . . . . . . . . . . . . . . . . . . 52 46

Taxes other than income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 46

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 24

Customer deposits(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 33

Income taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 2

Fair value of derivative contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2

Current deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 4

Sales return reserve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 4

Current portion of repositioning and restructuring reserves . . . . . . . . . . . . . . . . . . — 1

Current portion of reserve for discontinued operations . . . . . . . . . . . . . . . . . . . . . . 14 3

Other operating costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 65

$268 $246

(1) Customer deposits include unredeemed gift cards and certificates, merchandise credits and, deferred revenue related to undelivered

merchandise, including layaway sales.

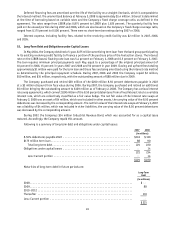

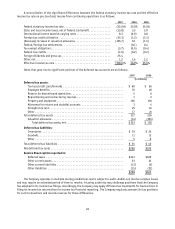

14. Revolving Credit Facility

At February 2, 2008, the Company had unused domestic lines of credit of $189 million, pursuant to a $200 million

unsecured revolving credit agreement. $11 million of the line of credit was committed to support standby letters of

credit. These letters of credit are primarily used for insurance programs.

In May 2004, shortly after the Footaction acquisition, the Company amended its revolving credit agreement,

thereby extending the maturity date to May 2009 from July 2006. In October 2007, the Company amended its revolving

credit agreement to provide for a one-year extension of the revolving credit facility to May 19, 2010 and a reduction

in the fixed charge coverage ratio to no less than 1.25:1 for the fourth quarter of 2007 and the first quarter of 2008,

increasing to 2.0:1 by the first quarter of 2010. The amendment also permits the payment of dividends by the Company

of up to $90 million in 2008 and up to $100 million for each year thereafter. With regard to stock repurchases, the

amendment provides that not more than $50 million in the aggregate may be expended after October 26, 2007 unless

the fixed charge coverage ratio is at least 2.0:1 for the quarter immediately preceding any such repurchase and the

Company has delivered its annual audited financial statements with respect to 2007.