Foot Locker 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

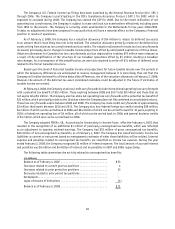

19. Repositioning and Restructuring Reserves

1999 Restructuring

The Company recorded restructuring charges in 1999 for programs to sell or liquidate eight non-core businesses.

The restructuring plan also included an accelerated store-closing program in North America and Asia, corporate

headcount reduction and a distribution center shutdown. The dispositions of Randy River Canada, Foot Locker Outlets,

Colorado, Going to the Game!, Weekend Edition and the store-closing program were essentially completed in 2000.

In 2001, the Company completed the sales of The San Francisco Music Box Company and the assets related to its Burger

King and Popeye’s franchises. The termination of the Maumelle distribution center lease was completed in 2002. As of

February 2, 2008 and February 3, 2007 the reserve balance is $1 million.

1993 Repositioning and 1991 Restructuring

The Company recorded charges in 1993 and in 1991 to reflect the anticipated costs to sell or close under-performing

specialty and general merchandise stores in the United States and Canada. During 2007, the Company adjusted the

reserve by $2 million primarily due to favorable lease terminations. As of February 2, 2008 and February 3, 2007, the

reserve balance was $1 million and $3 million, respectively.

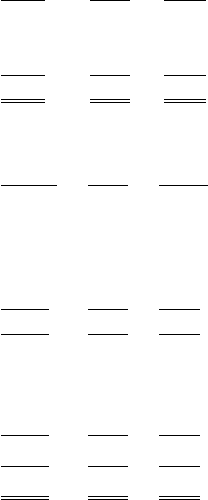

20. Income Taxes

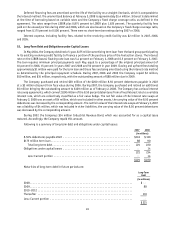

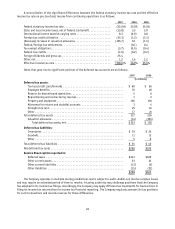

Following are the domestic and international components of pre-tax (loss) income from continuing operations:

2007 2006 2005

(in millions)

Domestic ................................................... $(131) $320 $309

International ................................................ 81 72 96

Total pre-tax (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (50) $392 $405

The income tax (benefit) provision consists of the following:

2007 2006 2005

(in millions)

Current:

Federal .................................................. $ (4) $ 93 $72

State and local ............................................ (4) 14 11

International ............................................. 38 17 35

Total current tax provision ................................... 30 124 118

Deferred:

Federal .................................................. (58) 10 22

State and local ............................................ — 6 7

International ............................................. (71) 5 (5)

Total deferred tax (benefit) provision ............................. (129) 21 24

Total income tax (benefit) provision .............................. $ (99) $145 $142

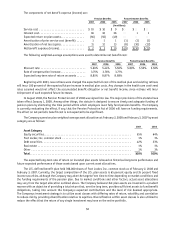

Provision has been made in the accompanying Consolidated Statements of Operations for additional income taxes

applicable to dividends received or expected to be received from international subsidiaries. The amount of unremitted

earnings of international subsidiaries for which no such tax is provided and which is considered to be permanently

reinvested in the subsidiaries totaled $476 million and $427 million at February 2, 2008, and February 3, 2007,

respectively.