Foot Locker 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

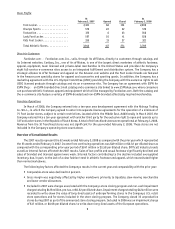

Store Profile

At

February 3, 2007 Opened Closed At

February 2, 2008

Foot Locker . . . . . . . . . . . . . . . . . . . . 2,101 66 161 2,006

Champs Sports . . . . . . . . . . . . . . . . . 576 22 22 576

Footaction . . . . . . . . . . . . . . . . . . . . 373 623 356

Lady Foot Locker . . . . . . . . . . . . . . . . 557 10 41 526

Kids Foot Locker . . . . . . . . . . . . . . . . 335 13 27 321

Total Athletic Stores . . . . . . . . . . . . . 3,942 117 274 3,785

Direct-to-Customers

Footlocker.com — Footlocker.com, Inc., sells, through its affiliates, directly to customers through catalogs and

its Internet websites. Eastbay, Inc., one of its affiliates, is one of the largest direct marketers of athletic footwear,

apparel, equipment, team licensed and private-label merchandise in the United States and provides the Company’s

eight full-service e-commerce sites access to an integrated fulfillment and distribution system. The Company has a

strategic alliance to offer footwear and apparel on the Amazon.com website and the Foot Locker brands are featured

in the Amazon.com specialty stores for apparel and accessories and sporting goods. In addition, the Company has a

marketing agreement with the U.S. Olympic Committee (USOC) providing the Company with the exclusive rights to sell

USOC licensed products through catalogs and via an e-commerce site. The Company has an agreement with ESPN for

ESPN Shop — an ESPN-branded direct mail catalog and e-commerce site linked to www.ESPNshop.com, where consumers

can purchase athletic footwear, apparel and equipment which will be managed by Footlocker.com. Both the catalog and

the e-commerce site feature a variety of ESPN-branded and non-ESPN-branded athletically inspired merchandise.

Franchise Operations

In March of 2006, the Company entered into a ten-year area development agreement with the Alshaya Trading

Co. W.L.L., in which the Company agreed to enter into separate license agreements for the operation of a minimum of

75 Foot Locker stores, subject to certain restrictions, located within the Middle East. Additionally in March 2007, the

Company entered into a ten-year agreement with another third party for the exclusive right to open and operate up to

33 Foot Locker stores in the Republic of South Korea. A total of 10 franchised stores were operational at February 2, 2008.

Revenue from the 10 franchised stores was not significant for the year-ended February 2, 2008. These stores are not

included in the Company’s operating store count above.

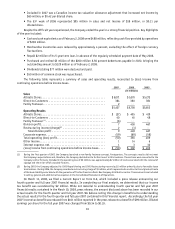

Overview of Consolidated Results

The 2007 results represent the 52 weeks ended February 2, 2008 as compared with the prior year which represented

the 53 weeks ended February 3, 2007. Income from continuing operations was $49 million or $0.32 per diluted share as

compared with the corresponding prior-year period of $247 million or $1.58 per diluted share. Difficult industry trends

as well as internal factors affected the 2007 results. Sales of low-profile and casual footwear significantly declined and

sales of branded and licensed apparel were weak. Internal factors contributing to the decline included oversupplied

inventory, due, in part, to the lack of a clear fashion trend in athletic footwear and apparel, which necessitated higher

than normal markdowns.

The following key factors affected the Company’s results in the current year and comparability with the prior year:

• Comparable-store sales declined 6.3 percent.

• Gross margin was negatively affected by higher markdowns primarily to liquidate slow-moving merchandise

and lower vendor allowances.

• Included in 2007 were charges associated with the Company’s store closing program and non-cash impairment

charges totaling $128 million, pre-tax, or $0.52 per diluted share. Impairment charges totaling $124 million were

recorded to write-down the value of long-lived assets of underperforming stores in the Company’s U.S. retail

store operations and for stores included in the store closing program. The Company closed 33 unproductive

stores during 2007 as part of the announced store closing program. Included in 2006 was an impairment charge

of $17 million, or $0.08 per diluted share, to write-down long-lived assets of the European operations.