Food Lion 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

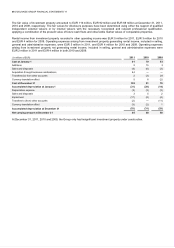

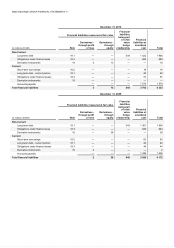

96 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

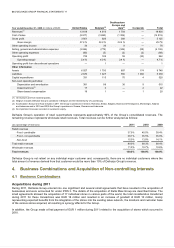

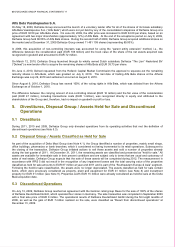

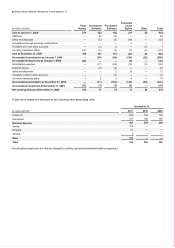

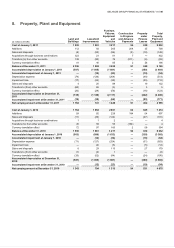

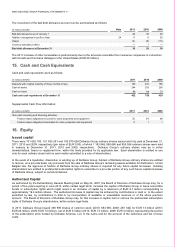

(in millions of EUR)

Land and

Buildings

Leasehold

Improvements

Furniture,

Fixtures,

Equipment

and

Vehicles

Construction

in Progress

and Advance

Payments

Property

under

Finance

Leases

Total

Property,

Plant and

Equipment

Cost at January 1. 2009

1 604

1 593

2 892

97

839

7 025

Additions

73

64

205

115

66

523

Sales and disposals

(6)

(27)

(89)

—

(19)

(141)

Acquisitions through business combinations

3

8

3

—

—

14

Transfers (to) from other accounts(1)

123

58

(47)

(149)

(15)

(30)

Currency translation effect

(33)

(44)

(73)

(1)

(26)

(177)

Balance at December 31, 2009

1 764

1 652

2 891

62

845

7 214

Accumulated depreciation at January 1, 2009

(398)

(820)

(1 595)

—

(317)

(3 130)

Accumulated impairment at January 1, 2009

—

(13)

(33)

—

(17)

(63)

Depreciation expense

(56)

(122)

(226)

—

(49)

(453)

Impairment loss

(1)

(5)

(7)

—

—

(13)

Sales and disposals

3

25

84

—

19

131

Transfers to (from) other accounts(1)

(60)

(1)

68

—

7

14

Currency translation effect

9

23

42

—

11

85

Accumulated depreciation at December 31,

2009

(503) (899) (1 633) — (330) (3 365)

Accumulated impairment at December 31, 2009

— (14) (34) — (16) (64)

Net carrying amount at December 31, 2009

1 261

739

1 224

62

499

3 785

_______________

(1) During 2009 certain permanent building fixtures were transferred from “Furniture, fixtures, equipment and vehicles” to “Land and Buildings.”

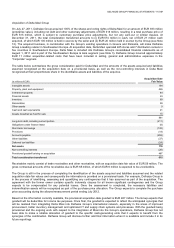

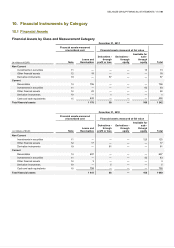

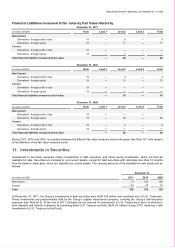

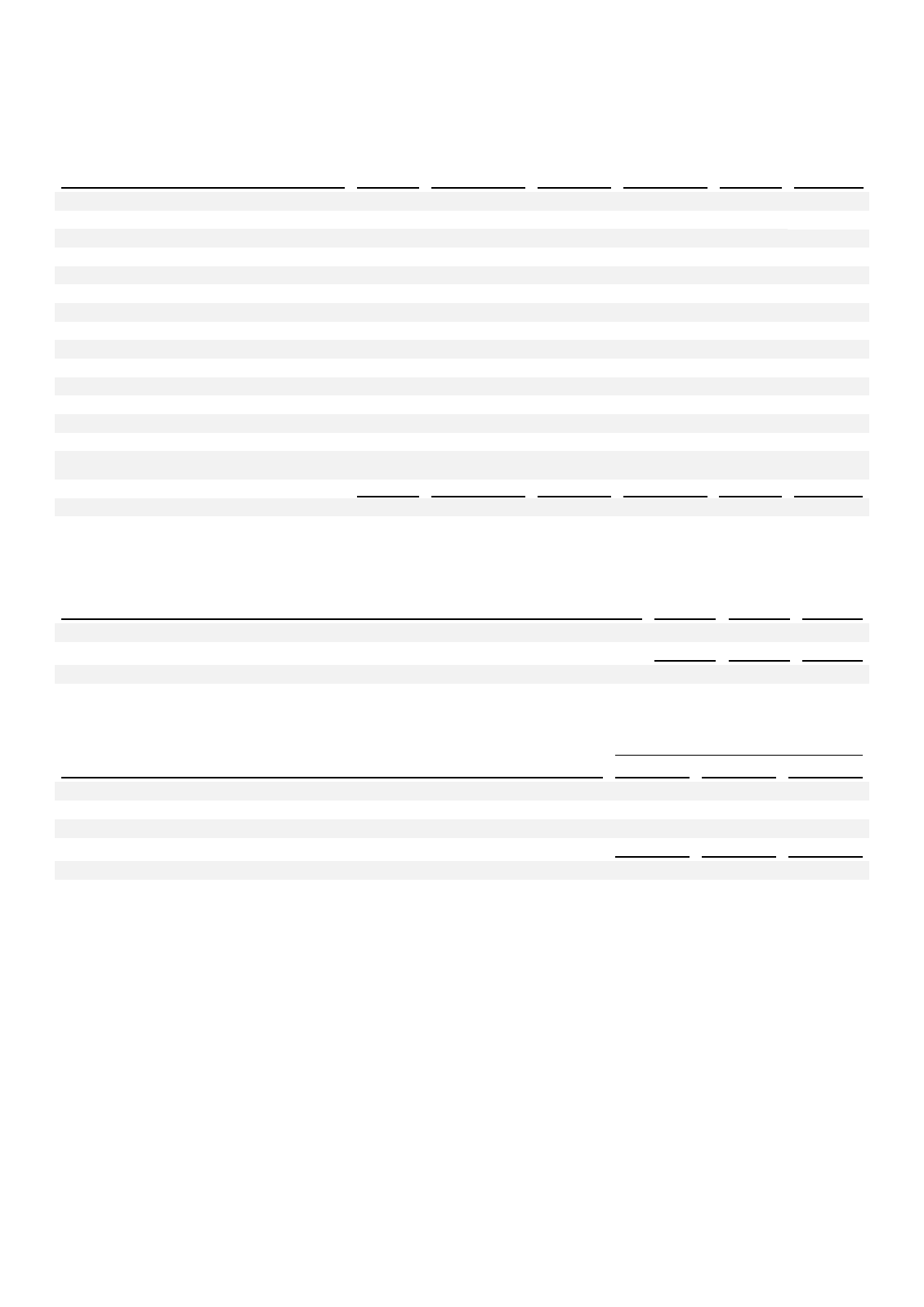

Depreciation expense is included in the following line items of the income statement:

(in millions of EUR) 2011 2010 2009

Cost of sales

56

56

44

Selling, general and administrative expenses 457 447 409

Total depreciation

513

503

453

Property, plant and equipment can be summarized by reportable segment as follows:

(in millions of EUR)

December 31,

2011 2010 2009

United States 2 750 2 794 2 596

Belgium 808 784 764

Southeastern Europe and Asia 988 488 415

Corporate 9 9 10

Total property, plant and equipment 4 555 4 075 3 785

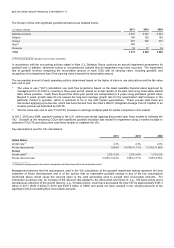

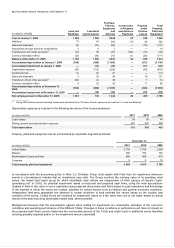

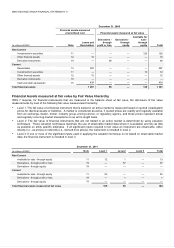

In accordance with the accounting policy in Note 2.3, Delhaize Group tests assets with finite lives for impairment whenever

events or circumstances indicate that an impairment may exist. The Group monitors the carrying value of its operating retail

stores, the lowest level asset group for which identifiable cash inflows are independent of other (groups of) assets (“cash-

generating unit” or CGU), for potential impairment based on historical and projected cash flows, using the main assumptions

detailed in Note 6: the value in use is estimated using projected discounted cash flows based on past experience and knowledge

of the markets in which the stores are located, adjusted for various factors such as inflation and general economic conditions.

Independent third-party appraisals are obtained in certain situations to help estimate fair values based on the location and

condition of the stores. Closed stores are reviewed for impairment based on a fair value less cost to sell basis, based on actual

results of the past and using observable market data, where possible.

Management believes that the assumptions applied when testing for impairment are reasonable estimates of the economic

conditions and operating performance of the different CGUs. Changes in these conditions or performance will have an impact on

the projected cash flows used to determine the recoverable amount of the CGUs and might result in additional stores identified

as being possibly impaired and/or on the impairment amount calculated.