Food Lion 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

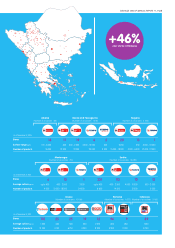

Revenues of the Southeastern Europe and Asia

segment increased in 2011 at actual exchange

rates by 32.0%. This was mainly a result of the

Delta Maxi acquisition and to a lesser extent

of revenue growth in Greece despite a diffi cult

economic environment, in Romania and in Indo-

nesia.

The strong local brand image of Alfa Beta in

Greece, in combination with the price invest-

ments made in 2011, paid off. Both by attract-

ing more traffi c in the existing stores and by

expanding the network through acquisitions

and new openings. Alfa Beta succeeded to

win a bigger share in a declining market. Also

Indonesia and Romania benefi ted from a strong

store expansion program, solidifying their posi-

tion in a promising market.

The performance of Maxi in the newly acquired

operations in Serbia, Bulgaria, Bosnia & Herze-

govina, Montenegro and Albania evolved posi-

tively since the integration in August 2011 and

as a result of the implementation of the New

Game Plan with respect to pricing and assort-

ment changes.

In 2011, gross margin decreased by 22 basis

points due to the lower gross margin of Maxi.

Excluding Maxi, gross margin for the segment

increased by 65 basis points as a result of better

supplier terms. Selling, general and adminis-

trative expenses as a percentage of revenues

increased by 25 basis points to 20.5%. Oper-

Southeastern Europe & Asia

In 2011, Delhaize Group

combined the newly acquired

Maxi-operations in 5 Balkan

countries with the existing

activities of Alfa Beta in

Greece and Mega Image in

Romania, including Super

Indo in Indonesia, into the

Southeastern Europe & Asia

(SEE & Asia) segment. With

EUR 2 459 million, this segment

contributed in 2011 12% of the

total Group revenues.

Find more info on

www.delhaizegroup.com

DELHAIZE GROUP ANNUAL REPORT ‘11 // 33