Food Lion 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

insurance to cover such risk. However, if

a product liability claim is successful, the

Group’s insurance may not be adequate

to cover all liabilities it may incur, and it

may not be able to continue to maintain

such insurance or obtain comparable

insurance at a reasonable cost, if at all.

In addition, even if a product liability

claim is not successful or is not fully pur-

sued, the negative publicity surrounding

any assertion that the Group’s products

caused illness or injury could affect the

Group’s reputation and its business and

financial condition and results of opera-

tions.

Delhaize Group takes an active stance

towards food safety in order to offer cus-

tomers safe food products. The Group

has worldwide food safety guidelines in

place, and their application is vigorously

followed.

Risk of Environmental Liability

Delhaize Group is subject to laws and

regulations that govern activities that

may have adverse environmental

effects. Delhaize Group may be respon-

sible for the remediation of such environ-

mental conditions and may be subject to

associated liabilities relating to its stores

and the land on which its stores, ware-

houses and offices are located, regard-

less of whether the Group leases, sub-

leases or owns the stores, warehouses

or land in question and regardless of

whether such environmental conditions

were created by the Group or by a prior

owner or tenant. The Group has put in

place control procedures at the operat-

ing companies in order to identify, prior-

itize and resolve adverse environmental

conditions.

Insurance Risk

The Group manages its insurable risk

through a combination of external insur-

ance coverage and self-insured reten-

tion programs. In deciding whether to

purchase external insurance or use self-

insured retention programs, the Group

considers the frequency and severity of

losses, its experience in managing risk

through safety and other internal pro-

grams, the cost and terms of external

insurance, and whether external insur-

ance coverage is mandatory.

External insurance is used when avail-

able at reasonable cost and terms. The

amount and terms of insurance pur-

chased are determined by an assess-

ment of the Group’s risk exposure, by

comparison to industry standards and

by assessment of financial capacity in

the insurance markets.

The main risks covered by Delhaize

Group’s insurance programs are prop-

erty, liability and health-care. The U.S.

operations of Delhaize Group use self-

insured retention programs for work-

ers’ compensation, general liability,

automotive accident, pharmacy claims,

and healthcare (including medical,

pharmacy, dental and short-term dis-

ability). Delhaize Group also uses cap-

tive insurance programs to provide flex-

ibility and optimize costs. In the event

of a substantial loss there is a risk that

external insurance coverage may not be

sufficient to cover the loss. It is possible

that the financial condition of an exter-

nal insurer may deteriorate over time in

which case the insurer may be unable

to meet the obligation to pay a loss. It

is possible that due to changes in finan-

cial or insurance markets that Delhaize

Group will be unable to continue to pur-

chase certain insurance coverage on

commercially reasonable terms.

Reserves for self-insured retentions

are based upon actuarial estimates of

claims reported and claims incurred but

not reported. Delhaize Group believes

these estimates are reasonable, how-

ever these estimates are subject to a

high degree of variability and uncer-

tainty caused by such factors as future

interest and inflation rates, future eco-

nomic conditions, litigation and claims

settlement trends, legislative and regu-

latory changes, changes in benefit lev-

els and the frequency and severity of

incurred but not reported claims. It is

possible that the final resolution of some

claims may require Delhaize Group to

make significant expenditures in excess

of existing reserves.

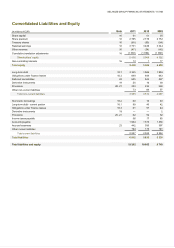

Self-insurance provisions of EUR 143 mil-

lion are included as liability on the bal-

ance sheet as of December 31, 2011.

More information on self-insurance can

be found in Note 20.2 “Self Insurance

Provisions” and related investments held

to cover the self-insurance exposure are

included in Note 11”Investments in Secu-

rities” to the Financial Statements.

If external insurance is not sufficient

to cover losses or is not collectable, or

if self-insurance expenditures exceed

existing reserves, the Group’s financial

condition and results of operation may

be adversely affected.

December 31, 2011 (in millions of EUR)

Currency Reference Interest Rate Shift Impact on Net Profit Impact on Equity

EUR 1.36% +/- 29 basis points +/- 0.1 -

USD 0.58% +/- 11 basis points -/+ 0.5 +/- 0.6

Total Increase/Decrease -/+ 0.4 +/- 0.6

December 31, 2010 (in millions of EUR)

Currency Reference Interest Rate Shift Impact on Net Profit Impact on Equity

EUR 1.01% +/- 16 basis points -/+ 0.2 -

USD 0.30% +/- 13 basis points -/+ 0.7 +/- 0.9

Total Increase/Decrease -/+ 0.9 +/- 0.9

December 31, 2009 (in millions of EUR)

Currency Reference Interest Rate Shift Impact on Net Profit Impact on Equity

EUR 0.70% +/- 13 basis points +/- 0.0 -

USD 0.25% +/- 11 basis points -/+ 0.6 +/- 0.7

Total Increase/Decrease -/+ 0.6 +/- 0.7

DELHAIZE GROUP ANNUAL REPORT ‘11 // 59