Food Lion 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

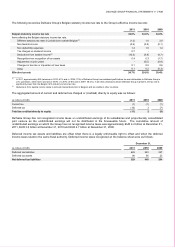

DELHAIZE GROUP FINANCIAL STATEMENTS ’11 // 125

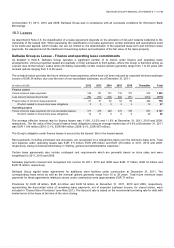

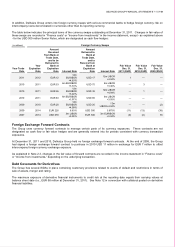

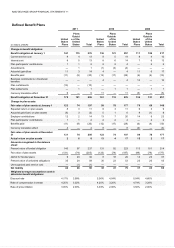

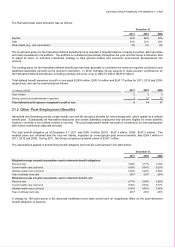

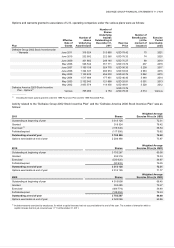

(in millions of EUR)

2011 2010 2009

United

States

Plans

Plans

Outside

of the

United

States Total

United

States

Plans

Plans

Outside

of the

United

States Total

United

States

Plans

Plans

Outside

of the

United

States Total

Component of pension cost:

Amounts recognized in the income

statement:

Current service cost

9

4

13

9

5

14

8

4

12

Interest cost

8

5

13

8

6

14

7

6

13

Expected return on plan assets

(8)

(3)

(11)

(8)

(3)

(11)

(6)

(3)

(9)

Amortization of past service cost

—

—

—

(1)

(3)

(4)

—

—

—

Curtailment gain recognized

(10)

—

(10)

—

—

—

—

—

—

Settlement loss recognized

—

1

1

—

1

1

—

1

1

Total pension cost recognized in the

income statement (1) 7 6 8 6 14 9 8 17

Amounts recognized in OCI:

Actuarial (gains)/losses immediately

recognized 17 — 17 (1) (1) (2) 2 7 9

Effect of changes in exchange rates

3

—

3

3

—

3

1

—

1

Cumulative amount of actuarial

gains and losses recognized

53

11

64

33

11

44

31

12

43

Weighted average assumptions used

to determine pension cost:

Discount rate 5.00%

4.54% 5.54% 4.66% 6.01% 5.55%

Expected long-term rate of return on

plan assets during year 6.99% 4.00% 7.75% 4.00% 7.75% 4.40%

Rate of compensation increase 4.25% 3.20% 4.74% 3.29% 4.67% 3.38%

Rate of price inflation 3.03% 2.00% 3.50% 2.00% 3.50% 2.09%

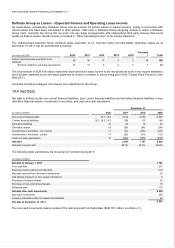

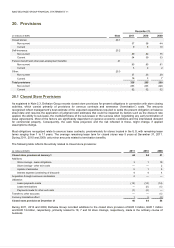

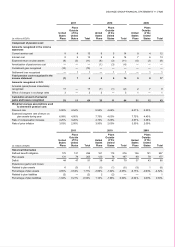

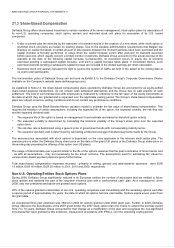

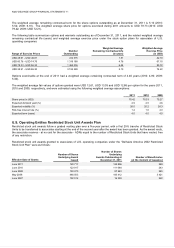

(in millions of EUR)

2011 2010 2009

United

States

Plans

Plans

Outside

of the

United

States Total

United

States

Plans

Plans

Outside

of the

United

States Total

United

States

Plans

Plans

Outside

of the

United

States Total

Historical Information

Defined benefit obligation

175

121

296

161

115

276

136

121

257

Plan assets

131

74

205

123

74

197

99

78

177

Deficit

44

47

91

38

41

79

37

43

80

Experience (gains) and losses:

Related to plan assets

6

(3)

3

(5)

(1)

(6)

(9)

1

(8)

Percentage of plan assets

4.65%

-3.54%

1.71%

-3.89%

-1.02%

-3.05%

-9.15%

-0.93%

-4.52%

Related to plan liabilities

(2)

—

(2)

2

(2)

— — 1

1

Percentage of plan liabilities

-1.02%

0.21%

-0.53%

1.14%

-1.96%

0.00%

-0.04%

0.49%

0.39%