Food Lion 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

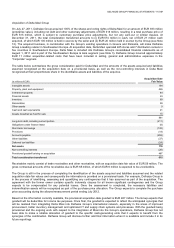

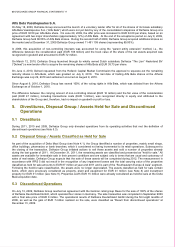

From the date of acquisition, Maxi has contributed EUR 460 million to the Group’s revenues and EUR (0.2) million to the net

profit of the year. If the business combination had occurred at the beginning of the year, the 2011 revenues of Delhaize Group

would have been approximately EUR 584 million higher. This pro forma information is provided for informational purposes only

and is not necessarily indicative of the revenues that actually would have been achieved had the acquisition been consummated

as of that time, nor is it intended to be a projection of future revenues. Due to significant differences in accounting policies

between Delta Maxi and Delhaize Group, it is impracticable to estimate the pro forma impact on the Group’s consolidated net

profit.

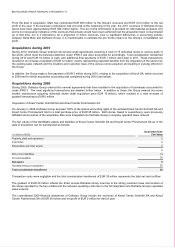

Acquisitions during 2010

During 2010, Delhaize Group entered into several small agreements acquiring a total of 15 individual stores in various parts of

the world, which meet the business definition under IFRS 3 and were accounted for accordingly. Total consideration transferred

during 2010 was EUR 16 million in cash, and additional final payments of EUR 1 million were paid in 2011. These transactions

resulted in an increase of goodwill of EUR 12 million, mainly representing expected benefits from the integration of the stores into

the existing sales network and the locations and customer base of the various stores acquired, all resulting in synergy effects for

the Group.

In addition, the Group made a final payment of EUR 3 million during 2010, relating to the acquisition of Koryfi SA, which occurred

in 2009 and for which acquisition accounting was completed during 2010 (see below).

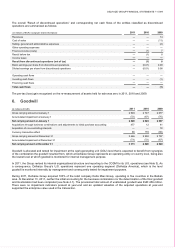

Acquisitions during 2009

During 2009, Delhaize Group entered into several agreements that have resulted in the acquisition of businesses accounted for

under IFRS 3. The most significant transactions are detailed further below. In addition to those, the Group entered into some

smaller transactions acquiring individual stores (total acquisition price EUR 13 million), which resulted in a total increase of

goodwill amounting to EUR 6 million.

Acquisition of Knauf Center Schmëtt SA and Knauf Center Pommerlach SA

On January 2, 2009, Delhaize Group acquired 100% of the shares and voting rights of the unlisted Knauf Center Schmëtt SA and

Knauf Center Pommerlach SA for a total purchase price of EUR 25 million. Both stores, based in Luxembourg, were previously

affiliated stores and as of the acquisition date were integrated into Delhaize Group’s company operated sales network.

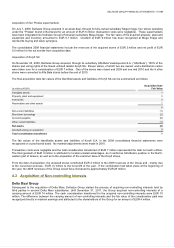

The fair values of the identifiable assets and liabilities of Knauf Center Schmëtt SA and Knauff Center Pommerlach SA as of the

date of acquisition can be summarized as follows:

(in millions of EUR)

Acquisition Date

Fair Value

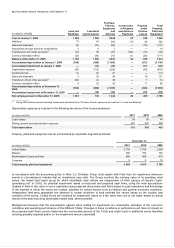

Property, plant and equipment

2

Inventories

2

Receivables and other assets 5

9

Non-current liabilities

(1)

Accounts payable (3)

Net assets

5

Goodwill arising on acquisition 20

Total consideration transferred

25

Transaction costs were negligible and the total consideration transferred of EUR 25 million represents the total net cash outflow.

The goodwill of EUR 20 million reflects the direct access Delhaize Group now has to the strong customer base and location of

the stores operated by the two entities and the reduced operating costs due to the full integration into Delhaize Group’s operated

sales network.

The consolidated 2009 financial statements of Delhaize Group include the revenues of Knauf Center Schmëtt SA and Knauf

Center Pommerlach SA of EUR 56 million and net profit of EUR 2 million for the full year.