Food Lion 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

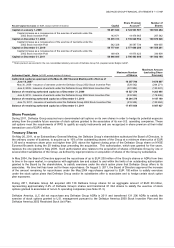

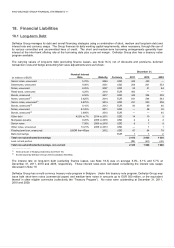

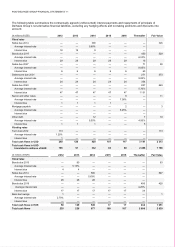

102 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

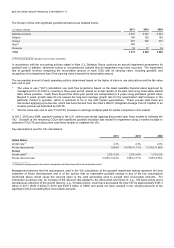

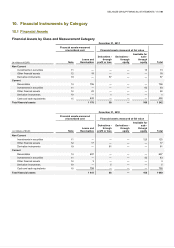

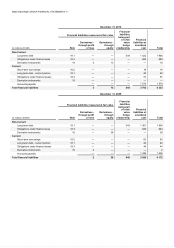

December 31, 2010

(in millions of EUR)

Financial liabilities measured at fair value

Financial

liabilities

being part

of a fair

value

hedge

relationship

Financial

liabilities at

amortized

cost Total

Note

Derivatives -

through profit

or loss

Derivatives -

through

equity

Non-Current

Long-term debt 18.1 — — 544 1 422 1 966

Obligations under finance lease 18.3 — — — 684 684

Derivative instruments 19 3 13 — — 16

Current

Short-term borrowings 18.2 — — — 16 16

Long-term debt - current portion 18.1 — — — 40 40

Obligations under finance leases 18.3 — — — 57 57

Derivative instruments 19 — — — — —

Accounts payable

—

—

—

1 574

1 574

Total financial liabilities 3 13 544 3 793 4 353

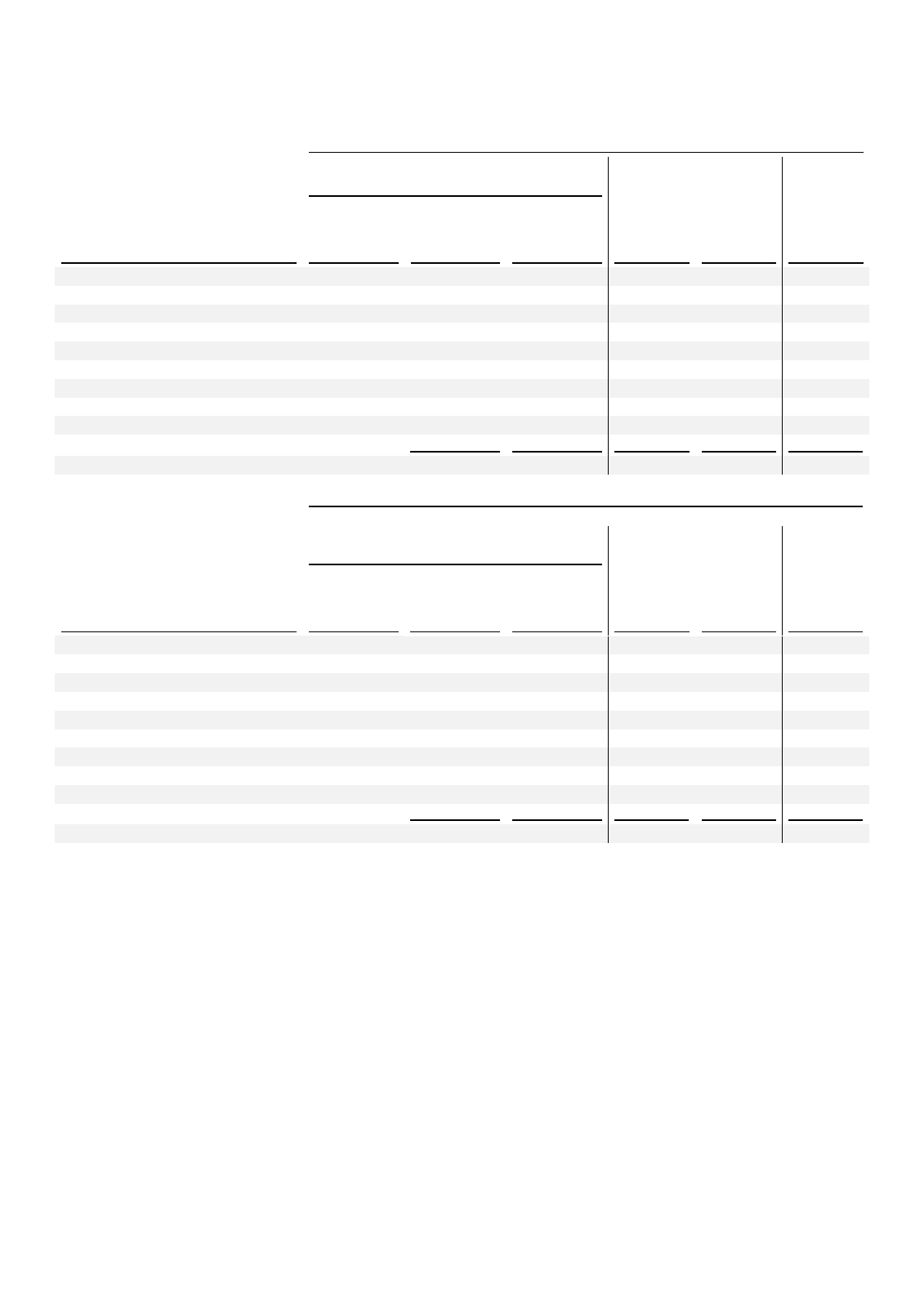

December 31, 2009

(in millions of EUR)

Financial liabilities measured at fair value

Financial

liabilities

being part

of a fair

value

hedge

relationship

Financial

liabilities at

amortized

cost Total

Note

Derivatives -

through profit

or loss

Derivatives -

through

equity

Non-Current

Long-term debt 18.1 — — 543 1 361 1 904

Obligations under finance lease 18.3 — — — 643 643

Derivative instruments 19 — 38 — — 38

Current

Short-term borrowings 18.2 — — — 63 63

Long-term debt - current portion 18.1 — — — 42 42

Obligations under finance leases 18.3 — — — 44 44

Derivative instruments 19 2 — — — 2

Accounts payable — — — 1 436 1 436

Total financial liabilities 2 38 543 3 589 4 172