Food Lion 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At the end of 2011, total equity had increased

by 7.1% to EUR 5.4 billion as a result of the

net profit and the non-controlling interests

related to the acquisition of Maxi, partly off-

set by the Group’s payment of dividends. The

number of Delhaize Group shares, includ-

ing treasury shares, increased in 2011 by

336 909 newly issued shares to 102 million.

Delhaize Group owned 1 183 948 treasury

shares at the end of 2011.

At the end of 2011, Delhaize Group’s net debt

increased by EUR 860 million (at actual rates) to

EUR 2 647 million mainly as a result of negative

free cash flow, the inclusion of Delta Maxi exist-

ing debt and the dividend payment.

At the end of 2011, Delhaize Group had total

annual minimum operating lease commit-

ments for 2012 of EUR 317 million, includ-

ing EUR 12 million related to closed stores.

These leases generally have terms that range

between 1 and 40 years with renewal options

ranging from 3 to 36 years.

Events after Balance Sheet Date

On January 12, 2012, Delhaize Group

announced, following a thorough portfolio

review of its stores, the decision to close one

distribution center and 146 stores across its

network: 126 stores in the U.S. (113 Food Lion,

7 Bloom and 6 Bottom Dollar Food) and 20

underperforming Maxi stores (in Serbia, Bul-

garia and Bosnia and Herzegovina), and to

abandon several of its investment properties.

As a result, the Group recorded an impairment

charge of USD 177 million (EUR 127 million) in

the fourth quarter of 2011 (see also above). This

charge solely relates to the U.S. operations as

the underperformance of the stores in South-

eastern Europe was already reflected in the

fair values of the related assets recorded in the

opening balance sheet.

Beginning the first quarter of 2012, the Group

expects earnings to be impacted by approxi-

mately EUR 200 million (approximately

USD 235 million for the U.S. and EUR 30 million

for Southeastern Europe) to reflect store closing

liabilities including a reserve for ongoing lease

and severance obligations, accelerated depre-

ciation related to store conversions, conversion

costs, inventory write-downs and sales price

mark downs. This will have an after tax impact

of approximately EUR 125 million on the 2012

earnings.

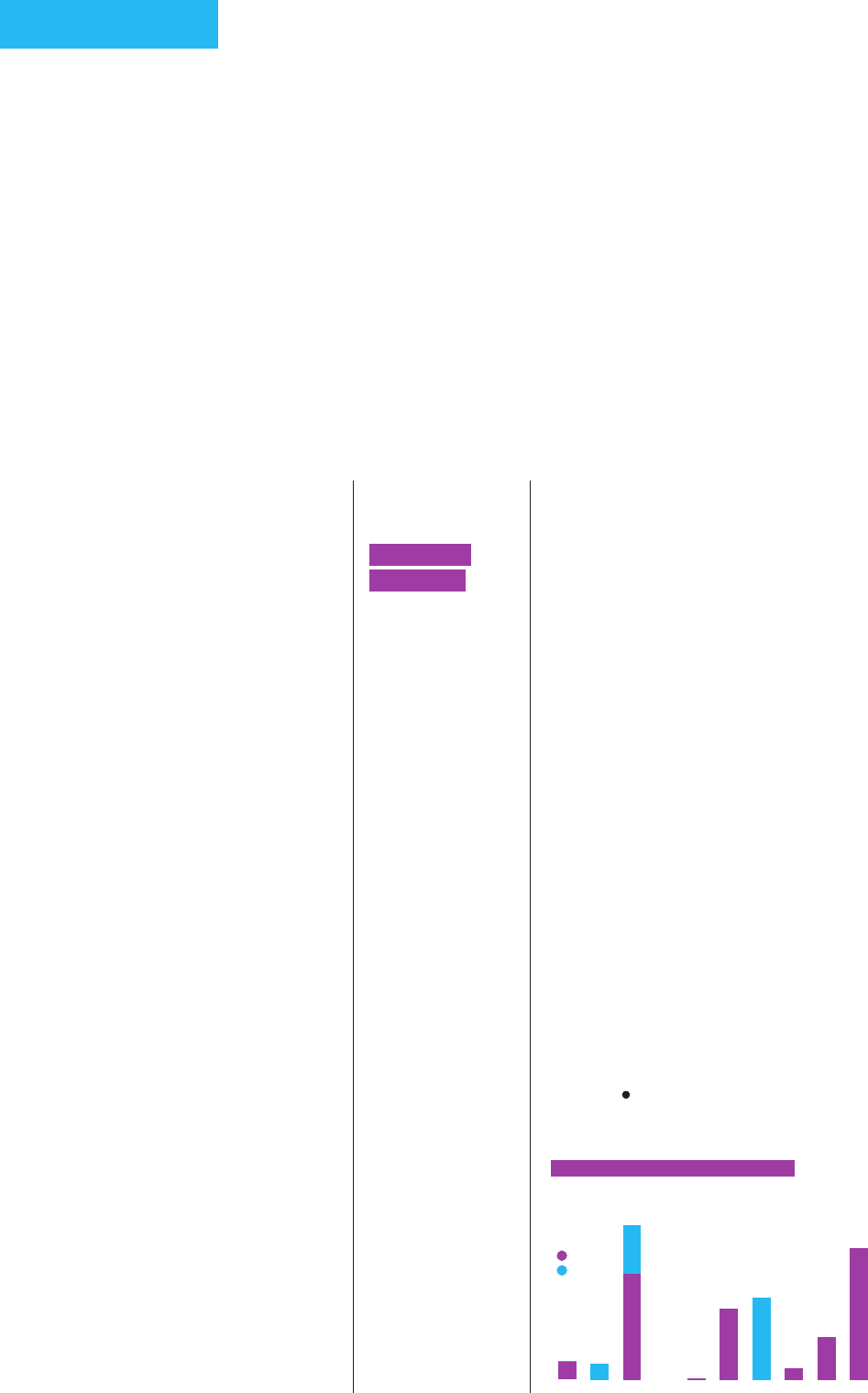

DEBT MATURITY PROFILE(1) (in millions of EUR)

2012 2013 2014 2015 2016 2017 2018 2027 2031 2040

USD

EUR

80

237

518

7

348

400

55

215

639

87

1

(1) Excluding finance leases; principal payments (related premiums and discounts

not taken into account) after effect of cross-currency interest rate swaps.

NON-GAAP

MEASURES

In its financial com-

munication, Delhaize

Group uses certain

measures that have

no definition under

IFRS or other generally

accepted accounting

standards (non-

GAAP measures).

Delhaize Group does

not represent these

measures as alterna-

tive measures to net

profit or other financial

measures determined

in accordance with

IFRS. These measures

as reported by Delhaize

Group might differ from

similarly titled measures

by other companies.

We believe that these

measures are important

indicators for our busi-

ness and are widely

used by investors,

analysts and other par-

ties. A reconciliation of

these measures to IFRS

measures can be found

in the chapter “Supple-

mentary Information”

of the Financial State-

ments (www.annual-

reports.delhaizegroup.

com). A definition of

non-GAAP measures

and ratio composed of

non-GAAP measures

can be found in the

glossary. The non-GAAP

measures provided in

this report have not

been audited by the

statutory auditor.

REVIEW

26 // DELHAIZE GROUP ANNUAL REPORT ‘11