Food Lion 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

decreased from EUR 821 million to

EUR 631 million mainly as a result of

lower operating profit. In 2011, income

taxes amounted to EUR 156 million,

compared to EUR 245 million in 2010.

The effective tax rate decreased to

24.7% (29.8% in 2010), mainly as a

result of the lower weight of our U.S.

operations due to the recorded impair-

ment charges.

Net profit from continuing operations

decreased by 17.5% and amounted to

EUR 475 million, mainly due to impair-

ment charges, or EUR 4.72 basic per

share (EUR 5.74 in 2010).

Group share in net profit amounted to

EUR 475 million, a decrease of 17.4% at

actual exchange rates (-14.9% at identi-

cal exchange rates) compared to 2010,

mainly due to the impairment charge.

Per share, basic net profit was EUR 4.71

(EUR 5.73 in 2010) and diluted net profit

was EUR 4.68 (EUR 5.68 in 2010).

Cash Flow Statement

In 2011, net cash provided by operating

activities amounted to EUR 1 106 million;

a decrease of EUR 211 million compared

to 2010, a decrease by 16.0% at actual

rates (12.4% at identical rates) mainly as

a result of lower operating profit in 2011

and higher cash used in core working

capital, mainly due to reducing overdue

supplier balances at Maxi.

Net cash used in investing activities

increased by EUR 600 million, mainly

due to higher business acquisitions and

higher purchase of tangible and intan-

gible assets partly offset by cash pro-

vided by sale or maturity of debt secu-

rities. Business acquisitions amounted

to EUR 591 million and predominantly

related to the acquisition of Delta Maxi.

Capital expenditures amounted

to EUR 762 million, an increase of

EUR 102 million compared to 2010 as

a result of a more new stores opened,

including in Southeastern Europe fol-

lowing the acquisition of Maxi and the

start of the construction of a new auto-

mated distribution center in

Belgium.

54.6% of total capital expendi-

tures were invested in the U.S. activi-

ties of the Group, 18.7% in the Belgian

operations, 24.2% in the Southeastern

Europe and Asia segment and 2.5% in

Corporate activities.

Investments in new store openings

amounted to EUR 231 million (30.3% of

total capital expenditures), an increase

of 18% compared to EUR 196 mil-

lion in 2010. Delhaize Group invested

EUR 185 million (24.3% of capital

expenditures) in store remodeling and

expansions (EUR 167 million in 2010).

In 2011, Delhaize Group remodeled or

expanded 66 supermarkets in the U.S.

and remodeled 23 supermarkets in Bel-

gium.

Capital spending in information tech-

nologies, logistics and distribution, and

miscellaneous categories amounted

to EUR 346 million (45.4% of total

capital expenditures), compared to

EUR 297 million in 2010.

Net cash used in financing activities

amounted to EUR 146 million, a decrease

of EUR 197 million compared to the prior

year mainly due to additional long-term

loans resulting from the issuance of a

EUR 400 million retail bond in October

2011 mainly used to repay Delta Maxi’s

long-term and short-term debt.

Balance Sheet

At the end of 2011, Delhaize Group’s

total assets amounted to EUR 12.2 bil-

lion, 12.3% higher than at the end of

2010, mainly as the result of the integra-

tion of the Delta Maxi operations.

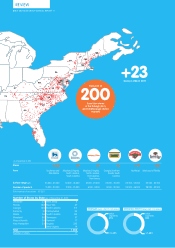

At the end of 2011, Delhaize Group’s

sales network consisted of 3 408 stores,

an increase of 608 stores compared to

2010. Of these stores, 695 were owned

by the Company. Delhaize Group also

owned 12 warehousing facilities in the

U.S., 7 in Belgium and 14 in the South-

eastern Europe and Asia segment.

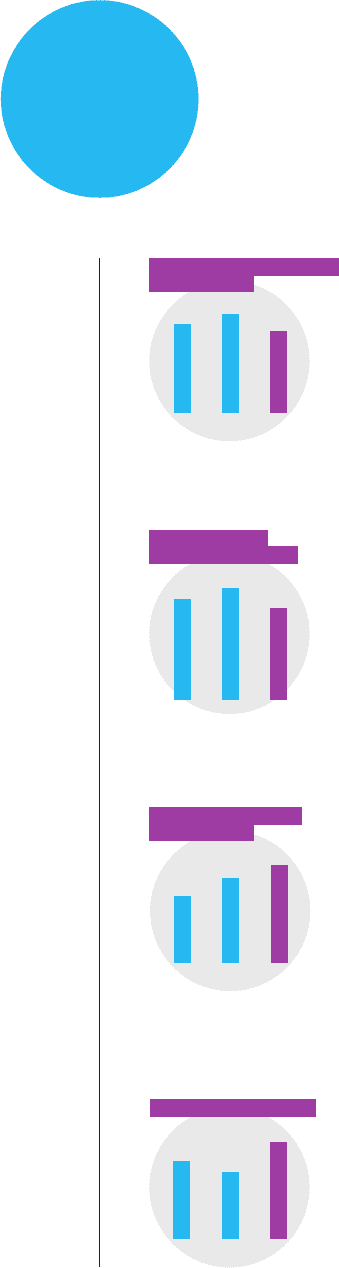

GROUP SHARE IN NET PROFIT

(in millions of EUR)

2009 2010 2011

475

574

514

BASIC NET PROFIT

(GROUP SHARE) (in EUR)

2009 2010 2011

4.71

5.73

5.16

CAPITAL EXPENDITURES

(in millions of EUR)

2009 2010 2011

762

660

520

EUR

21.1

billion revenues

in 2011

2009 2010 2011

2.6

1.8

2.1

NET DEBT (in billiions of EUR)

DELHAIZE GROUP ANNUAL REPORT ‘11 // 25