Food Lion 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS ’11 // 139

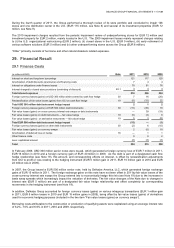

During the fourth quarter of 2011, the Group performed a thorough review of its store portfolio and concluded to impair 126

stores and one distribution center in the U.S. (EUR 115 million, see Note 8) and several of its investment properties (EUR 12

million, see Note 9).

The 2010 impairment charges resulted from the periodic impairment review of underperforming stores for EUR 12 million and

investment property for EUR 2 million, mainly located in the U.S. The 2009 impairment losses mainly represent charges relating

to (i) the U.S. organizational restructuring (EUR 2 million), (ii) closed stores in the U.S. (EUR 9 million), (iii) early retirement of

various software solutions (EUR 5 million) and (iv) other underperforming stores across the Group (EUR 6 million).

“Other” primarily consists of hurricane and other natural disasters related expenses.

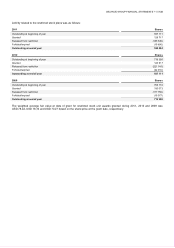

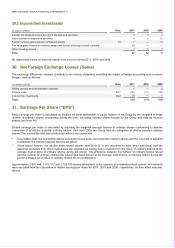

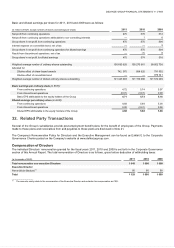

29. Financial Result

29.1 Finance Costs

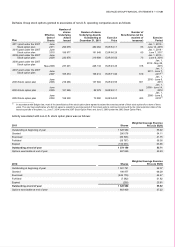

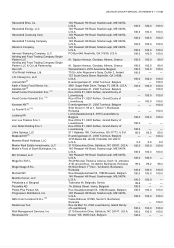

(in millions of EUR) Note 2011 2010 2009

Interest on short and long-term borrowings

121 117 120

Amortization of debt discounts (premiums) and financing costs

7 4 4

Interest on obligations under finance leases

78 81 76

Interest charged to closed store provisions (unwinding of discount) 20.1 4 4 4

Total interest expenses

210 206 204

Foreign currency losses (gains) on USD 300 million debt covered by cash flow hedge

30 7 16 (20)

Reclassification of fair value losses (gains) from OCI on cash flow hedge 19 (5) (15) 22

Total USD 300 million debt instrument hedge impact

2 1 2

Foreign currency losses (gains) on EUR 500 million debt instruments

30 (15) (39) 18

Fair value losses (gains) on cross currency interest rate swaps on debt instruments

— 39 (19)

Fair value losses (gains) on debt instruments — fair value hedge

19 (5) (3) 8

Fair value losses (gains) on derivative instruments — fair value hedge 19 5 3 (8)

Total EUR 500 million debt instrument hedge impact

(15) — (1)

Foreign currency losses (gains) on other debt instruments

30 (2) 6 (15)

Fair value losses (gains) on currency swaps

2 (5) 18

Amortization of deferred loss on hedge

16 — 1 1

Other finance costs

9 9 2

Less: capitalized interest (2) (3) (3)

Total

204 215 208

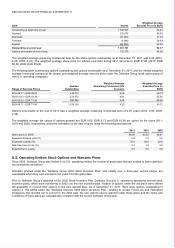

In February 2009, USD 300 million senior notes were issued, which generated a foreign currency loss of EUR 7 million in 2011,

EUR 16 million in 2010 and a foreign currency gain of EUR 20 million in 2009. As the debt is part of a designated cash flow

hedge relationship (see Note 19), this amount, and corresponding effects on interest, is offset by reclassification adjustments

from OCI to profit or loss relating to the hedging instrument (EUR 5 million gain in 2011, EUR 15 million gain in 2010 and EUR

22 million loss in 2009).

In 2007, the Group issued a EUR 500 million senior note, held by Delhaize America, LLC, which generated foreign exchange

gains of EUR 15 million in 2011. The foreign exchange gains on this note have not been offset in 2011by fair value losses of the

cross-currency interest rate swaps the Group entered into to economically hedge this risk (see Note 19) due to the increases in

basis swap spreads which increasingly impact the valuation of derivates. The fair value changes of the Note due to changes in

interest rate (EUR 5 million) are part of a designated fair value hedge relationship and offset completely by corresponding

movements in the hedging instrument (see Note 19).

In addition, Delhaize Group accounted for foreign currency losses (gains) on various intragroup transactions (EUR 1 million gain

in 2011, EUR 5 million losses in 2010 and EUR 15 million gains in 2009), being offset by fair value losses (gains) of derivatives

used for economic hedging purposes (included in the line item “Fair value losses (gains) on currency swaps”).

Borrowing costs attributable to the construction or production of qualifying assets were capitalized using an average interest rate

of 6.2%, 7.5% and 6.9% in 2011, 2010 and 2009, respectively.