Food Lion 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Economic conditions were

challenging in 2011, with food

inflation particularly high in

the second half of the year.

In 2011, revenues in the U.S. increased by

2.2% in local currency. Comparable store sales

increased by 0.7%. Economic conditions were

challenging in 2011 especially in the Southeast-

ern U.S., with food inflation particularly high

in the second half of the year. Delhaize Group

ended 2011 with 1 650 supermarkets in the U.S.,

a net increase of 23 stores compared to the

prior year.

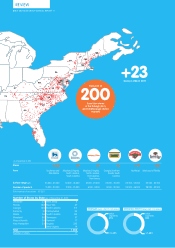

In 2011, Delhaize Group re-launched 200 Food

Lion stores located in the Raleigh and Chat-

tanooga markets. This brand strategy work

showed good results, especially in the Raleigh,

North Carolina market. The trends in customer

visits and number of items sold continue to out-

pace the rest of the Food Lion network, result-

ing in positive comparable store sales growth

fueled by the additional price investments in

these stores.

The Bottom Dollar Food stores in Philadel-

phia also recorded excellent revenue growth

and high comparable store sales growth and

strengthened our confidence in the concept. In

early 2012, Bottom Dollar Food entered the Pitts-

burgh, Pennsylvania market and early indica-

tions are positive.

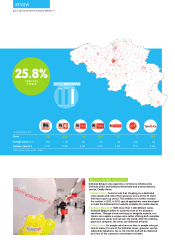

The U.S. gross margin decreased by 33 basis

points to 27.3% as a result of price investments,

especially at Food Lion and inventory losses,

partly offset by procurement savings. In spite of

soft sales and thanks to a continued focus on

cost management, selling, general and admin-

istrative expenses as a percentage of revenues

only increased by 27 basis points to 22.7%.

The operating margin of our U.S. business

decreased to 3.9% mainly as a result of the

impairment charges related to the portfolio

optimization and resulting 126 store closings.

Operating profit decreased by 25.6% to USD

742 million (EUR 534 million).

Total capital expenditures were USD 579 mil-

lion, an increase of 6.6% compared to prior year.

Food Lion

Founded in 1957, Food Lion prides itself on

offering customers a good assortment of qual-

ity products at low prices in clean, convenient

stores. At the end of 2011, Food Lion operated

1 188 stores located in 11 states in the Southeast-

ern United States. In January and February 2012,

Food Lion closed 113 underperforming stores,

most of which were located in markets with the

lowest store density. This portfolio optimization

will enable Food Lion to focus its efforts on the

most promising Food Lion stores and markets.

Bloom

In January 2012, Delhaize America announced

it would close 7 and convert 42 Bloom stores to

Food Lion and retire the banner. This decision

will simplify our business and the converted

stores will benefit from the Food Lion brand

strategy work.

Bottom Dollar Food

Bottom Dollar Food is our soft discount format in

the U.S. At the end of 2011, we operated 57 Bot-

tom Dollar Food stores. The encouraging results

of Bottom Dollar Food in the Philadelphia market

support our expansion plans in additional mar-

kets that present the same growth profile. This

will include a couple of hundred new Bottom

Dollar Food stores over the next five years. To

simplify this growth strategy, at the start of 2012,

we decided to close 6 stores and convert 22

Bottom Dollar Food stores to Food Lion in North

Carolina, Virginia and Maryland.

Harveys

Harveys is a supermarket format focused on

large assortment and fresh products, serving

rural markets in Georgia, South Carolina and

North Florida and possesses strong brand rec-

ognition and customer loyalty. At the end of

2011, Harveys operated 72 stores.

Hannaford

Hannaford is a chain of 179 large stores (most

with pharmacies) offering a large range of high

quality and fresh products. The Hannaford to

Go, the click and collect concept from Delhaize

Belgium, was introduced in two stores and the

results are exceeding expectations.

Sweetbay

Located in Southwest Florida, Sweetbay has a

reputation for quality, price and fresh food. The

banner is also well-known for its strong His-

panic food offering.

DELHAIZE GROUP ANNUAL REPORT ‘11 // 29