Food Lion 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

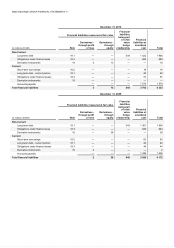

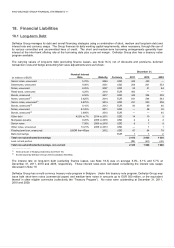

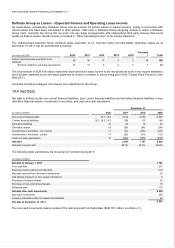

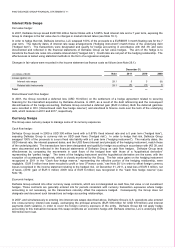

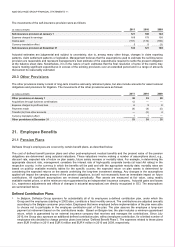

The following table summarizes the contractually agreed (undiscounted) interest payments and repayments of principals of

Delhaize Group’s non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into

account:

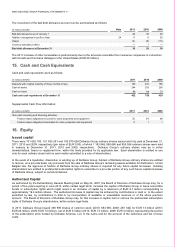

(in millions of USD)

2012 2013 2014 2015 2016 Thereafter Fair Value

Fixed rates

Notes due 2014 — — 300 — — — 326

Average interest rate — — 5.88% — — —

Interest due 18 18 9 — — —

Bonds due 2017 — — — — — 450 529

Average interest rate — — — — — 6.50%

Interest due 29 29 29 29 29 15

Notes due 2027 — — — — — 71 90

Average interest rate — — — — — 8.05%

Interest due 6 6 6 6 6 60

Debentures due 2031 — — — — — 271 373

Average interest rate — — — — — 9.00%

Interest due 24 24 24 24 24 354

Notes due 2040 — — — — — 827 849

Average interest rate — — — — — 5.70%

Interest due 47 47 47 47 47 1 131

Senior and other notes — — — — 9 — 11

Average interest rate — — — — 7.06% —

Interest due 1 1 1 1 —

Mortgage payable — — — — 2 — 3

Average interest rate — — — — 8.25% —

Interest due — — — — — —

Other debt — — 12 — — 7 19

Average interest rate — — 5.50% — — 4.50%

Interest due 1 1 1 — — 5

Floating rates

Term loan 2012 113 — — — — — 113

Average interest rate 1.25% — — — — —

Interest due 1 — — — — —

Total cash flows in USD 240 126 429 107 117 3 191 2 313

Total cash flows in USD

translated in millions of EUR 185 97 332 83 90 2 466 1 788

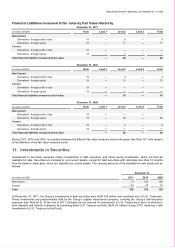

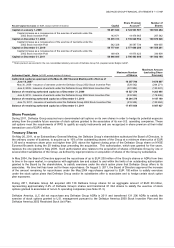

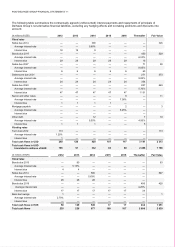

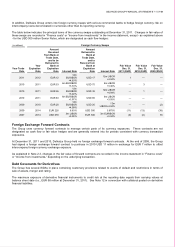

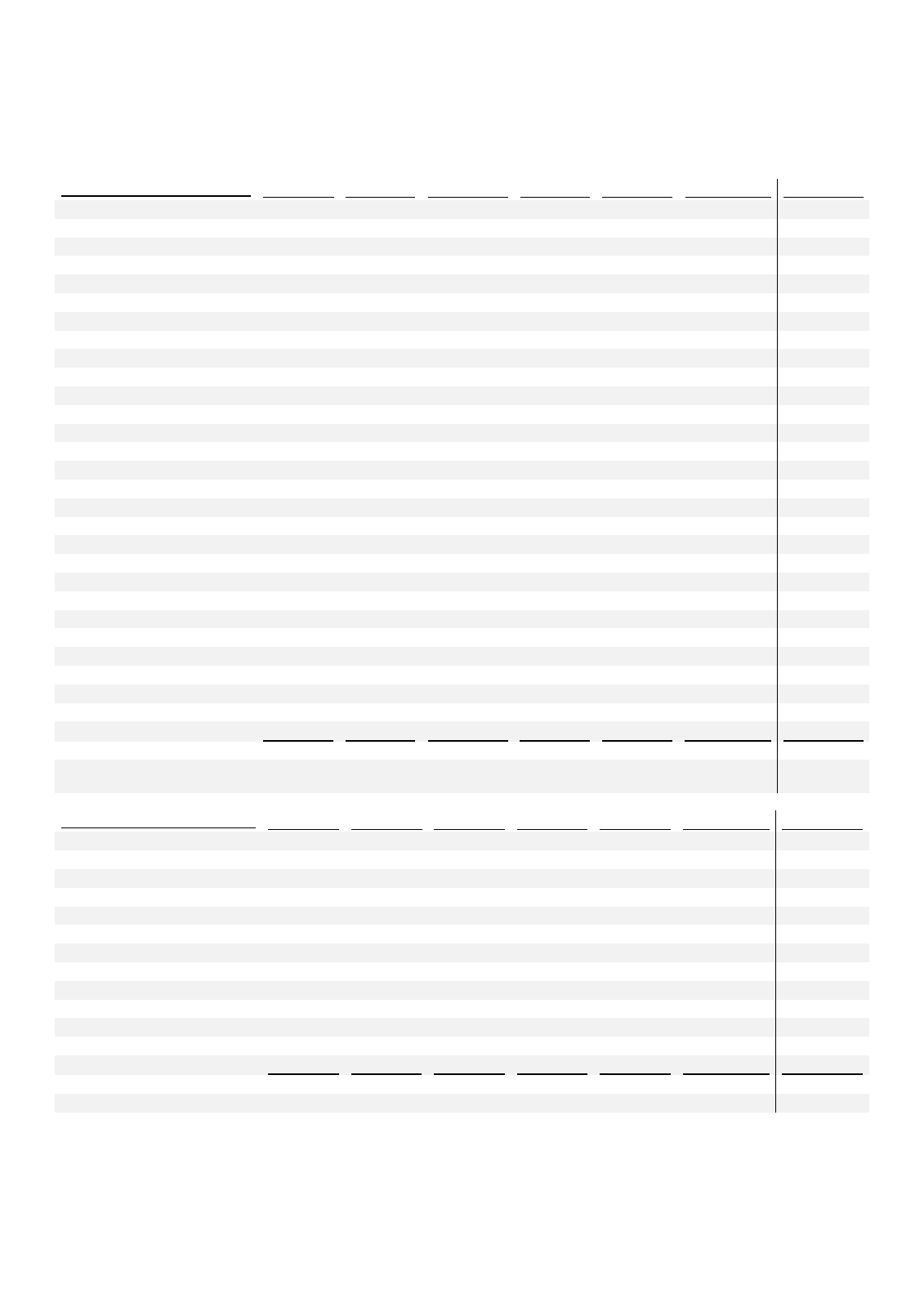

(in millions of EUR)

2012 2013 2014 2015 2016 Thereafter Fair Value

Fixed rates

Bonds due 2013 — 80 — — — — 83

Average interest rate — 5.10% — — — —

Interest due 4 4 — — — —

Notes due 2014 — — 500 — — — 547

Average interest rate — — 5.63% — — —

Interest due 28 28 28 — — —

Bonds due 2018 — — — — — 400 420

Average interest rate — — — — — 4.25%

Interest due 17 17 17 17 17 34

Bank borrowings 1 — — — — — 1

Average interest rate 2.70% — — — — —

Interest due

— — — — — —

Total cash flows in EUR 50 129 545 17 17 434 1 051

Total cash flows 235 226 877 100 107 2 900 2 839