Food Lion 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

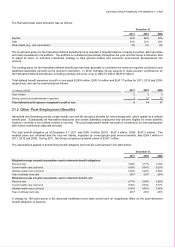

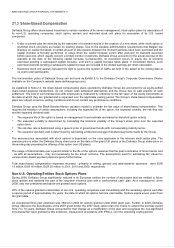

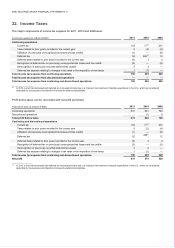

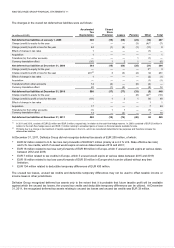

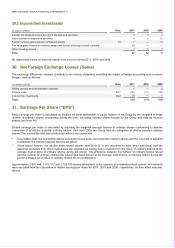

22. Income Taxes

The major components of income tax expense for 2011, 2010 and 2009 were:

Income tax expense (in millions of EUR) 2011 2010 2009

Continuing operations

Current tax

103

17(1)

231

Taxes related to prior years recorded in the current year

5

(2)

(4)

Utilization of previously unrecognized tax losses and tax credits

(1)

—

(8)

Deferred tax

52

226(1)

12

Deferred taxes related to prior years recorded in the current year

(5)

3

2

Recognition of deferred tax on previously unrecognized tax losses and tax credits

(2)

—

(5)

Derecognition of previously recorded deferred tax assets

3

2

—

Deferred tax expense relating to changes in tax rates or the imposition of new taxes

1

(1)

—

Total income tax expense from continuing operations

156

245

228

Total income tax expense from discontinued operations

—

—

—

Total income tax expense from continuing and discontinued operations

156

245

228

_______________

(1) In 2010, current tax decreased and deferred tax increased primarily due to a change in tax treatment of capital expenditures in the U.S., which are considered

deductible for tax purposes and therefore increase the deferred tax liabilities.

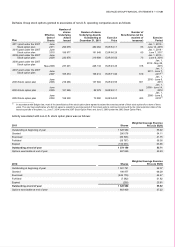

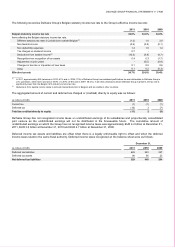

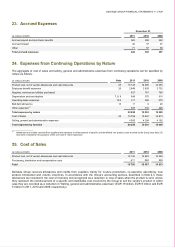

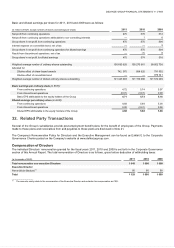

Profit before taxes can be reconciled with net profit as follows:

Profit before taxes (in millions of EUR) 2011 2010 2009

Continuing operations

631

821

740

Discontinued operations - (1) 8

Total profit before taxes

631

820

748

Continuing and discontinued operations

Current tax

103

17(1)

231

Taxes related to prior years recorded in the current year

5

(2)

(4)

Utilization of previously unrecognized tax losses and tax credits

(1)

—

(8)

Deferred tax 52 226

(1

)

12

Deferred taxes related to prior years recorded in the current year

(5)

3

2

Recognition of deferred tax on previously unrecognized tax losses and tax credits

(2)

—

(5)

Derecognition of previously recorded deferred tax assets

3

2

—

Deferred tax expense relating to changes in tax rates or the imposition of new taxes

1

(1)

—

Total income tax expense from continuing and discontinued operations

156 245 228

Net profit

475

575

520

______________

(1) In 2010, current tax decreased and deferred tax increased primarily due to a change in tax treatment of capital expenditures in the U.S., which are considered

deductible for tax purposes and therefore increase the deferred tax liabilities.