Food Lion 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

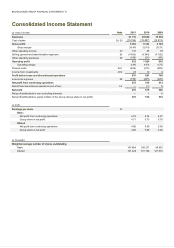

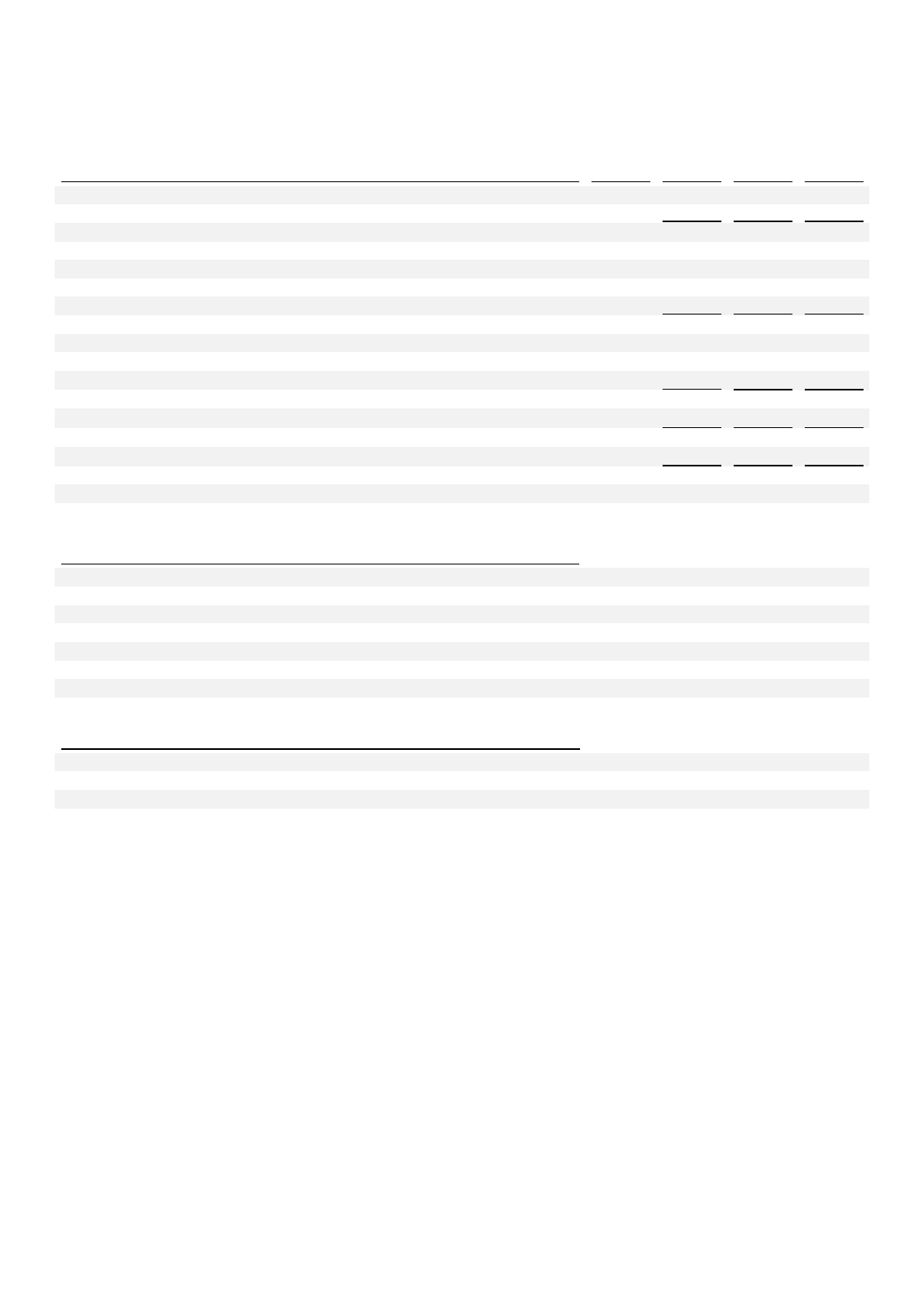

64 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

Consolidated Income Statement

(in millions of EUR) Note 2011 2010 2009

Revenues

21 119

20 850

19 938

Cost of sales

24, 25 (15 756) (15 497) (14 813)

Gross profit

5 363

5 353

5 125

Gross margin

25.4%

25.7%

25.7%

Other operating income

27

118

85

78

Selling, general and administrative expenses

24

(4 500)

(4 394)

(4 192)

Other operating expenses

28 (169) (20) (69)

Operating profit

812

1 024

942

Operating margin

3.8%

4.9%

4.7%

Finance costs

29.1

(204)

(215)

(208)

Income from investments 29.2 23 12 6

Profit before taxes and discontinued operations

631

821

740

Income tax expense

22

(156)

(245)

(228)

Net profit from continuing operations

475

576

512

Result from discontinued operations (net of tax) 5.3 — (1) 8

Net profit

475

575

520

Net profit attributable to non-controlling interests

—

1

6

Net profit attributable to equity holders of the Group (Group share in net profit)

475

574

514

(in EUR)

Earnings per share

31

Basic

Net profit from continuing operations

4.72

5.74

5.07

Group share in net profit

4.71

5.73

5.16

Diluted

Net profit from continuing operations

4.68

5.69

5.00

Group share in net profit

4.68

5.68

5.08

(in thousands)

Weighted average number of shares outstanding

Basic

100 684

100 271

99 803

Diluted

101 426

101 160

101 574